Swings in inflation not ‘unusual,’ but underlying price pressures still high: BoC

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 19/09/2023 (806 days ago), so information in it may no longer be current.

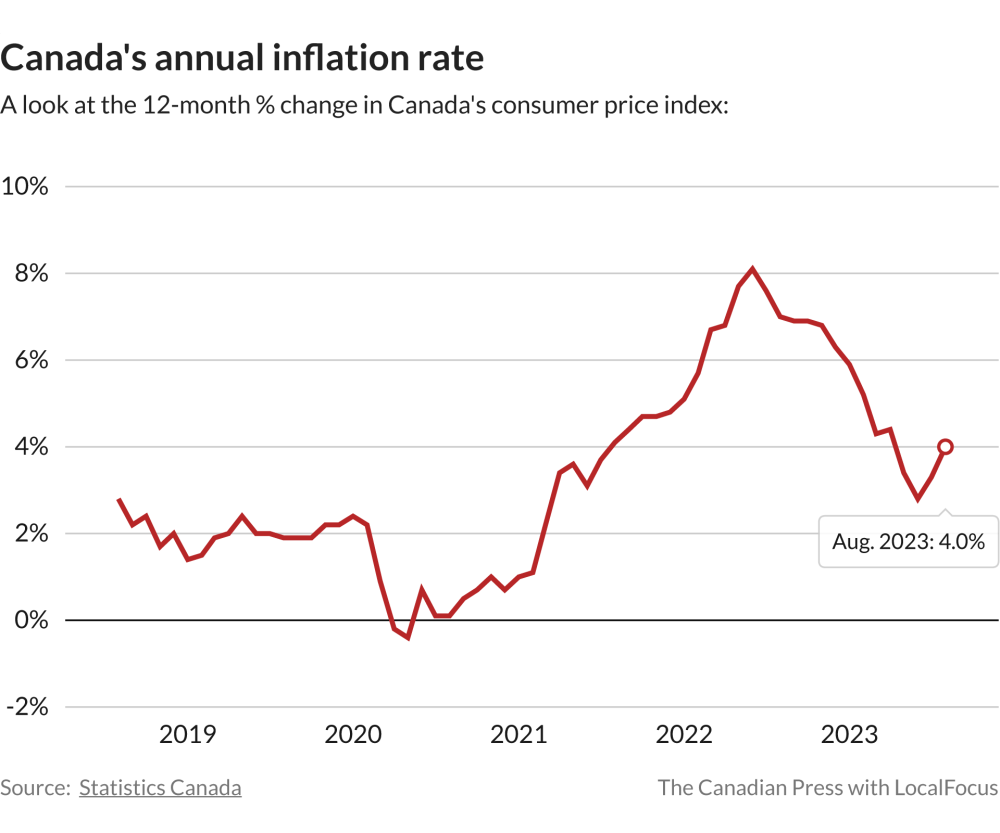

OTTAWA – Bank of Canada deputy governor Sharon Kozicki says swings in the inflation rate are to be expected after the latest consumer price index report showed inflation climbed in August for the second month in a row.

Statistics Canada reported today that inflation ticked up to four per cent last month, up from 3.3 per cent in July amid higher gasoline prices.

Kozicki weighed in on the numbers during a speech at the University of Regina on Tuesday.

“Ups and downs of the size we’ve seen in the past couple of months are not that unusual and are one reason why we look at measures of core inflation — which exclude components with more volatile price movements — to get a sense of what underlying inflation is,” Kozicki said, according to prepared remarks.

She later expanded on this point in a question-and-answer period with the audience.

“One of the big drivers in inflation this month was coming from energy and gasoline costs,” Kozicki said. “That’s one of those pieces that can be pretty volatile.”

As for core measures of inflation, Kozicki acknowledges those numbers haven’t eased by much recently.

During her speech, the deputy governor also took aim at the argument that inflation has come down if mortgage interest costs are excluded from the calculation of inflation.

Some economists have argued that the central bank should exclude mortgage interest costs when looking at inflation, given those costs are driven by rate hikes.

But Kozicki notes that even when these costs are excluded, core inflation doesn’t appear to be much lower.

Economists reacting to Tuesday’s inflation report say the data spells bad news for the central bank, though many expect the Bank of Canada to continue holding rates steady as the economy slows.

The Bank of Canada opted to hold its key interest rate steady earlier this month after recent data showed the economy shrank in the second quarter.

While the central bank held off from raising rates, it warned that the door was still open to more rate hikes if needed. Kozicki reiterated that message on Tuesday.

“We are prepared to raise the policy interest rate further if needed,” she said.

This report by The Canadian Press was first published Sept. 19, 2023.