Electrical storm on the horizon

Mounting debt not only hurts Manitoba Hydro, but potentially the province's bottom line

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 22/04/2017 (3120 days ago), so information in it may no longer be current.

On March 12, 1873, six years before Thomas Edison invented the light bulb, Winnipeg businessman Robert A. Davis was lighting his Main Street hotel with electricity. Using an arc lamp and a steam-powered electric dynamo brought from New York, the man who would become Manitoba’s fourth premier set in motion a series of events that would culminate in today’s Manitoba Hydro.

The Manitoba Free Press described Davis’ light — turned on four days after the founding of the Winnipeg Gas Co. — as an institution that “guides the weary traveller to a haven of rest, billiards and hot drinks, and lights up the streets probably more than the lamp of the newly incorporated gas company will for centuries to come.”

That Davis would cast a shadow on the future of gas lighting would turn out to be no small coincidence. Electricity would go on to become a cornerstone of the province’s economy, an economic driver providing residents with cheap power and a significant lure for energy-intensive industries. It would generate billions of dollars in jobs and revenue and establish Manitoba as a world leader in hydroelectric power.

So where did it all go wrong? Has it all gone wrong? Does Hydro’s forecast of a $25-billion debt bring the corporation perilously close to insolvency, or is it a temporary liability on the path to a stronger future? Opinion, it seems, is divided by ideology. If you’re on the political right, the sky is falling. On the left? It’s no worse than Hydro’s building boom in the 1970s.

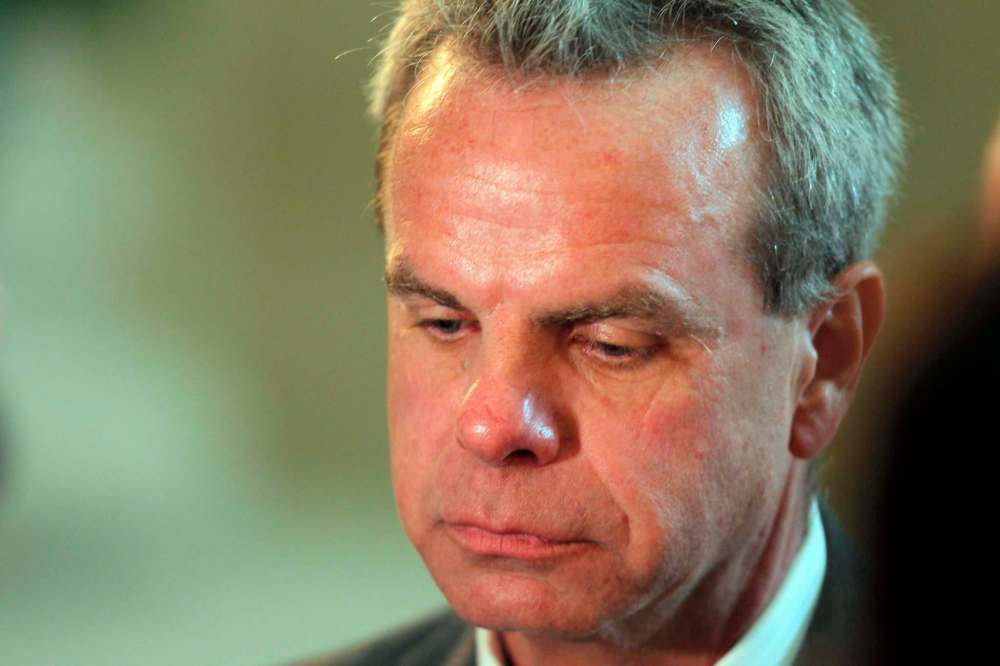

“I’d characterize our financial situation as challenging,” said Kelvin Shepherd, president and CEO of Manitoba Hydro. “I wouldn’t characterize it as a crisis, by any stretch of the imagination.”

Seven years after Donald Smith — the same man who pounded the famous last spike at Craigellachie, B.C., and thus completed Canada’s first transcontinental railway — co-founded Winnipeg Gas Co., the provincial legislature passed an act of incorporation creating the Manitoba Electric and Gas Light Co. in 1880. The two power companies would merge in 1881, a move that could be seen as a death knell for gas lighting and a sign electricity was here to stay.

