Stock market today: Wall Street edges lower despite solid data on the economy

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 19/03/2025 (234 days ago), so information in it may no longer be current.

NEW YORK (AP) — U.S. stock indexes edged lower Thursday following another reminder that big, unsettling policy changes are underway because of President Donald Trump, along with more signals suggesting the U.S. economy remains solid for now.

The S&P 500 slipped 0.2% after flipping between modest gains and losses through the day. The Dow Jones Industrial Average dipped by 11 points, or less than 0.1 %, and the Nasdaq composite fell 0.3%.

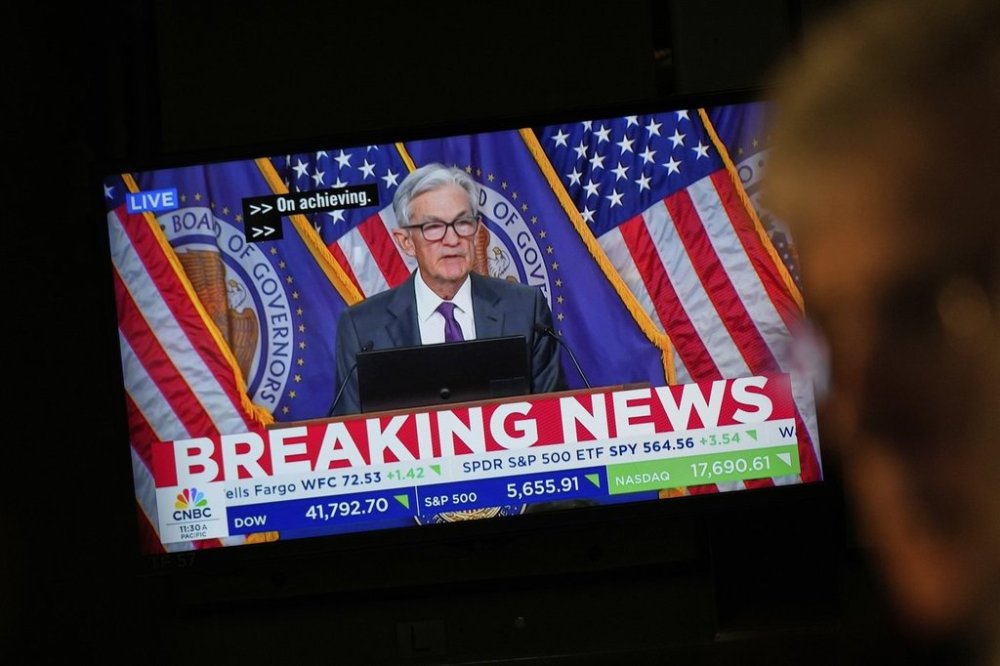

Wall Street has been swinging for weeks on a roller-coaster ride, as stock prices veer on uncertainty about what Trump’s trade war will do to the economy. Stocks got a boost Wednesday after the head of the Federal Reserve said the economy remains solid enough at the moment to leave interest rates where they are.

More data arrived Thursday to bolster that view. One report said slightly fewer U.S. workers filed for unemployment benefits last week than economists expected. It’s the latest sign of a potentially “low fire, low hire” job market.

A separate report said sales of previously occupied homes were stronger last month than economists expected, while a third said manufacturing growth in the mid-Atlantic region appears to be better than economists expected.

But Fed Chair Jerome Powell also stressed on Wednesday that extremely high uncertainty is making it difficult to forecast what will happen next.

It’s not just uncertainty about the trade war affecting Wall Street. Accenture fell to one of the market’s larger losses Thursday even though the consulting and professional services company reported slightly better profit and revenue for the latest quarter than analysts expected.

Worries are rising about the hit Accenture may take to its revenue from the U.S. government as Elon Musk leads efforts to cut federal spending. The federal government accounted for 17% of Accenture’s North American revenue last fiscal year, and its stock sank 7.3%.

The broad U.S. stock market was likely due for its recent drop, which took it more than 10% below its all-time high in just a few weeks, after prices climbed much faster than corporate profits to make it look too expensive, according to Barry Bannister, chief equity strategist at Stifel.

He said the S&P 500 could bounce higher in the near term, particularly after Fed officials indicated Wednesday they see room to cut interest rates twice this year. Lower interest rates would give a boost to the economy, as well as prices for investments. The market has also traditionally had “relief rallies” after major, long-term upward runs for stocks cracked, Bannister said.

But he expects stock prices to remain under pressure as the economy’s growth slows more sharply in the second half of the year and as inflation remains stubbornly high. That could create a mild form of “stagflation,” which is something the Fed doesn’t have good tools to fix. The Fed could lower interest rates further to help the economy, but that would also push upward on inflation.

On Wall Street, Darden Restaurants climbed 5.8% after reporting profit for the latest quarter that matched analysts’ expectations. That was despite what the company behind Olive Garden, Ruth’s Chris Steak House and other restaurant chains called “a challenging environment.”

All told, the S&P 500 slipped 12.40 points to 5,662.89. The Dow Jones Industrial Average dipped 11.31 to 41,953.32, and the Nasdaq composite fell 59.16 to 17,691.63.

In stock markets abroad, London’s FTSE 100 fell 0.1% after the Bank of England held its main interest rate steady.

Indexes fell more sharply across much of the rest of Europe, and German stocks in the DAX lost 1.2%. The drop was even worse in Hong Kong, where the Hang Seng index fell 2.2% following heavy pressure on tech-related stocks.

In the bond market, the yield on the 10-year Treasury fell to 4.23% from 4.25% late Wednesday.

___

AP Business Writers Matt Ott and Elaine Kurtenbach contributed.