Bank of Canada raises interest rates as it tries to get ahead of hot economy

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.95 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.99/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19.95 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 07/06/2023 (941 days ago), so information in it may no longer be current.

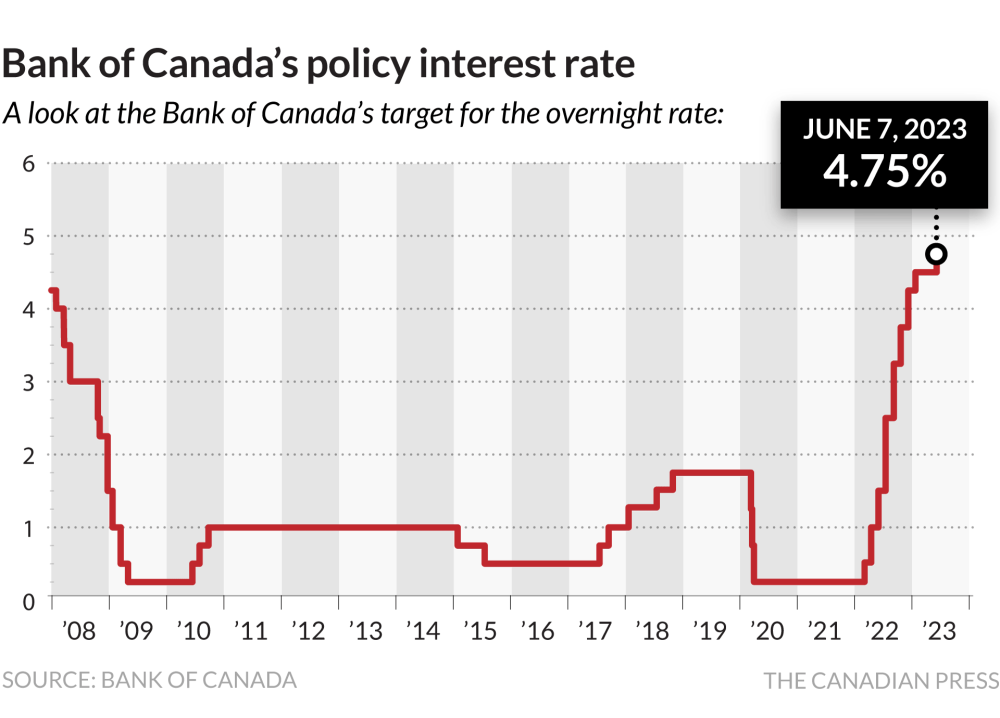

OTTAWA — After watching to see whether its aggressive rate hike path were enough to quash inflation, the central bank has opted to raise interest rates again — fuelling speculation that another rate hike is in the cards for July.

The central bank announced a quarter of a percentage point rate hike on Wednesday. The rate increase brings its key interest rate to 4.75 per cent, the highest it’s been since 2001.

The decision to raise interest rates comes after speculation among economists and forecasters that ongoing strength in the Canadian economy would push the central bank to hike rates again, though many expected it would wait until the summer before pulling the trigger.

Royce Mendes, managing director and head of macro strategy at Desjardins, said the rate hike isn’t too surprising given economic indicators released since the last rate decision suggest the economy is still overheated.

“It makes complete sense that if the bank thought it needed to raise rates, it should do so earlier, rather than later,” Mendes said.

”It makes complete sense that if the bank thought it needed to raise rates, it should do so earlier, rather than later.”–Royce Mendes, MD of Desjardins

Excess demand in the economy appears to be more persistent than the bank previously anticipated, the rate announcement said, citing a tight labour market, better-than-expected economic growth in the first quarter as well as “surprisingly strong” consumption growth.

Inflation also came in hotter than expected in April, the central bank said, noting prices for a “broad range” of good and services rose more than anticipated.

Still, Mendes criticized the central bank for not communicating its intentions clearly ahead of time. Notably, governor Tiff Macklem didn’t seem overly concerned about the rise in inflation in April during a news conference last month, he said.

“The Bank of Canada should be doing a better job of communicating their intentions to the (financial) market,” Mendes said.

Though the Bank of Canada had little to say about its future plans, many forecasters like Mendes are now convinced that another rate hike is coming in July.

“We continue to lean towards another 25 basis point rate hike at the next rate decision, only because I don’t think the bank will have seen enough progress towards restoring price stability before that date,” he said.

But not everyone is convinced raising interest rates further is the right move.

