‘Bankruptcy risk is associated with lower income’: U of W report

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$1 per week for 24 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $4.00 plus GST every four weeks. After 24 weeks, price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 06/04/2015 (3840 days ago), so information in it may no longer be current.

Poor Winnipeggers have almost no consumer debt but still live close to bankruptcy while wealthier Winnippegers have much heftier debt levels but a very low risk of insolvency.

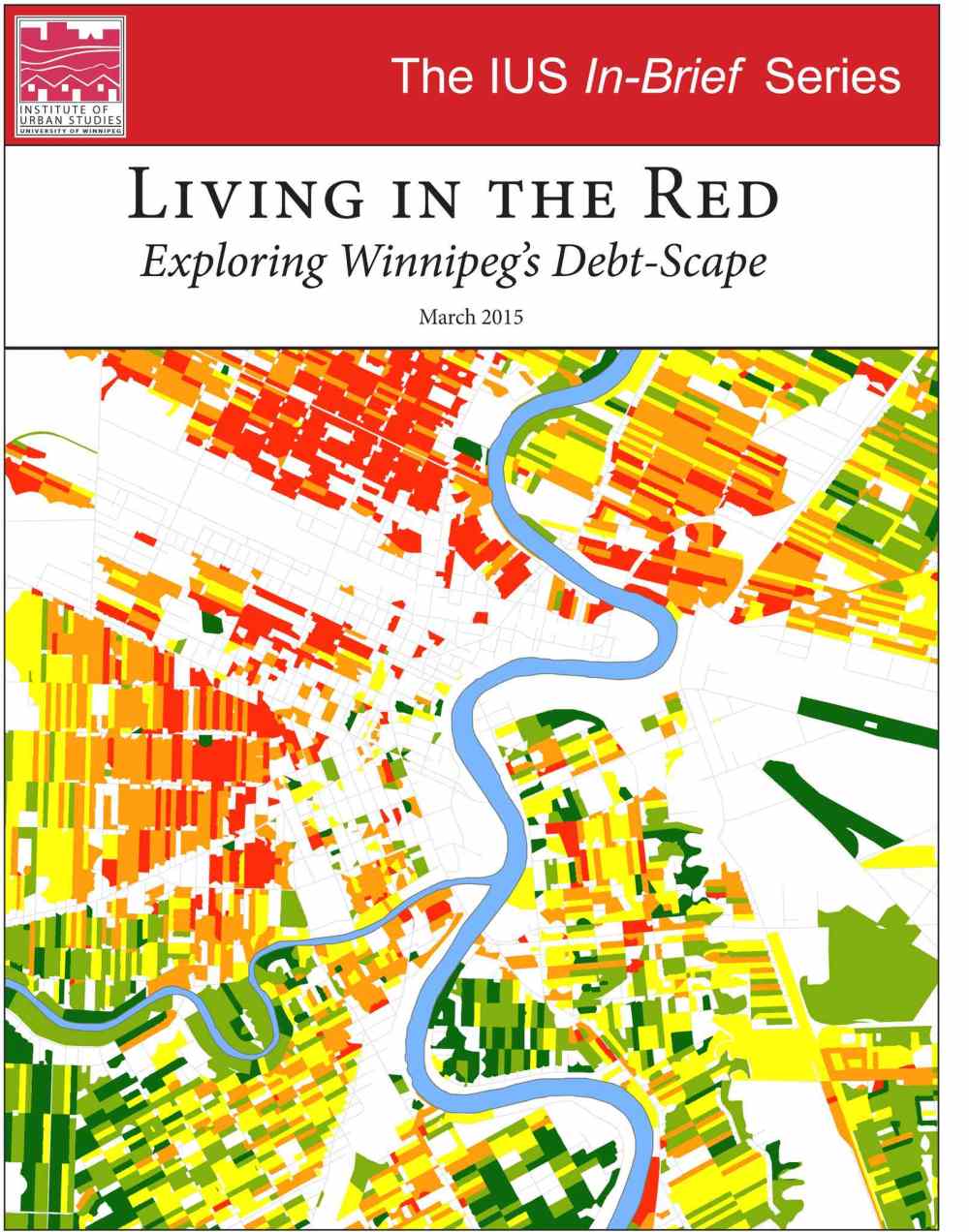

That’s the finding of a new report released today by the University of Winnipeg’s Institute of Urban Studies. Researchers there crunched data on consumer debt such as credit cards, car loans and lines of credit as well as bankruptcy risk based on postal code.

The IUS found that neighbourhoods like the North and West Ends had low debt rates but a high risk of declaring bankruptcy in the next 18 months.

Meanwhile, neighbourhoods such as Tuxedo had high debt rates because higher incomes allowed them to borrow more, but low bankruptcy risk.

“This may suggest that bankruptcy risk is associated with lower income, not higher spending,” said the report.