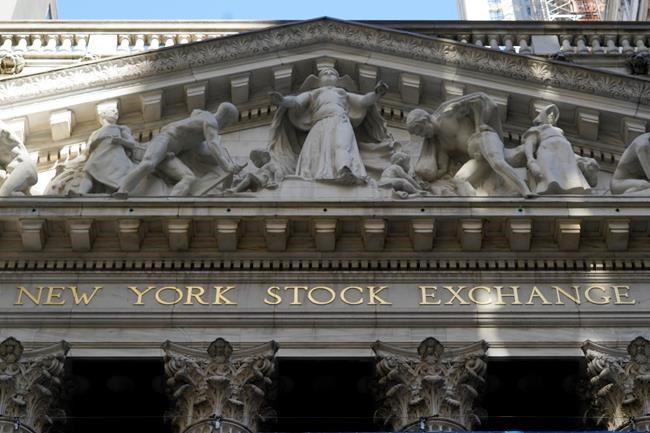

Stocks lower after Kabul bombing; traders also wait for Fed

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$1 per week for 24 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $4.00 plus GST every four weeks. After 24 weeks, price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 26/08/2021 (1525 days ago), so information in it may no longer be current.

Singapore – Stocks moved lower in afternoon trading Thursday following suicide attacks at the Kabul airport in Afghanistan, with reports of multiple deaths and casualties.

The S&P 500 index was down 0.3% as of 1:03 p.m. Eastern. The Dow Jones Industrial Average fell 0.2% and the Nasdaq composite fell 0.2%. The three major indexes remain on track for a weekly gain.

Twin suicide bombings struck Thursday outside Kabul’s airport, where large crowds of people trying to flee Afghanistan have massed, killing at least 13 people, Russian officials said. The airport had been the focus of NATO evacuations from the country after the Taliban took over last week.

Before the attack, most of the market’s attention was on the Federal Reserve. The Federal annual two-day convention started in Jackson Hole, Wyoming, on Thursday. Fed Chair Jerome Powell is scheduled to speak on Friday.

Traders are betting that Fed officials will remain in a “wait and see” mode regarding inflation, since most policymakers believe any inflation earlier this year would be temporary and the rise in COVID-19 cases has worried some economists.

That said, yields have steadily risen in the bond market in the past week, which could be a sign that traders are preparing for the Fed to start winding down its emergency support measures in the coming months. The yield on the 10-year Treasury note was trading at 1.36%, up from 1.34% the day before.

The selling was widespread, with 10 of the 11 sectors in the S&P 500 moving lower. Technology stocks and a mix of companies that rely on consumer spending accounted for much of the pullback. Western Digital fell 3.8% and Dollar Tree dropped 11.7%.

Jobless claims edged up by just 4,000 to 353,000 from a pandemic low 349,000 a week earlier, the Labor Department reported Thursday. The four-week average fell by 11,500 to 366,500. That’s the lowest since mid-March 2020.

Salesforce.com was one of the biggest gainers, rising more than 4.7% after the company’s quarterly results easily beat analysts’ expectations. The company also raised its full-year outlook.

Companies that report their results after Thursday’s closing bell include technology giant HP, as well as Gap.