Reports of counterfeit bills double

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.95 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.99/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19.95 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 02/05/2025 (245 days ago), so information in it may no longer be current.

Winnipeg police have warned the public there’s been a significant spike in the amount of counterfeit cash seized this year.

“These bank notes are being found basically all over the city,” said Const. Keith Ladobruk of the police financial crime unit.

At a news conference Friday, police said they’d received 67 counterfeit cash reports in the first quarter of 2025 compared with 30 in the first quarter of 2024. Officers have seized about $12,000 worth of counterfeit bills this year.

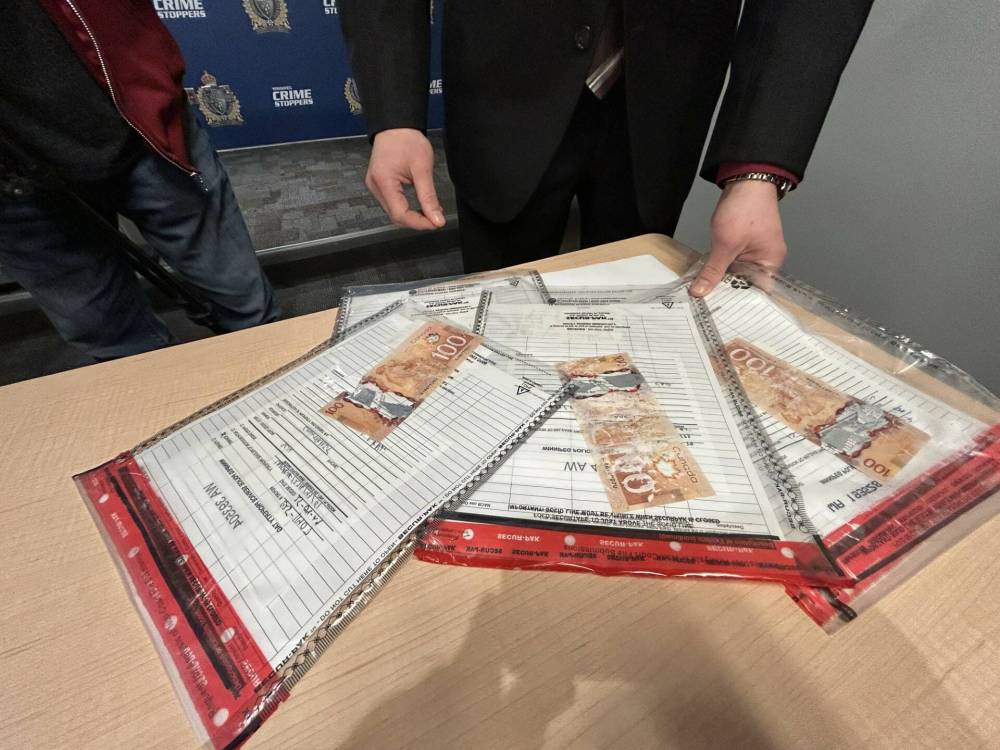

Winnipeg Police Service financial crimes Const. Keith Ladobruk shows off seized counterfeit bills. (Erik Pindera / Free Press)

The realistic-looking fakes have been used at restaurants, retail stores, casinos, banks and credit unions, Ladobruk said.

Some people may have received and used the fake money unwittingly, while others are illegally trying to pass off the cash as legitimate.

Ladobruk said some consumers, particularly newcomers to Canada, may be less familiar with the look of Canadian cash.

“We haven’t seen counterfeiting issues to this level in almost a generation, since polymer bank notes were developed to combat counterfeiting,” said Sgt. Trevor Thompson.

“There’s a level of naivete, I would say. People think that the polymer notes are 100 per cent foolproof… it’s been 10, 15, 20 years since we’ve had a problem to this extent.”

He said polymer notes, introduced in 2011, almost eliminated counterfeiting before the recent spike.

“We have a generation of people working at retail locations… that don’t have a lot of experience handling cash because of digital payment systems, and when they do receive cash, they may not be familiar with it,” said Thompson.

“Counterfeit’s not top of mind.”

Police have not confirmed how the fakes landed in Winnipeg or where they’re made.

