Prairie king

One-time Winnipeg industrial real estate titan Robert Andjelic is now the largest farmland owner in Canada

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$1 per week for 24 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $4.00 plus GST every four weeks. After 24 weeks, price increases to the regular rate of $19.95 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.99/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19.95 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 26/09/2022 (1212 days ago), so information in it may no longer be current.

When Robert Andjelic sold his Winnipeg industrial real estate company, Sun-X Properties, in 2007, even he could not have predicted that in the next 15 years he would become the single largest owner of farmland in the country.

The only other person who owns more farmland in North America is Bill Gates, and not by much.

But while Gates’ investment may be a diversification play, Andjelic sees no need to hedge against a potential downturn in the agricultural space.

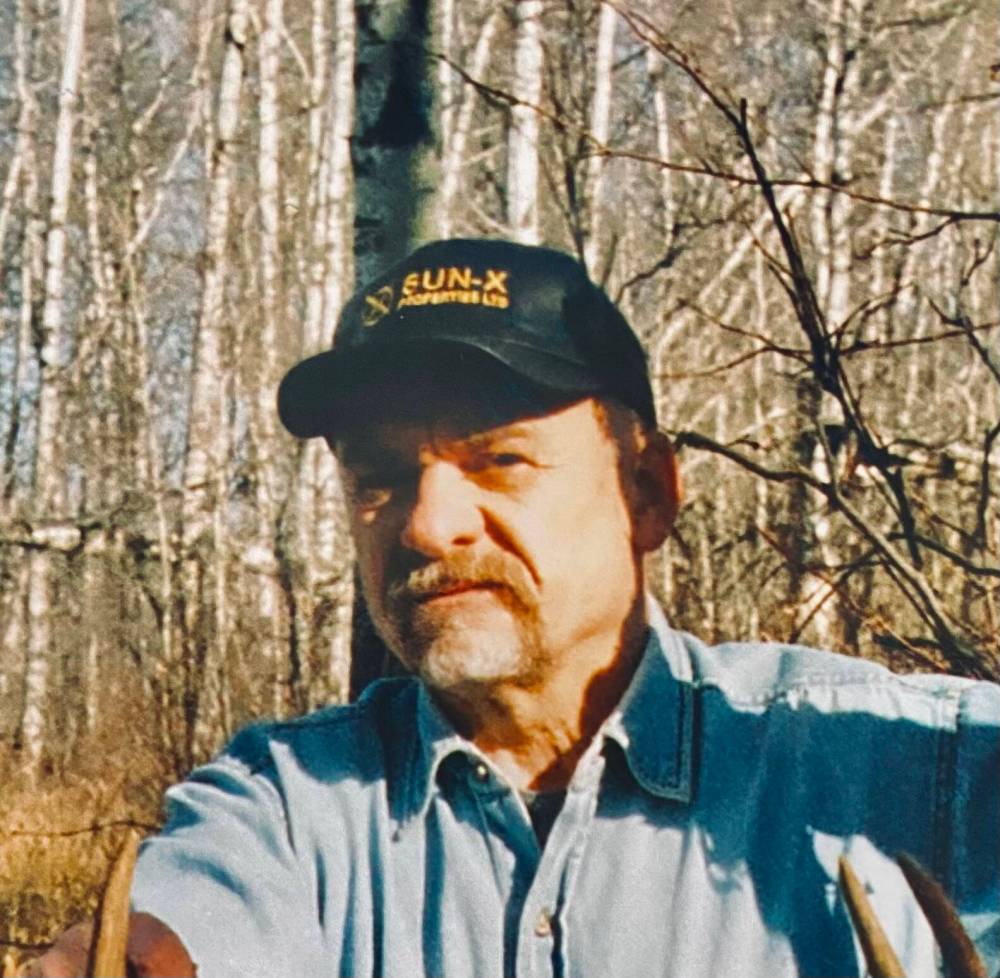

SUPPLIED

Asked if he considers investing in other assets, Robert Andjelic said, “No. I don’t think you can be in a better industry.”

Asked if he considers investing in other assets, he said, “No. I don’t think you can be in a better industry.”

As a long-term global thinker, Andjelic, 76, is not so much driven by wealth accumulation — his holdings are likely worth at least half a billion dollars — so much as he is committed to bolstering the food production capacity in the Prairies, the strategic importance of which has been emphasized because of the impact the war in Ukraine is having on global food security.

The vast majority of his tenants are also land owners. They lease additional land from Andjelic to enhance their own economies of scale. For example large agricultural equipment is designed to be optimized servicing as much as 7,000 to 10,000 acres.