Streetcars played a major role in the layout of city streets and in rolling out electricity, with Albert Austin founding the Winnipeg Street Railway Co. in 1881, at first running horse-drawn and later electric streetcars in Winnipeg and in the parishes of St. Boniface, St. John’s, St. James and Kildonan. That same year, New York businessman P.V. Carroll supplied a small dynamo to power a nightly demonstration of electric light along Main Street and Broadway, using the same arc-lamp technology as Davis used eight years earlier.

Two years later, in 1883, the North West Electric Light and Power Co. was created, and built a power plant on Wesley Street, near what’s now known as William Stephenson Way.

Then, in 1891, the first Edison electric streetcar made a maiden voyage along River Avenue, powered by a steam plant at what is now Bonnycastle Park on Assiniboine Avenue. It was the start of Albert Austin’s electric fleet, which he’d later sell to the Winnipeg Electric Streetcar Co.

The idea of using rivers to generate electricity dates back to the grist mills of the 16th and 17th centuries. Once it was understood electricity could be generated by moving a magnet inside a coil of wire, it didn’t take long for someone to get the idea to turn the power of a mill from grinding grain to generating volts.

The world’s first hydroelectric scheme, according to several sources, was in 1878 in Northumberland, England, where William George Armstrong used the flow of water to power a single arc lamp in his art gallery.

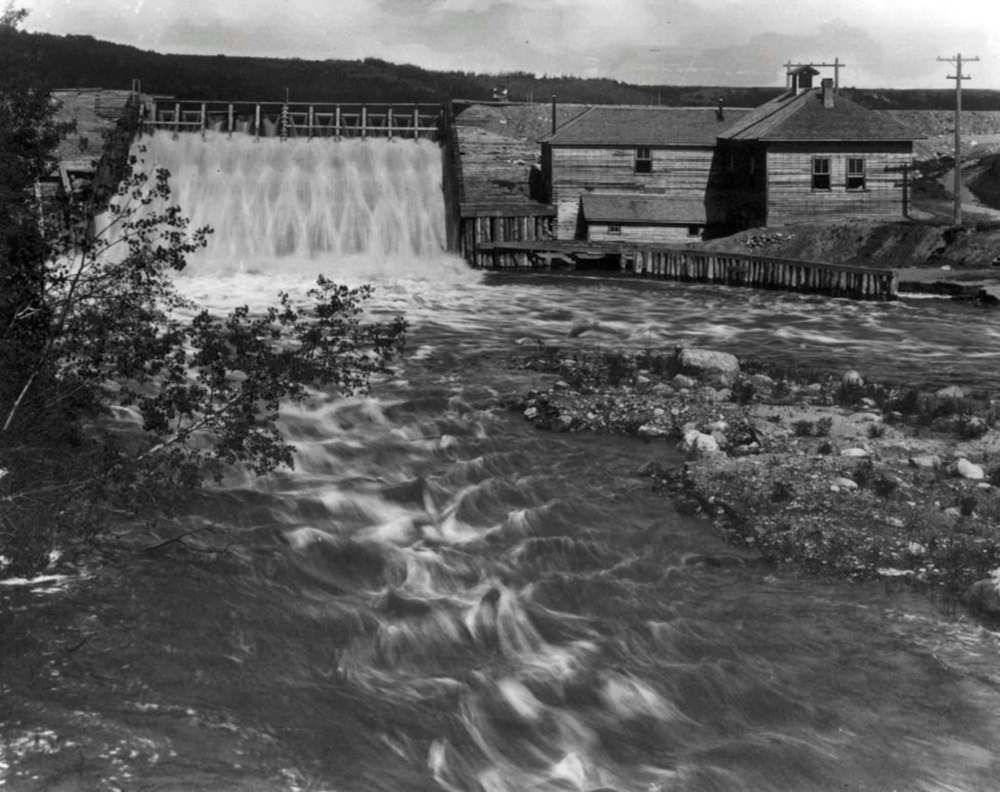

Manitoba would start to harness the power of its many rivers starting in 1900, though the first few steps were tentative. That year, the province’s first hydro plant was built on the Minnedosa River — now known as the Little Saskatchewan River — just south of Rivers. It operated only eight months of the year and sent power to Brandon, 14 kilometres to the east. It was dismantled in 1924.

