Economic challenges in forecast

Higher interest rates mean steeper payments on mortgages and other loans

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 17/02/2023 (1029 days ago), so information in it may no longer be current.

Manitobans may avoid a recession, but they won’t be relieved of relatively high interest rates and slower growth this year, a top RBC economist predicted Thursday.

As a result, home sales will drop below 2019 levels this year — but prices won’t follow such a steep trend, Canadian Real Estate Association (CREA) projections show.

“We are in a transition period from… highly unusual circumstances to something that’s more normal,” said Robert Hogue, RBC’s assistant chief economist.

SUPPLIED

“It’s a really difficult time to be making forecasts,” noted Jeremy Davis, the Winnipeg Regional Real Estate Board’s market intelligence director.

Early Thursday, he forecast that the Bank of Canada’s key policy rate — 4.5 per cent, up four percentage points over the past year — will continue into 2024.

Hogue predicted Canada will undergo a “relatively mild” recession through 2023’s first half.

“The sharp interest rate is really squeezing those with debt,” he said.

Manitobans have less debt compared to those in provinces with higher costs of living, like Ontario. The average Manitoban carried $17,095 of debt, while the average Ontarian held $21,456, according to an Equifax report on 2022’s third quarter.

“The highly diversified nature of Manitoba will be a big advantage going into this Canadian recession,” Hogue said, noting the province’s export sectors.

Still, it won’t be immune to a cooling economy. RBC is forecasting Manitoba’s real gross domestic product (GDP) to grow 0.8 per cent this year.

It’s a sharp drop from the bank’s prediction for Manitoba in 2022 — real GDP growth of 3.7 per cent — but an improvement from Canada’s outlook. RBC expects Canada’s real GDP to grow just 0.5 per cent this year.

The Bank of Canada has continually increased its key policy rate over the past year to stifle inflation.

In 2022, Manitoba’s year over year inflation rate hit 7.9 per cent.

Higher interest rates mean higher payments on mortgages and other loans.

“Home prices got very expensive, rates were very low… and then rates went up,” said Shaun Cathcart, a CREA senior economist, during a Winnipeg Regional Real Estate Board market insights event Thursday.

“First time home buyers… they’re going to be stuck on the sidelines, unfortunately,” Cathcart added.