“Right now I’m happy to say that a lot of my tenants are friends as well and they are some of the best producers in the Prairie provinces,” he said.

Andjelic said he declines many interview requests. He only agreed to a lengthy recent piece in the Globe and Mail to highlight the strategic importance of Prairie agricultural production and its commitment to efficiencies, something he fears could be hampered by federal government directives on reductions to greenhouse gas emissions from fertilizers.

Andjelic maintains that precision farming and other techniques already minimize fertilizer application.

Retirement didn’t take

After he sold Sun-X, the largest industrial real estate portfolio in the city at about two million square feet, he said he thought he’d try retirement, but that didn’t take.

He did some commodity trading — copper, aluminum, lots of gold and rare earth metals. In addition to cashing out his property holdings right before the real estate bubble burst in 2008, he also anticipated the growing demand for rare earth metals that are needed in the manufacture of batteries and made a lot of money in that.

Those who knew him understood how smart he is and also that he had a singular way of doing business. If they were to think about it, they might come to the conclusion, as Andjelic has, that investing in agricultural land the way he did is the best investment you could make.

”I don’t think he has ever taken advantage of anyone, ever.”–Martin McGarry

Martin McGarry, an industrial developer and longtime player in the Winnipeg commercial real estate market, said it was always a “pleasure” dealing with Andjelic.

“He was so easy to deal with as a landlord,” McGarry said. “There was no transactional, adversarial landlord-tenant issues. He just made it so easy. Everyone won. I don’t think he has ever taken advantage of anyone, ever.”

Sandy Shindleman, the CEO of Shindico, has also known Andjelic for a long time.

“He was always so accommodating,” he said. “He’d be moving tenants up and down if they needed more space. We all wanted tenants to sign 10-year leases but they wanted five and Bob had no problem with that. He was always a man of his word.”

Visits producers who work the land

His private Regina-based company called Andjelic Land now owns about 225,000 acres of farmland in Saskatchewan, about 75 per cent of which was acquired in the first half of the last decade.

And he now spends much of his time visiting the producers that work that land. He figures he puts 80,000 to 100,000 kilometres a year on his Dodge truck.

“The one I have now is three months old and its got 30,000 kilometres on it already,” he said

With his cowboy boots and modest lifestyle — he said “anybody with ordinary wage could afford” his Calgary residence — he used to strike a distinctive figure in the high-stakes real estate development world.

McGarry said, “When we were doing deals with large institutional investors, Bob would be in his cowboy boots drinking coffee, eating a doughnut and they would ask, ‘Who is this guy?’ I would tell them, ‘He is the guy that makes it all happen.’”

In a long telephone interview with the Free Press last week, Andjelic said his pace of acquisition has slowed because the price of agricultural land has increased so much, especially in Saskatchewan.

Started land acquisition in Sask.

The self-taught entrepreneur — he said he doesn’t think he finished Grade 11 — started buying land in Saskatchewan around 2011 for about $400 to $500 per acre.

At the time, farmland in Manitoba was twice as much and in Alberta it was three to four times as much.

The price of farmland in Saskatchewan was lower largely because of legislation that existed in that province until early this century that restricted the purchase of farmland to Saskatchewan residents. Since that legislation was changed, allowing all Canadian residents to buy land, prices have risen, as much as 20 per cent per year at times.

Andjelic slowed his pace of acquisition after land prices started hitting $1,500 per acre — they’re now north of $3,000 in Saskatchewan.

“He’s committed to making every dollar he has for the improvement of farmland.”–Martin McGarry

Andjelic is not off put by the rising prices. He said he’ll only buy now if it means acquiring the last quarter to complete a full section or acquiring some land in an area he has targeted for a certain type of crop. He’s also starting to look at Manitoba and Alberta.

Andjelic said he does not get in the way of the farming operations of his 250 to 300 tenants but does advise them on financial decisions. But he said he is active in the industry in promoting investment in processing because of the potential for job creation in the region and because it provides his producer tenants another opportunity to sell their production.

For instance, he said he was an early proponent of the current boom in plant-protein extraction. Although he has shied away from direct investment in processing operations to avoid conflicts of interest, he is now in discussions with some potential such investments.

“In the early stages I working with a (plant protein) company from California as an investor. I wanted to get the ball rolling.,” he said.

But since that industry is now flourishing he backed off.

“I wanted my producers to have other buyers,” he said. “I didn’t want them exporting product for $1 and then buying back a finished product for $20.”

McGarry said, “He’s committed to making every dollar he has for the improvement of farmland.”

martin.cash@winnipegfreepress.com