By 1906, the Winnipeg Electric Railway Co. held a virtual monopoly on electricity in Winnipeg. That company built the first hydroelectric station, and the first to operate year-round, on the Winnipeg River, near Pinawa.

Of course, a monopoly didn’t sit well with the City of Winnipeg, which created City Hydro. Ald. John Wesley Cockburn, on his initiative, secured development rights for what would become the Pointe du Bois generating station and surrendered those rights to the city. Pointe du Bois — which is still in operation — would open in 1911 at a cost of $3,250,000 (about $79 million today).

Fast forward to 1961, and Manitoba Hydro is born, an amalgamation of the Manitoba Hydro-Electric Board and the Manitoba Power Commission. It would acquire Winnipeg Hydro in 2002. Today, Hydro operates 15 hydroelectric generating stations on the Nelson, Winnipeg, Saskatchewan, Burntwood and Laurie rivers. The corporation claims 96 per cent of its power is renewable, including power purchased from independent wind farms in Manitoba.

Hydro says it has contracts to sell $9 billion of power on the export market over the next 20 years, and will sell power on the spot market as opportunity arises.

For James Allum, NDP MLA, finance critic and backup Crown corporations critic, those who took the leap of faith to invest in the province’s future through hydroelectric power deserve our thanks.

“The historian in me knows that you stand on the shoulders of the ones who came before you,” he said. “Those individuals and many others had a vision for hydro that ultimately came together to be for the benefit of the people of Manitoba.

“I think right now, the current government is putting that at risk.”

The Progressive Conservatives under Brian Pallister have been sounding the alarm about Hydro’s debt, pointing to delays and rising costs for the Keeyask generating station and the Bipole III transmission line, and laying blame at the feet of the NDP, who held power when the projects were started and which pushed through the controversial western route for Bipole III, a $4.5-billion project made $1 billion more expensive by choosing a western route instead of east of Lake Winnipeg.

The Tories have been joined by credit-rating agency S&P Global, which declared Hydro’s debt “unsustainable.” However, other credit-rating agencies, including Moody’s and Dominion Bond Rating Service have a more favourable outlook, although those agencies tie their ratings to the government guarantee of Hydro’s debt.

Business lobby groups such as the Canadian Taxpayers Federation and Winnipeg Chamber of Commerce have also expressed concern, saying Hydro’s debt threatens Manitoba’s status as having some of the cheapest power in North America and calls into question the balance sheet of the province as a whole.

“When you have a major bond-rating agency saying Hydro’s debt is so high it’s not self-sustaining, that’s very scary,” said Todd MacKay, regional director for the taxpayers’ federation. “It should be a wake-up call to us all.

“You have lots of businesses who were in Manitoba because of low power rates, and now they’re wondering why to stay.”

The Winnipeg Chamber of Commerce said low energy costs have been an important piece of Manitoba’s economic-development toolkit, and rate hikes could diminish that benefit, while runaway debt threatens the province’s autonomy.

“It’s not just the fiscal cost,” said chamber president Loren Remillard. “The real cost could be losing the ability to determine our own future.”

Remillard said the more debt a corporation holds, the more control those creditors expect over the institution. At some point, those creditors say no, or attach strings to further debt.

Pallister appointed longtime businessman Sandy Riley as chairman of Hydro, who soon joined Finance Minister Cameron Friesen in announcing the rising debt could lead to a downgrade of the province’s finances. Riley then announced 900 job cuts, and Hydro hopes to meet the bulk of that cut through a combination of attrition and a voluntary departure program released to employees April 10.

“Even with these reductions, double-digit annual rate increases would be required for at least five years in order to re-establish Manitoba Hydro on a proper financial footing,” he told the Free Press in February.

Riley later announced he was asking the province for an infusion of equity to help stabilize Hydro’s balance sheet. The reaction was swift, and somewhat bewildered.

“I found that extremely baffling,” the taxpayers’ federation’s MacKay said. “An equity partner? Manitoba owns Manitoba Hydro. How can you have more than 100 per cent equity?

“It’s kind of like deciding which end of a leaky canoe to bail out. If the government bails out Hydro, it shows up on the province’s debt. If they don’t, it shows up on Hydro’s. Ultimately, it’s a shell game.”

