July retail sales ‘positive surprise’ but need more rate cuts to persist: analysts

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 20/09/2024 (443 days ago), so information in it may no longer be current.

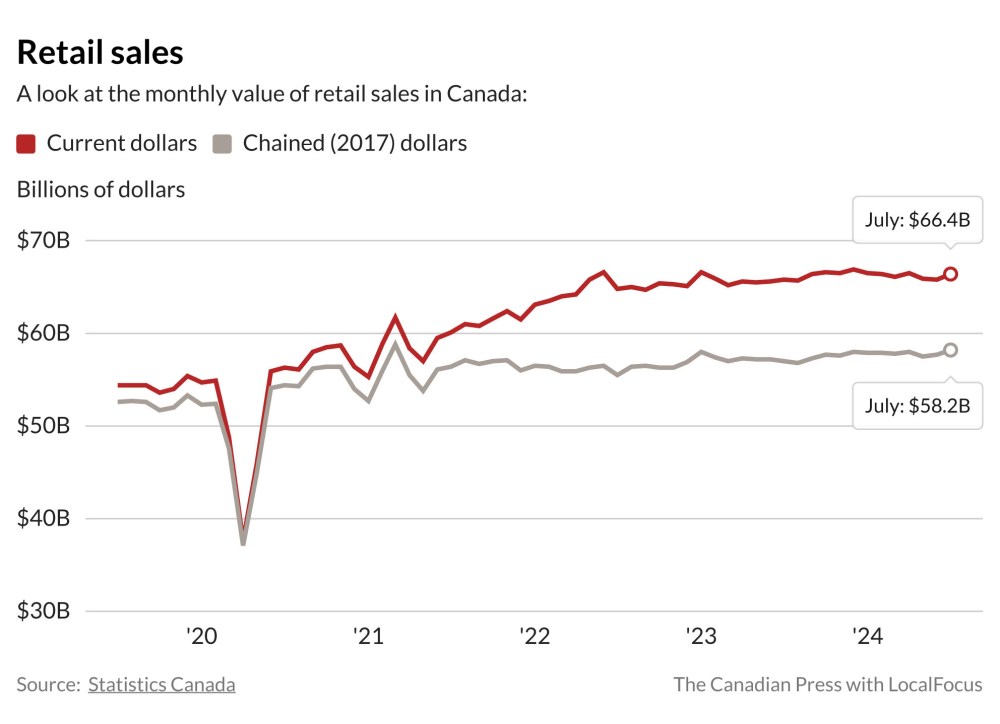

Retail sales edged up in July, but economists say it will take further interest rate cuts to really spark lasting activity.

Statistics Canada said Friday that retail sales rose 0.9 per cent to $66.4 billion in July, helped by stronger new car sales.

The agency said sales were higher in seven of the nine subsectors it tracks with sales at motor vehicle and parts dealers up 2.2 per cent, boosted by a 2.3 per cent increase in sales at new car dealers.

“It’s rare to see a positive surprise from Canadian consumers these days, but the July retail sales report delivered,” Shelly Kaushik, an economist with BMO Capital Markets, said in a note to investors.

The period the figures covered was largely marked by people anticipating and then delighting in the Bank of Canada’s decision to cut its key interest rate in July. The central bank cut rates again in September to 4.25 per cent.

The rate has weighed on shoppers, particularly those looking to make big purchases or take out mortgages, but as it’s been dropping, it’s delivered some relief to wallets.

That was reflected in core retail sales, which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers. They rose 0.6 per cent in July.

Sales at food and beverage retailers increased because of a 1.2 per cent jump in sales at supermarkets and other grocery retailers, a 2.1 per cent climb at specialty food retailers and 0.4 per cent rise at convenience retailers and vending machine operators.

Higher sales were also reported at health and personal care retailers in July.

In volume terms, Statistics Canada said retail sales across the month increased 1.0 per cent.

However, sales at gasoline stations and fuel vendors fell 0.6 per cent for the month as sales for the subsector in volume terms fell 1.7 per cent.

Looking forward, Statistics Canada said its preliminary estimate for retail sales in August pointed to a gain of 0.5 per cent for the month, though it cautioned the figure will be revised.

“As we’ve stressed many times before, spending growth pales in comparison to the population surge,” Kaushik said. “Consumers will need to see more rate cuts filter through the economy to see a more meaningful recovery.”

TD Bank economist Maria Solovieva also detected the same downward trend in retail spending.

“A good start to the quarter is unlikely to sway the odds decisively on whether the Bank of Canada will cut rates by 50 basis points in October,” she told investors in a note.

This report by The Canadian Press was first published Sept. 20, 2024.

History

Updated on Friday, September 20, 2024 8:27 AM CDT: Adds graphic