Bad to worse

Economist’s new book predicts continuing high inflation, poor economic times ahead

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 21/05/2024 (531 days ago), so information in it may no longer be current.

Jeff Rubin thinks we’re living in the eye of a perfect financial storm — and that the dark clouds show no sign of breaking up.

Since moving on from Bay Street, where the 69-year-old served as chief economist at CIBC World Markets, the author of books such as The Carbon Bubble and The End of Growth has kept his finger on the financial pulse as the world has drastically changed — and what he sees isn’t pretty.

Book launch preview

An evening with Jeff Rubin

Launching A Map of the New Normal: How Inflation, War, and Sanctions Will Change Your World

● Wednesday, May 22, 7 p.m.

● McNally Robinson Booksellers,

1120 Grant Ave.

● Free

Rubin’s latest book A Map of the New Normal: How Inflation, War, and Sanctions Will Change Your World Forever is a wide-ranging deep dive that details how the COVID-19 lockdown (and financial handouts), the war in Ukraine and sanctions against Russia and China have contributed to higher interest rates, high inflation and more.

“When I was first approached by Penguin Random House to write this book, it was going to be a book called Is There Light at the End of the Tunnel?, and it was going to be about coming out of the pandemic and its economic legacy, how it had changed the economy,” Rubin says by Zoom from his Toronto home.

He’ll launch A Map of the New Normal in Winnipeg Wednesday at 7 p.m. at McNally Robinson Booksellers’ Grant Park, where he’ll be joined in conversation by Globe and Mail reporter Temur Durrani. It will also be streamed on McNally Robinson’s YouTube page.

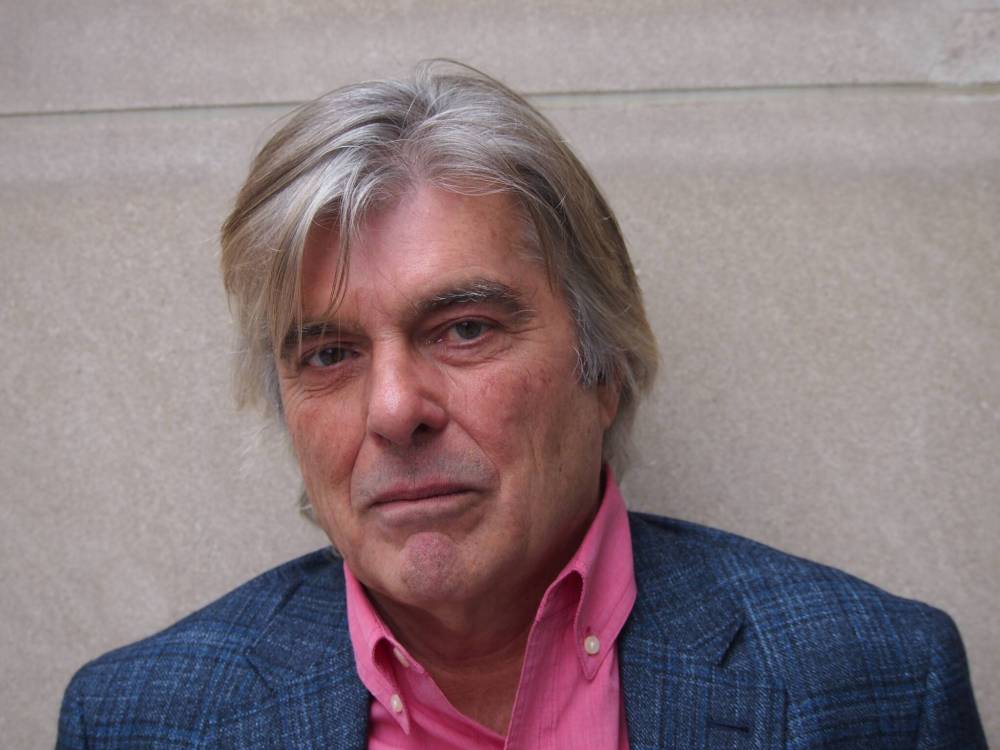

James Graham Photo Author and economist Jeff Rubin expects inflation and interest rates to continue climbing in the face of global and political uncertainty.

Rubin’s initial focus was on the repercussions of governments in many countries doling out financial aid left, right and centre during the pandemic. As government debt rose, central banks printed more money to cover the shortfall, while keeping interest rates at historic lows to help stimulate spending — an unsustainable trend.

In 2022, Russia invaded Ukraine, which proved to be the catalyst for Rubin shifting his writing to a broader scope.

“Events were superseding the original premise of the book, so we took a U-turn. The book took on an entirely different direction, hence the two-year time period to write it, which is about twice as long as what it would normally take me,” he says.