Pallister’s response was blunt: no.

Both MacKay and Allum are on the same side of the bailout argument, and each has his own opinion about ulterior motives.

“It’s a pretty silly argument. The only people who benefit are Manitoba Hydro management, who get a boatload of cash to paper over their problems,” MacKay said.

Allum sees a different reason.

“We’ve seen this movie played over and over, by the same characters,” Allum said, adding a similar script was used in the lead-up to the privatizations of MTS and Ontario Hydro.

“It’s trying to create a crisis by throwing everything into the pot to unnerve Manitobans about the state of Manitoba Hydro and Manitoba’s economy.

“Every other indicator, however, tells us the debt affordability of Manitoba Hydro and the larger Manitoba context is on solid ground — debt always has to be managed, no one will ever dispute that — but those investments will pay for themselves over the long term and in the interim, we have multiple benefits for Manitobans.”

Allum said the projects creating the bulk of Hydro’s debt, the Keeyask generating station and the Bipole III high-voltage transmission line, are necessary for meeting future demand for power.

He also sees benefits beyond electricity, particularly with the way First Nations have been integrated into the project, officially run by the Keeyask Hydropower Limited Partnership, which joins Manitoba Hydro and four Manitoba First Nations.

A report from the Boston Consulting Group supports Allum’s assertions, in part. It said Bipole III is a necessary addition to Manitoba’s electric infrastructure, insurance against catastrophic damage to its predecessors, Bipole I and Bipole II. Further, it said Bipole I and Bipole II run so closely together, a common catastrophe could wipe out both.

The Boston report, however, labelled the start of Keeyask as “imprudent,” saying domestic demand isn’t expected to rise to a level requiring Keeyask’s output for 10 years after construction.

Allum said if that’s true, there’s no predicting what the future cost of construction and interest will be, adding today’s low-interest environment means there’s no time like the present.

“It (borrowing cost) was 13 cents on the dollar when we came into power,” he said, referring to 1999, when the NDP under Gary Doer formed a majority government. “Today, it’s six cents.”

Ian Goodman, president of The Goodman Group, an energy consultancy in Berkeley, Calif., said what’s also worrisome about Keeyask’s output is a soft export market held back by rock-bottom natural gas prices, weak economies and improving energy efficiency.

“It’s a perfect storm of relatively cheap supply and low demand for growth keeping electricity pricing cheap,” he said.

Combine that with an American federal government moving away from environmental protection — U.S. President Donald Trump recently removed a moratorium on coal mining, for instance — and Manitoba Hydro’s ability to charge a premium for “green” hydroelectricity vanishes.

“In some ways, it’s gambling. When the gambles come off well, it’s good. When they don’t, it’s the people of Manitoba who are left picking up the tab,” he said.

Goodman said some of this could have been foreseen: reviews prior to construction raised red flags, but also included the possibility of some favourable scenarios. That, and a tendency to favour job creation, is seen as the impetus for moving forward.

“I think that’s part of the concern. It’s a government-owned utility, a big force in the province’s economy and you tend toward what to an extent are political objectives. On a shorter-term focus, there are pluses: you spend a lot of money and it results in some jobs, very visible jobs.

“I understand the attraction politically. Instead of 10 jobs here and five jobs there, you get thousands of jobs in one place.”

Not helping Hydro’s finances, Goodman said, is the policy of running domestic rates as low as they are. It makes it a sound economic-development tool, but leaves little margin to build up cash reserves. That’s an issue Hydro president Shepherd plans to address.

“It’s hard to have that debate now, when things aren’t going so well. Once again, that may be, as a long-term choice, whether you’re going to plan and build up some reserves.”

As for where Hydro goes from here, the taxpayers’ federation’s MacKay said it’s crucial to not overreact but rather to conduct an in-depth analysis of what’s gone wrong, what’s gone right and what steps should be taken to move forward. He said cancelling the two big projects now is not an option, with billions already spent and billions more dependent on their completion.

Allum, meanwhile, was less circumspect. He said it’s time the Tories get their heads out of the 1970s, when the party predicted the same doom and gloom about the Limestone Generating Station, and look to the future.