Western University economic professor Stephen Williamson said he didn’t expect the central bank to announce a rate hike on Wednesday, and doesn’t think raising rates in July would make sense either.

“If I were them, I would have just stayed at four and a half per cent and wait (to) see some more data,” he said.

Williamson said the Bank of Canada appears to be making policy decisions on the assumption that there’s a trade-off between inflation and the unemployment rate. However, inflation has managed to fall significantly without employment falling, he noted.

“Their whole narrative is about is… maybe (high interest rates will) make unemployment go up, but that’s just the pain we have to bear to bring inflation down,” Williamson said.

“Well, inflation has come down a lot with, in fact, an unemployment rate lower than it was in January 2020.”

Statistics Canada is schedule to release employment figures for May on Friday.

Earlier in the year, the Bank of Canada announced it would pause its aggressive rate-hiking cycle that began in March 2022. The central bank appeared cautiously optimistic that interest rates might be high enough to quash inflation, although it stressed that the pause was conditional on inflation falling and the economy softening.

Since then, incoming economic data has continued to surprise forecasters who had anticipated the economy to stall by now. Despite elevated interest rates making borrowing more expensive for consumers and businesses, businesses are still hiring, and consumers continue to spend.

And even as the population grows rapidly, new workers have been absorbed quickly into the labour market, keeping the unemployment rate at five per cent for five consecutive months. That’s just above the all-time low of 4.9 per cent reached last summer.

On the inflation front, price growth has slowed significantly since peaking at 8.1 per cent last year. However, the annual rate ticked up slightly in April to 4.4. per cent, marking the first rise in inflation since the summer.

The central bank says it still expects inflation to fall to about three per cent in the summer, but with core inflation still elevated its concerns about inflation getting stuck above two per cent have increased.

This report by The Canadian Press was first published June 7, 2023.

Text of the Bank of Canada’s rate decision

The Bank of Canada today increased its target for the overnight rate to 4.75 per cent, with the Bank Rate at five per cent and the deposit rate at 4.75 per cent. The Bank is also continuing its policy of quantitative tightening.

Globally, consumer price inflation is coming down, largely reflecting lower energy prices compared to a year ago, but underlying inflation remains stubbornly high. While economic growth around the world is softening in the face of higher interest rates, major central banks are signalling that interest rates may have to rise further to restore price stability.

The Bank of Canada today increased its target for the overnight rate to 4.75 per cent, with the Bank Rate at five per cent and the deposit rate at 4.75 per cent. The Bank is also continuing its policy of quantitative tightening.

Globally, consumer price inflation is coming down, largely reflecting lower energy prices compared to a year ago, but underlying inflation remains stubbornly high. While economic growth around the world is softening in the face of higher interest rates, major central banks are signalling that interest rates may have to rise further to restore price stability.

In the United States, the economy is slowing, although consumer spending remains surprisingly resilient and the labour market is still tight. Economic growth has essentially stalled in Europe but upward pressure on core prices is persisting. Growth in China is expected to slow after surging in the first quarter. Financial conditions have tightened back to those seen before the bank failures in the United States and Switzerland.

Canada’s economy was stronger than expected in the first quarter of 2023, with GDP growth of 3.1 per cent. Consumption growth was surprisingly strong and broad-based, even after accounting for the boost from population gains. Demand for services continued to rebound.

In addition, spending on interest-sensitive goods increased and, more recently, housing market activity has picked up. The labour market remains tight: higher immigration and participation rates are expanding the supply of workers but new workers have been quickly hired, reflecting continued strong demand for labour. Overall, excess demand in the economy looks to be more persistent than anticipated.

CPI inflation ticked up in April to 4.4 per cent, the first increase in 10 months, with prices for a broad range of goods and services coming in higher than expected. Goods price inflation increased, despite lower energy costs. Services price inflation remained elevated, reflecting strong demand and a tight labour market.

The Bank continues to expect CPI inflation to ease to around three per cent in the summer, as lower energy prices feed through and last year’s large price gains fall out of the yearly data.

However, with three-month measures of core inflation running in the 3.5-4 per cent range for several months and excess demand persisting, concerns have increased that CPI inflation could get stuck materially above the two per cent target.

Based on the accumulation of evidence, Governing Council decided to increase the policy interest rate, reflecting our view that monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the two per cent target.

Quantitative tightening is complementing the restrictive stance of monetary policy and normalizing the Bank’s balance sheet. Governing Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation.

In particular, we will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the inflation target. The Bank remains resolute in its commitment to restoring price stability for Canadians.