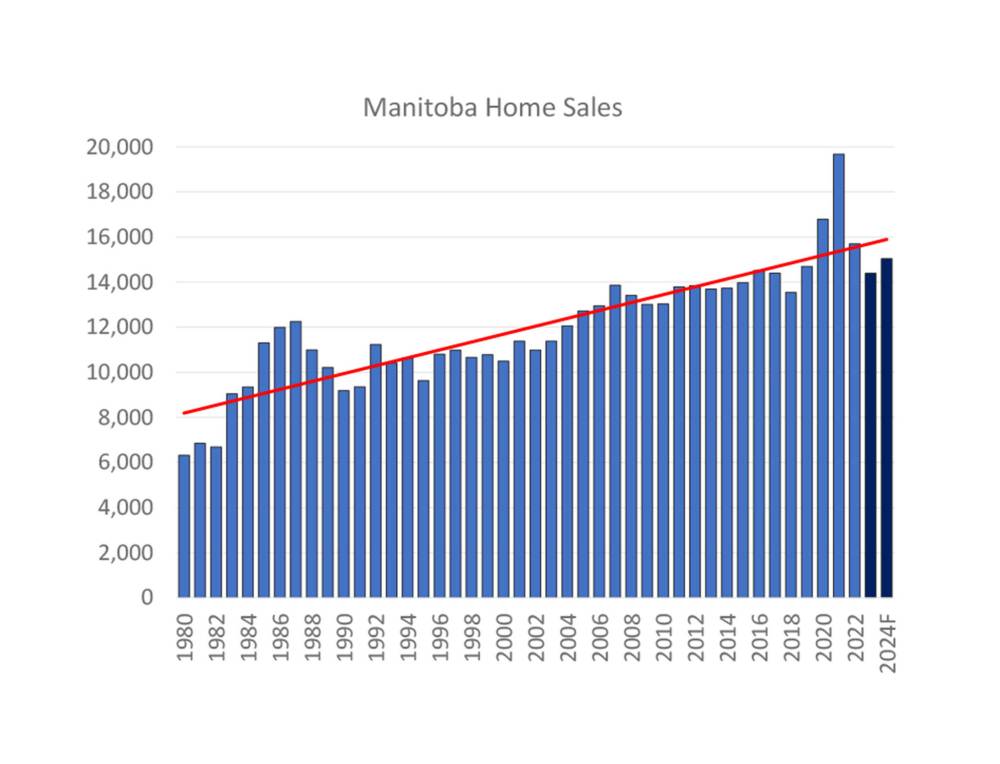

Last year, Winnipeg and surrounding regions saw 14,660 home sales, according to WRREB data. Both 2020 and 2021 set records for home purchases; 2021 elicited 18,575 sales.

The CREA expects home sales won’t overshoot 2019 levels until 2024 — the same time Hogue envisions the Bank of Canada reducing its key policy rate.

“It won’t be a barnburner of a year (for home sales) until rates are… lower,” Cathcart said.

Meantime, Winnipeg home prices are dropping. The Winnipeg Regional Real Estate Board forecasts a four per cent dip in home prices this year.

“It’s a really difficult time to be making forecasts,” noted Jeremy Davis, the Winnipeg Regional Real Estate Board’s market intelligence director.

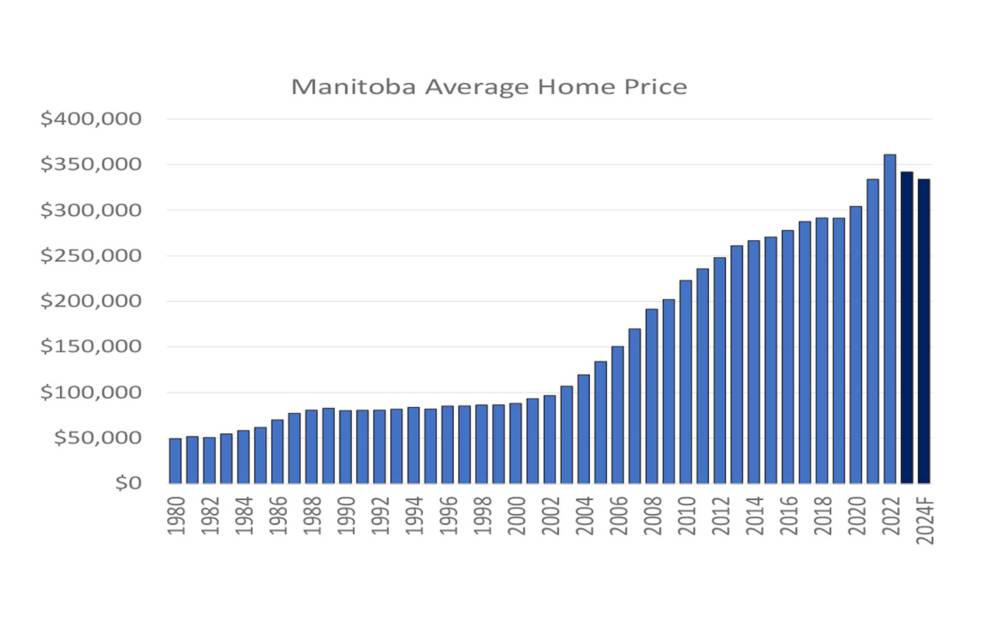

A typical Winnipeg house cost $323,600 last January, according to CREA data. The price peaked in May of 2022 at $369,600.

The CREA projects Manitoba home prices to decrease this year and next, though not below an average $325,000. Prices will likely stay higher than they were in 2021 and earlier, according to CREA data.

On average, in 2022, a residential detached home was $413,912 —16 per cent above the five-year average.

Even with prices decreasing, Winnipeggers typically need more money than last year to qualify for a home purchase.

According to a Ratehub.ca calculation, someone buying a home in Winnipeg would need another $5,750 to buy an average home, this January compared to last.

The entity based the calculation off of a home costing $323,600, a stress test rate of 7.37 per cent and a mortgage rate of 5.37 per cent this year (both are higher than January 2022’s rates).

While home prices fall, Winnipeg’s apartment rental rates continue to rise.

