Total cost of IGF to be $376M if all goes according to business plan

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 04/01/2016 (3600 days ago), so information in it may no longer be current.

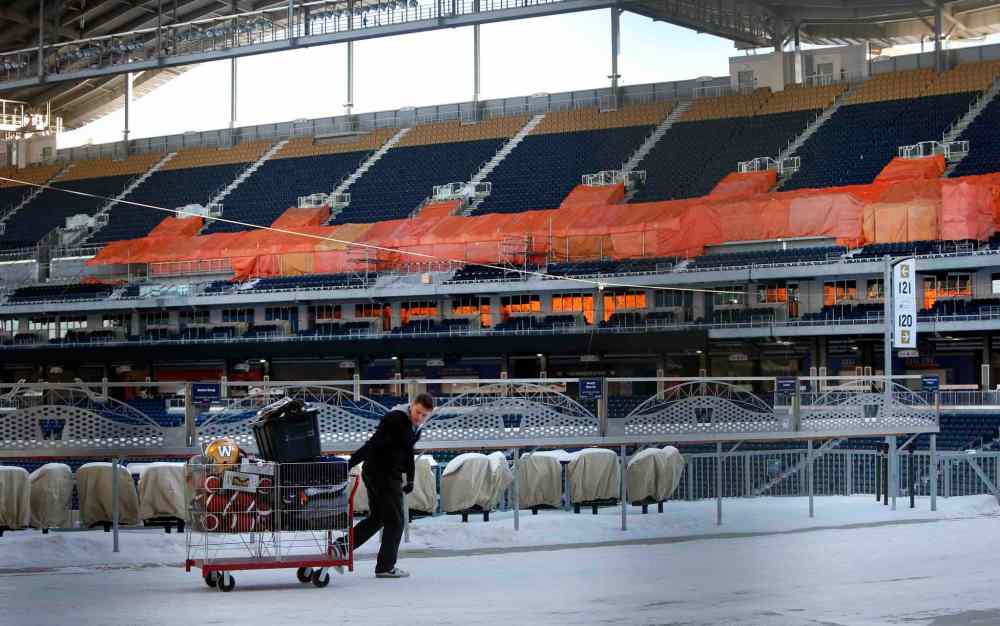

The total cost of Investors Group Field will be $376 million by the time all the loans are paid back, provided the assumptions in the football stadium’s business plan are met.

The financing plan for the Winnipeg Blue Bombers’ three-year-old home at the University of Manitoba calls for the city, province and Winnipeg Football Club to spend $167 million on interest charges on a pair of loans over the 45-year life of the 33,500-seat facility.

The projected interest comes on top of $209 million spent on the building the stadium, which opened in 2013. Those interest charges will stay under $167 million as long as the Winnipeg Blue Bombers continue meeting their annual stadium-payment obligations — and the former Canad Inns Stadium site at Polo Park starts generating more property-tax revenue.

So far, the football club has fulfilled its obligations to transfer $4.5 million a year to Triple B Stadium, the shell company that owns Investors Group Field. Property-tax revenue from the former Canad Inns Stadium site, however, totalled $1.3 million in 2015, lagging behind business-plan projections.

This site was exempt from paying property taxes when it housed a stadium. Now owned by a partnership between Shindico Realty and Cadillac Fairview, the land is home to an empty former Target store.

The Selinger government expects the former Canad Inns site to be redeveloped in full by 2019 and start generating enough tax revenue to ensure principal and interest payments on the larger of two stadium loans exceed new financing charges.

“You have to remember that the site at Polo Park site was yielding zero taxes and now it’s yielding significant tax revenue and it has significant potential for the future,” Premier Greg Selinger said Monday in an interview, adding Winnipeg is growing fast enough to ensure a high demand for commercial real estate.

“There will be more development at Polo Park. The specific timing for that will depend on the larger story of the Canadian economy, but the biggest driver will be population growth.”

Shindico development manager Bob Downs said last week the redevelopment of the site should resume this year and described its future prospects as “not bad.”

Selinger said the province will monitor the redevelopment “on a year-by-year basis” and will re-evaluate the stadium’s financing plan if Polo Park revenue does not meet expectations.

The premier said in the interim, there’s no need to worry about mounting interest charges on $170 million worth of stadium loans.

“The borrowing costs for any capital project are among the lowest we’ve seen in decades, all across the country,” said the premier, whose province now sports a combined debt of $20.4 billion.

Selinger also suggested it’s unfair to look at the stadium’s $376-million total project cost without considering the facility’s economic benefits. Those spinoffs include tourism revenue and other economic activity generated by events such as the Grey Cup, the FIFA Women’s World Cup and concerts at Investors Group Field, he said.

“If you’re going to look at the total story, you have to square that up with the total benefits, and in the first three years, the total benefits are well over $100 million dollars,” he said. “The financing costs are over 40 years. Over that 40 years, how many hundreds of millions of dollars are we going to get?”

Selinger nonetheless said the province should disclose both capital and financing charges when projects are announced.

He also said more capital costs may be added to the stadium project once the courts decide which party is responsible for construction and design flaws at the facility.

In 2015, the province guaranteed a $35.3-million loan that will allow Triple B Stadium to replace concrete concourses at Investors Group Field, fix improper drainage and conduct other repairs. Selinger said insurance is expected to cover “at least a portion” of these costs, pending the resolution of a lawsuit between Triple B Stadium, builder Stuart Olson and architect Ray Wan.

bartley.kives@freepress.mb.ca