Statistics Canada says household debt ratio up in second quarter

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.95 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.99/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19.95 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 12/09/2022 (1215 days ago), so information in it may no longer be current.

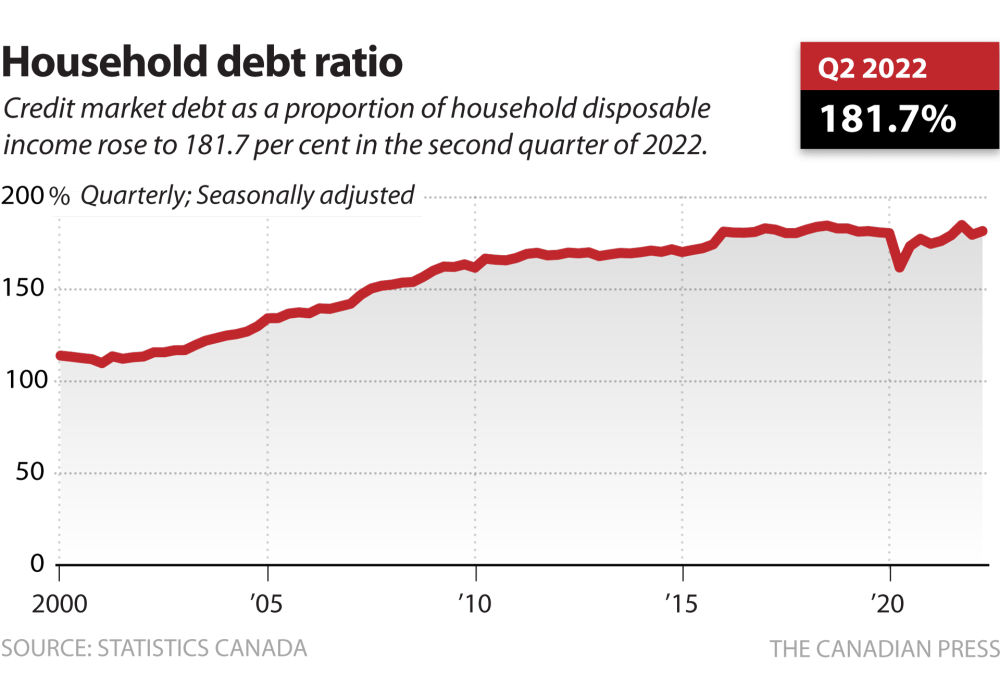

OTTAWA – Statistics Canada says the amount Canadians owe relative to their income moved higher in the second quarter as the level of debt grew faster than their earnings.

The agency says household credit market debt as a proportion of household disposable income rose to 181.7 per cent on a seasonally adjusted basis in the second quarter, up from 179.7 per cent in the first quarter.

In other words, there was about $1.82 in credit market debt for every dollar of household disposable income in the second quarter.

The increase came as households’ disposable income increased 1.0 per cent, but household credit market debt rose 2.1 per cent.

Statistics Canada says, on a seasonally adjusted basis, households added $56.3 billion of debt in the second quarter including $48.7 billion in mortgages.

The household debt service ratio, measured as total obligated payments of principal and interest on credit market debt as a proportion of household disposable income, was 13.63 per cent in the second quarter compared with 13.34 per cent in the first quarter.

This report by The Canadian Press was first published Sept. 12, 2022.