The average one-bedroom apartment increased 10.8 per cent year over year in January, according to new Rentals.ca data.

SUPPLIED

“It’s a really difficult time to be making forecasts,” noted Jeremy Davis, the Winnipeg Regional Real Estate Board’s market intelligence director.

Such a unit costs $1,289 monthly; a two-bedroom is now $1,564, up 7.5 per cent from January of 2022, Rentals.ca said.

“We will see… continued upward pressure on rental rates and continued downward pressure on vacancy rates,” said Martin McGarry, CEO of Cushman & Wakefield Stevenson.

There’s a nationwide housing shortage, Cathcart from the CREA said during the WRREB’s event.

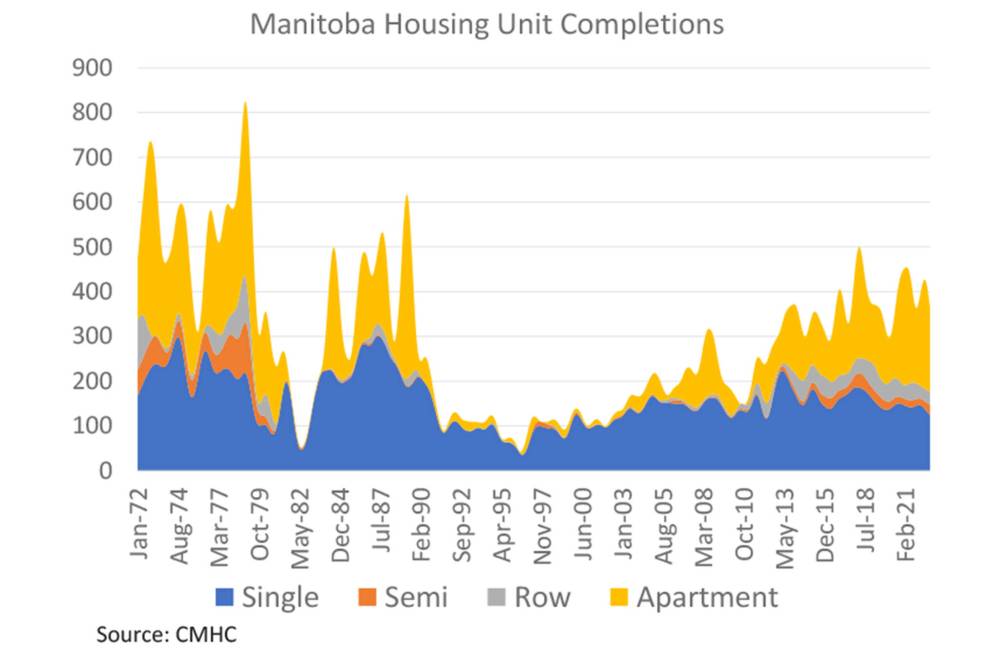

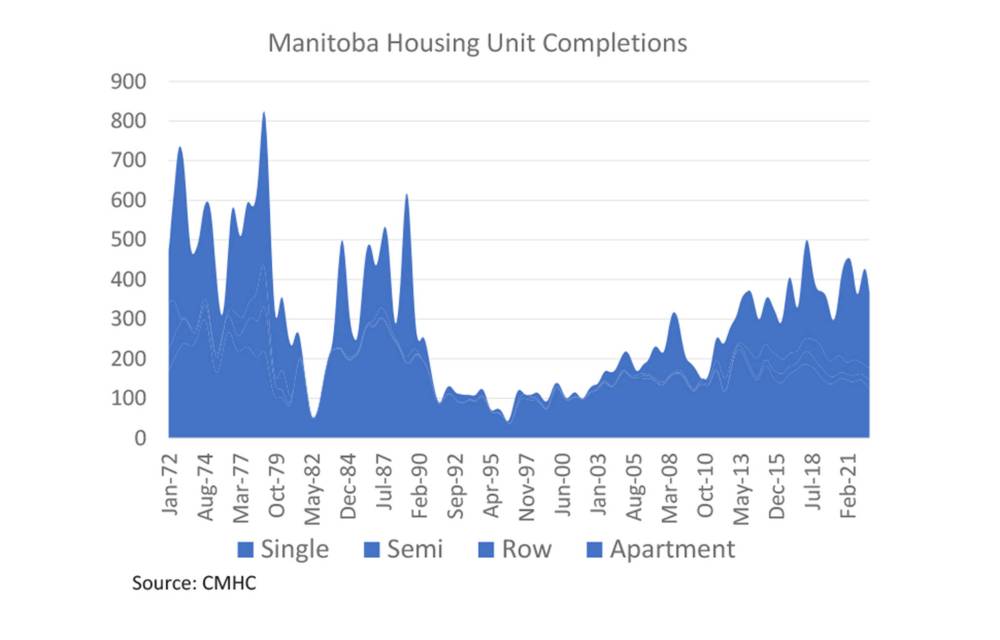

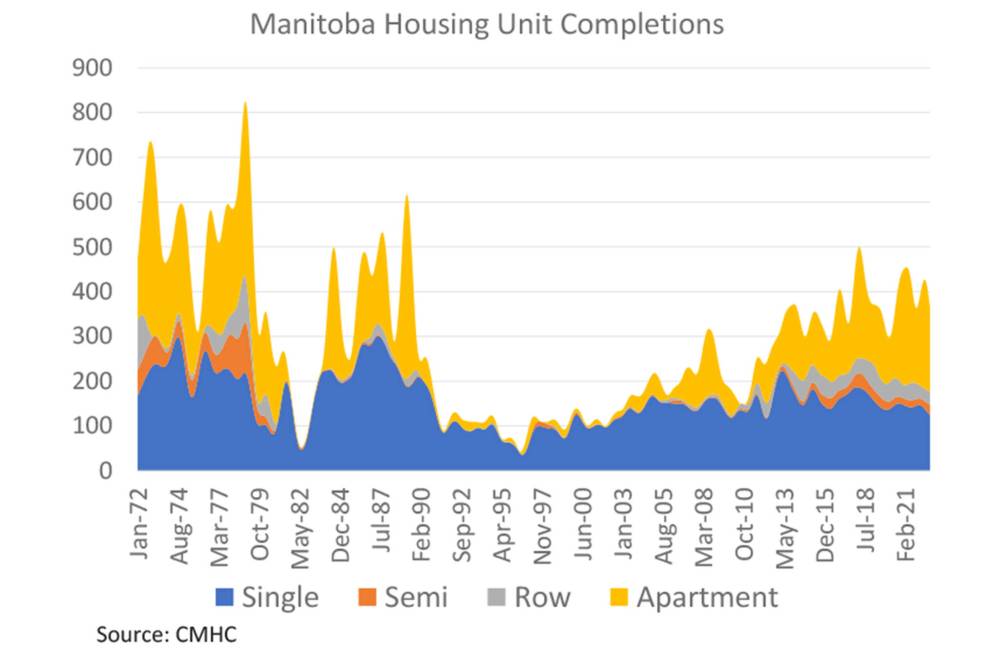

There’s been an increase in the number of housing units completed over the past several years — hovering between 300 and 500 annually since 2013 — but it’s nothing compared to the 70s, where a typical year elicited between 500 to 800 builds, Cathcart noted.

Further, more apartment units are being built than detached or row homes, CREA charts show.

“You can’t just replace a 2,000-sq.-ft. home with a little condo and call them both units,” Cathcart said. “They’re not interchangeable that way.”

An increase in immigration, and a crop of young people entering their 30s, will put strain on Manitoba’s housing market in the coming years, Cathcart said.

He predicted Canada’s housing market could undergo a similar situation to mid-pandemic days— not enough houses, high demand — in 2024 and 2025.

“The best way to keep housing affordable is by building more stock,” Davis said.

This year will likely bring more conversions of downtown office space to residential, more e-fulfilment centres and increased demand for smaller commercial sites, McGarry said.

gabrielle.piche@winnipegfreepress.com

Gabrielle Piché reports on business for the Free Press. She interned at the Free Press and worked for its sister outlet, Canstar Community News, before entering the business beat in 2021. Read more about Gabrielle.

Every piece of reporting Gabrielle produces is reviewed by an editing team before it is posted online or published in print — part of the Free Press‘s tradition, since 1872, of producing reliable independent journalism. Read more about Free Press’s history and mandate, and learn how our newsroom operates.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.