SUPPLIED

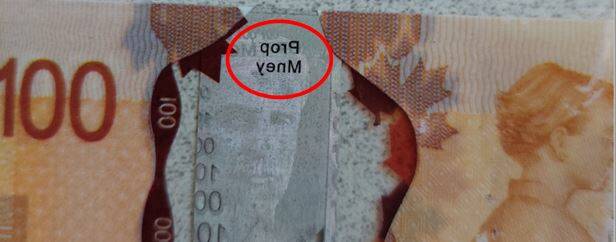

‘Prop money’ printed in reverse on a $100 billThompson said they likely originate from outside Canada. Police across the country have noticed a spike in counterfeit cash, he said.

He said counterfeit money is sold on social media under the guise that the bills are props for film and television production.

The fake cash that’s been seized, which uses Bank of Canada trademarks, cannot be legitimately used as a prop in the film industry, Thompson said.

The Bank of Canada is aware of the increase in counterfeit bills and is working with law enforcement, financial institutions, retailers and the Canada Border Services Agency to address the issue, said bank spokesman Sean Gordon.

Thompson noted the border agency has made recent significant seizures of counterfeit money.

In March, border agents and RCMP in Nova Scotia announced they had seized more than $100,000 in counterfeit money shipped from China.

Thompson said it’s believed organized crime is involved. Winnipeg police arrested people accused of knowingly using the fakes to make purchases.

The majority of the fraud incidents in Winnipeg involved a specific type of fake banknote.

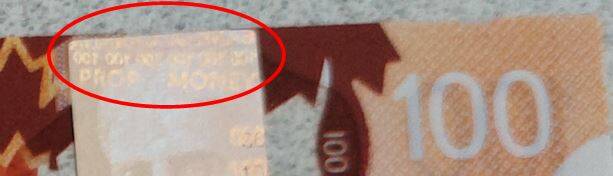

SUPPLIED

The words ‘prop money’ embedded in a bill’s holographic imageOne contains the words “prop money” printed in reverse, in small black type, on the top of the holographic strip on the back of the note. The same words are embedded in the holographic image.

The fraudulent bills are of high quality and replicate the look and feel of real banknotes, police said. The bills also have some security features that are found in legitimate notes.

The notes seized bear the serial numbers GJR6710018 through GJR6710022 and are in $20, $50 and $100 denominations.

Police suggest the public scan a banknote to look for a slight difference in colour, pictures on the note starting to wear off, notes becoming creased in the middle, bills that seem more similar to a paper note, and a slightly raised holographic strip.

Police advised people who think they might have counterfeit bills to contact their bank or credit union or go to the Bank of Canada website.

Thompson said an individual or business that receives the fake cash can’t exchange it for real currency.

John Graham, the Retail Council of Canada’s government relations director for the Prairies, said the fake notes are a concern.

“The sophistication of counterfeit money has increased dramatically,” said Graham, noting retailers tend do most of their business with credit and debit, rather than cash.

He said some retailers are reinforcing their policies and training to prevent counterfeit cash from being accepted.

SUPPLIED

The notes currently being seized contain the serial numbers GJR6710018 through GJR6710022.“Few stores have the ability to move away from cash without impacting their sales,” he said.

Menchie Finlay, a co-owner of two Cinnaholic bakery outlets in Winnipeg, said they haven’t noticed counterfeit currency at their Kenaston Boulevard location, which accepts cash.

“We don’t have any concern at all,” she said, adding they stopped accepting cash at their McPhillips Street location a year ago due to concern about robberies.

“I hope other companies or businesses start using cashless. That’s the way to go.”

erik.pindera@freepress.mb.ca

Erik Pindera is a reporter for the Free Press, mostly focusing on crime and justice. The born-and-bred Winnipegger attended Red River College Polytechnic, wrote for the community newspaper in Kenora, Ont. and reported on television and radio in Winnipeg before joining the Free Press in 2020. Read more about Erik.

Every piece of reporting Erik produces is reviewed by an editing team before it is posted online or published in print — part of the Free Press‘s tradition, since 1872, of producing reliable independent journalism. Read more about Free Press’s history and mandate, and learn how our newsroom operates.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.

History

Updated on Friday, May 2, 2025 11:51 AM CDT: Adds more photos

Updated on Friday, May 2, 2025 3:03 PM CDT: Updates with final version

Updated on Friday, May 2, 2025 3:14 PM CDT: Adds byline