Atlanta Fed president Bostic to retire in February, opening seat on key committee

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

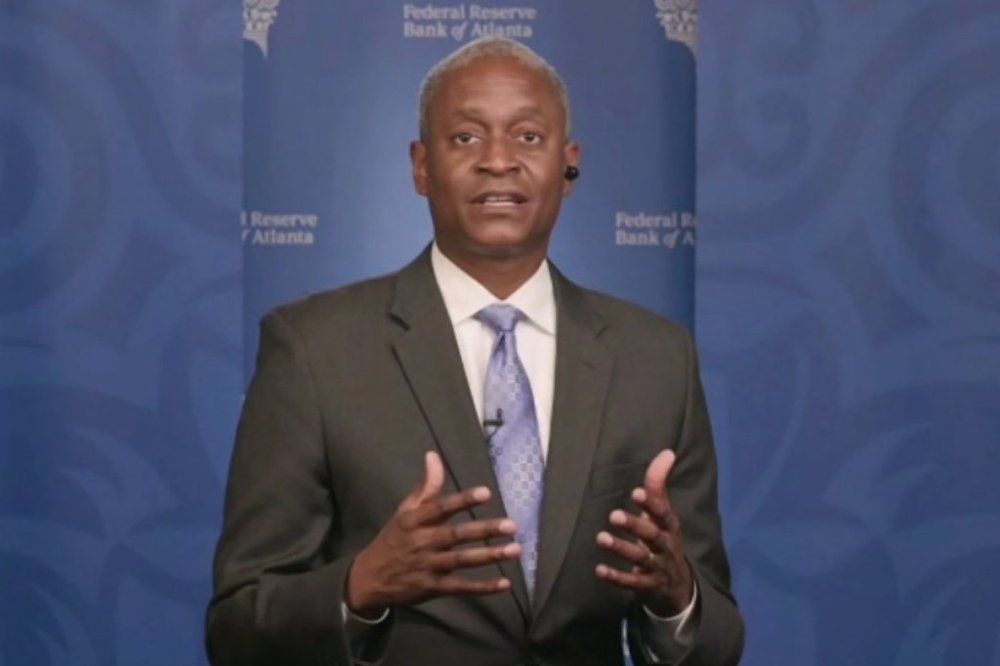

WASHINGTON (AP) — Raphael Bostic, president of the Federal Reserve Bank of Atlanta, will retire at the end of his current term in February, opening up a new seat on the Fed’s interest-rate setting committee at a time that President Donald Trump is seeking to exert more control over the central bank.

As president of one of the Fed’s 12 regional banks, Bostic, 59, serves on the 19-member committee that meets eight times a year to decide whether to change a key short-term interest rate that influences borrowing costs throughout the economy. Only 12 of the 19 participants vote on rates at each meeting. The regional Fed presidents rotate as voters, and the Atlanta Fed’s president will next vote in 2027.

Bostic’s replacement will be selected by the Atlanta Fed’s board of directors, which are made up of local business and community leaders, not the Trump administration. The terms of all the regional Fed presidents end in 2026.

Bostic is the first Black and openly gay president of a regional Fed bank in the Fed’s 112-year history and was first appointed in June 2017. He has recently expressed concerns that inflation is still too high for the Fed to deeply cut its key rate, and suggested he supported just one rate cut this year, while the Fed has cut twice.

Bostic did not provide a reason for stepping down, but is speaking later Wednesday and could provide more details.

In 2022, Bostic acknowledged that many of his financial investments and trades in previous years had violated Fed ethics rules and revised all his financial statements dating back to 2017. At the time, he said the trades were made by investment managers that he did not directly oversee and that he was unaware of the transactions.

The Fed’s Washington, D.C.-based board of governors will vote on whether to approve Bostic’s replacement. Trump has sought to gain more control over the Fed’s board, which would potentially give the administration more sway over the approval of the regional Fed presidents. Three of the current seven members of the board were appointed by Trump.

Trump has also sought to fire Fed governor Lisa Cook, which would have given him a fourth seat on the board. But Cook has sued to keep her seat and the Supreme Court has allowed her to stay in the job while the issue is fought out in court.

The regional Fed banks were set up specifically to ensure that voices outside Washington and New York would have a say in the central bank’s decisions.

Trump has repeatedly attacked the Fed this year for not cutting interest rates as quickly as he would prefer. The Fed reduced its key rate by a quarter-point at its September and October meetings, but Chair Jerome Powell said at a news conference last month that another cut in December is not a “foregone conclusion.”

In a September essay, Bostic said that the Fed’s short-term interest rate — at that time about 4.3% — was only “marginally restrictive,” meaning that it was barely holding back the economy and it wouldn’t require many cuts to bring it to a level that would stimulate the growth.

At the same time, Bostic said he remained worried about inflation: “I will not be complacent and simply assume … another inflation outbreak won’t happen,” he wrote.