“When you look at the big picture and the multiple benefits associated with (Keeyask and Bipole III), and I’m referring to the partnerships with the indigenous nations, and you have a favourable picture all the way around,” Allum said.

“What I detect from the Tories constantly is they know the cost of everything and the value of nothing, “ he said.

“They don’t see the benefits of these investments, with Keeyask or in the past whether it was Limestone or others, and the result of that is they could do considerable damage to a Crown corporation that has served Manitobans very well over 50 years and hopefully for many more years to come.

“The Tory approach to this is always to undermine the validity of the corporation, likely with a view towards privatization, which is what we saw with the privatization of Ontario Hydro and what we saw with MTS in the mid-90s.”

As for Riley’s request for cash, Allum was also blunt.

“I think Mr. Riley needs to get out and start selling more power.”

Goodman said that’s not so easy. He said Hydro’s prime export market is Minnesota, in particular the Twin Cities. It’s there where cheap natural gas — used in thermal generation — is driving down energy costs. He said that’s less of a concern on long-term contracts, which typically hedge rates based on inflation or the cost of new generating stations.

“But Manitoba Hydro also sells lots of exports via short-term contracts or spot transactions, and pricing for those types of exports will likely be based on prevailing rates.”

Worrisome, he said, is that about 70 per cent of Hydro’s exports are these types of “opportunity” sales, while only 30 per cent are long-term, or “dependable.”

“Manitoba Hydro seems to have based its plans on the assumption it would get the benefit of these dependable export sales, plus get better pricing for opportunity exports than it has been getting, and is likely to get,” he said.

“So, in a period when Manitoba Hydro is spending heavily, notably for Bipole III and Keeyask, Hydro will be under continuing financial stress because costs are rising faster than revenues.”

Goodman also said Hydro’s ability to build financial reserves is restricted by its policy of selling domestic power on very thin margins, offering cheap power to Manitobans but little in the way of profit that could build a cushion against future financial uncertainty.

For his part, Hydro president Shepherd said despite the challenges, steps Hydro is taking now — a 15 per cent staff reduction, overhaul of management and salaries and applications for rate increases — will help put the company back on solid ground financially.

He thinks this is a lean period from which Hydro will emerge stronger and more stable. He doesn’t envy our neighbours, who face considerable expense in the future moving away from fossil fuels for their electric needs.

“I do. I mean, we definitely have some financial challenges, but we also have some tremendous strengths: we generate almost all our electricity from renewable energy, from hydro, and we don’t face the cost uncertainty of jurisdictions such as Saskatchewan or Alberta in carbon pricing and converting from coal,” he said. “We have a cost-effective and stable generating platform.”

Shepherd said a key issue for Hydro is a revenue structure that provides for low rates, but generates insufficient revenue.

“If you look at core operations, forget the big projects, we’re not generating enough cash flow to cover core operations, so aside from the debt challenges we’re facing, there’s an underlying structural problem. Rates need to go up over a period of time.”

Manitobans will get a clearer picture of Hydro’s financial situation from its submission to the Public Utilities Board in May arguing for rate increases. The PUB has typically set a high standard for using Hydro finances to approve a rate increase.

“There are some positives people need to remember, as well,” Shepherd said. “If you look at our strengths, we have a lot of debt, yes, but we have a lot of room with rates where they are to generate the revenue to support the company’s operations. When we’re talking about rate increases, we’re still going to have among the lowest rates in the country over the next 10 years.”

kelly.taylor@freepress.mb.ca

Kelly Taylor

Copy Editor, Autos Reporter

Kelly Taylor is a copy editor and award-winning automotive journalist, and he writes the Free Press‘s Business Weekly newsletter. Kelly got his start in journalism in 1988 at the Winnipeg Sun, straight out of the creative communications program at RRC Polytech (then Red River Community College). A detour to the Brandon Sun for eight months led to the Winnipeg Free Press in 1989. Read more about Kelly.

Every piece of reporting Kelly produces is reviewed by an editing team before it is posted online or published in print — part of the Free Press‘s tradition, since 1872, of producing reliable independent journalism. Read more about Free Press’s history and mandate, and learn how our newsroom operates.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.

History

Updated on Thursday, April 20, 2017 9:41 PM CDT: adds art