The invasion of Ukraine prompted western governments to impose economic sanctions on Russia, with the intent of crippling the country financially. Those sanctions didn’t work — in fact, they backfired.

“Vladimir Putin has been sanction-proofing the Russian economy since 2014 when the initial round of sanctions were levied against them for the annexation of Crimea,” Rubin says. “Sanctions haven’t done what they were intended to do, which is to bring the Russian and Chinese economies to their knees. But what they have done is strip to shreds the global trading order that we have constantly been told, for the last four decades, is the basis of our collective prosperity.”

SUPPLIED A local book launch for A Map of the New Normal takes place Wednesday at McNally Robinson Booksellers.

Before the Biden administration’s sanctions on Russia, Donald Trump’s government had imposed similar sanctions on China — with similar results. China began scaling back or withholding exports of cheaply made technology crucial to cellphones, computers and electric vehicles, while Russia shut down exports of goods such as natural gas, grain and fertilizer — the latter of which is used by many Canadian farmers to help grow food.

As a result, G7 countries have had to look elsewhere, including their own backyard, for goods once produced in China (where wages are much lower) or fuelled by Russia.

That, in turn, has seen the cost of groceries, electronics and almost everything else skyrocket, while rising inflation has seen the cost of borrowing for bigger-ticket items, such as cars and houses, similarly go through the roof.

Rubin doesn’t see much of a light at the end of the tunnel — at least not any time soon.

“Inflation is here to stay and, of course, with inflation comes much higher interest rates. We saw record borrowing during the pandemic … I predict mortgage rates will be going up further, and quite a bit in the next 12 months. We’re going to see a lot less borrowing — the era of free money is over,” he says.

In response to recent moves by the west, a powerhouse alliance of countries, including Russia and China, formed a group called BRICS as an alternative to the G7.

“BRICS includes the four fastest growing economies in the world — and I’m not just talking a single year, I’m talking an average of the last two decades — China, Russia, India and Brazil, in that order. And the fifth-fastest growing economy, Saudi Arabia, has also just recently joined,” Rubin says.

“If all the countries that have indicated a willingness to join BRICS get on board, it would dwarf the G7, not just in terms of GDP. It would have half the world’s population, it would have almost half of the world’s oil reserves and almost two-thirds of the world’s natural gas reserves.”

Sanctions have also hampered climate-change initiatives, as EU countries have had to pivot from Russian natural gas to older, dirtier energy sources such as coal, while solar panels and similar technology, typically coming from China, have largely dried up.

A shifting political landscape in the form of elections in the U.S. (and in Canada) could change the landscape somewhat, but not in a way that would bring back the pre-COVID normal.

“I think the war in Ukraine will be over in a matter of months, if not weeks, if Donald Trump becomes president again. He’s made it clear he does not consider Ukraine to be in America’s vital interests — nor, for that matter, does he consider Lithuania, Latvia or Estonia to be vital interests, all of whom also have large Russian minorities,” Rubin says.

There could also be changes closer to home, notably in relation to the abandoned Keystone XL pipeline, which would have seen oil flow from Alberta to the U.S.

“President Biden, when he cancelled the Keystone XL pipeline, pointed out rightfully that building fossil-fuel infrastructure like pipelines only perpetuates the use of fossil fuels. But why, then, is it OK for Europe to build 13 liquefied natural gas (LNG) terminals — which, by the way, can be 10 times as emission intensive as natural gas in its gaseous state — to replace Russian gas? Because the LNG happens to come from the U.S.,” Rubin says.

On a practical level, Rubin notes there have already been changes in consumers’ shopping habits and suggests people should focus on paying down debt, if possible, in the face of high interest rates, inflation and cost of living.

“Higher rates are here to stay because inflation is here to stay,” he says.

Near the outset of A Map of the New Normal, Rubin says “the shift to a new normal is a shift to war,” one that encompasses not only military conflict but also economic, diplomatic and informational battlefields.

The battle lines have been drawn, but those lines have also been blurred.

“This isn’t some biblical battle between good and evil,” says Rubin. “This is more Game of Thrones.”

ben.sigurdson@winnipegfreepress.com

Ben Sigurdson

Literary editor, drinks writer

Ben Sigurdson is the Free Press‘s literary editor and drinks writer. He graduated with a master of arts degree in English from the University of Manitoba in 2005, the same year he began writing Uncorked, the weekly Free Press drinks column. He joined the Free Press full time in 2013 as a copy editor before being appointed literary editor in 2014. Read more about Ben.

In addition to providing opinions and analysis on wine and drinks, Ben oversees a team of freelance book reviewers and produces content for the arts and life section, all of which is reviewed by the Free Press’s editing team before being posted online or published in print. It’s part of the Free Press‘s tradition, since 1872, of producing reliable independent journalism. Read more about Free Press’s history and mandate, and learn how our newsroom operates.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.