Alberta-Ottawa agreement on methane targets stokes dismay for some, relief for others

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

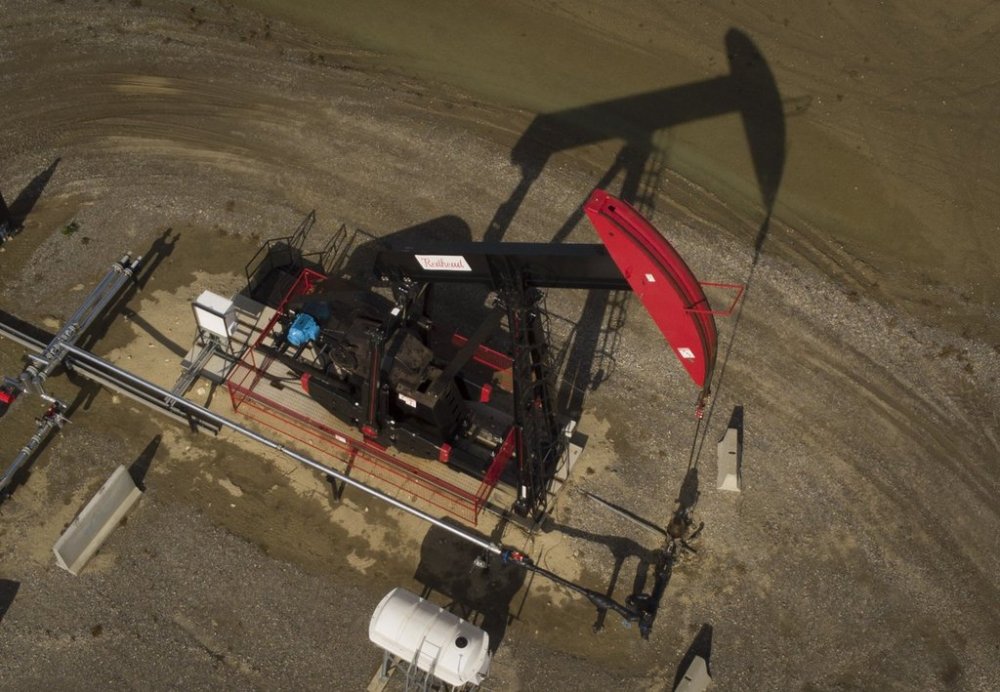

CALGARY – The prospect of building a new bitumen pipeline to the West Coast has garnered most of the attention since Ottawa and Alberta announced their sweeping energy accord late last month, but another item has left environmentalists dismayed and energy industry players pleasantly surprised.

The federal and provincial governments have agreed to extend by five years the timeline for the oil and gas sector to reduce its methane emissions. Draft federal regulations had called for a cut of 75 per cent from 2012 levels by 2030.

The memorandum of understanding would see the two orders of government enter into an equivalency agreement before April 1 with a 2035 target date to reduce emissions by 75 per cent over 2014 levels.

“The existing draft methane proposed laws put down by the federal government are completely unworkable. They’re not even close to being practical or realistic,” said Tristan Goodman, president of the Explorers and Producers Association of Canada. That group represents conventional producers, the bread-and-butter of Canada’s oilpatch outside the majors in the oilsands.

“So any opportunity to improve those or enhance them is constructive.”

Mark Scholz, president and CEO of the Canadian Association of Energy Contractors, welcomed the “more reasonable” methane policy.

Methane is a greenhouse gas more than 80 times more potent than carbon dioxide over a 20-year span, but its lifetime in the atmosphere is up to a dozen years versus centuries for CO2. So targeting methane is often considered low-hanging fruit for near-term emissions reduction efforts.

Alison Bailie, a senior research associate with the Canadian Climate Institute’s 440 Megatonnes policy progress tracker, said she was “puzzled” by the change.

She has previously written that finalizing the federal government’s regulations released in draft form in 2023 would be an “easy win for climate progress.”

The oil and gas sector is Canada’s biggest emitter of methane, the main component of natural gas. The gas can escape into the atmosphere through intentional venting, unintentional leaks from equipment and through inefficient burning.

Bailie said the “technology is there” to manage methane and there’s a growing industry to support those efforts. For instance, satellites can be used to better detect leaks and facilities can be improved to reduce the need for venting, which must sometimes be done for safety reasons.

The British Columbia government has set its own methane emissions target of 75 per cent below 2014 levels by 2030 and is aiming to eliminate them almost entirely by 2035.

But Bailie said other provinces might look for a deal with Ottawa similar to what Alberta managed to secure.

“A race to the bottom is something we want to really be careful about with these types of policies,” she said.

Alexandra Mallett, associate professor at Carleton University’s School of Public Policy and Administration, was also wondering why Ottawa and Alberta saw the need to lengthen the timeline, especially since there was so much consultation around the draft regulations.

“One could say, ‘Of course, the election of (U.S. President Donald) Trump — that’s a change,'” she said. Trump has looked to open up new areas to oil and gas development and boost his country’s domestic production while rolling back environmental regulation.

“And then of course there’s also this desire to support (liquefied natural gas),” Mallett added. LNG is natural gas that has been chilled into a liquid, enabling it to be shipped overseas on specialized tankers and sold in global markets.

Canada’s first cargoes of LNG started being shipped to Asia this summer from the LNG Canada plant in Kitimat, B.C. Several other plants are either under construction or in development on the West Coast.

Opponents of LNG development have cited methane leaks as one potential source of environmental harm.

Mallett said another reason she was surprised by the later timeline is that Europe and other trading partners have sent signals that they want their natural gas imports to have a lower emissions footprint. The European Union put into place stringent new methane regulations last year.

“So, in fact, (sticking to the more aggressive timeline) could be a way to make Canada more competitive,” she said.

Methane emissions reductions have been touted as one of the lower-cost tools in the climate-change-fighting tool box. The International Energy Agency said in a 2024 report that the amount of global investment needed to cut methane emissions by 75 per cent by 2030 would amount to less than five per cent of the US$2.4 trillion in net income the oil and gas industry generated in 2023.

The cost of meeting Canada’s existing draft methane targets has been pegged at $15.4 billion between 2027 and 2040.

“I don’t see that as cheap. That’s a lot of money,” said Goodman.

He said there are ways to “get a good result on methane for not a preposterous amount of spend,” but once companies take advantage of the easy opportunities that are available, it might not make economic sense to invest further.

Goodman added that the industry wants to reduce its methane emissions, but in the most efficient way possible. The status quo shows a “lack of knowledge on how the industry works,” he said.

“So we do hope to see some changes and some more openness on part of the federal government under this new approach to methane.”

This report by The Canadian Press was first published Dec. 14, 2025.