Manitoba’s economy forecast to grow 2.5 per cent this year

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.95 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.99/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19.95 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 28/08/2023 (865 days ago), so information in it may no longer be current.

Although we’ve not yet experienced an official recession — that’s two consecutive quarters of declining GDP — the ongoing climate of rising interest rates in Canada is definitely putting a drag on economic growth.

In its latest report that came out Monday, the Conference Board of Canada is forecasting GDP growth in Canada at 1.3 per cent this year, with the savings Canadians squirrelled away during the pandemic now running out and wage growth failing to keep up with inflation growth.

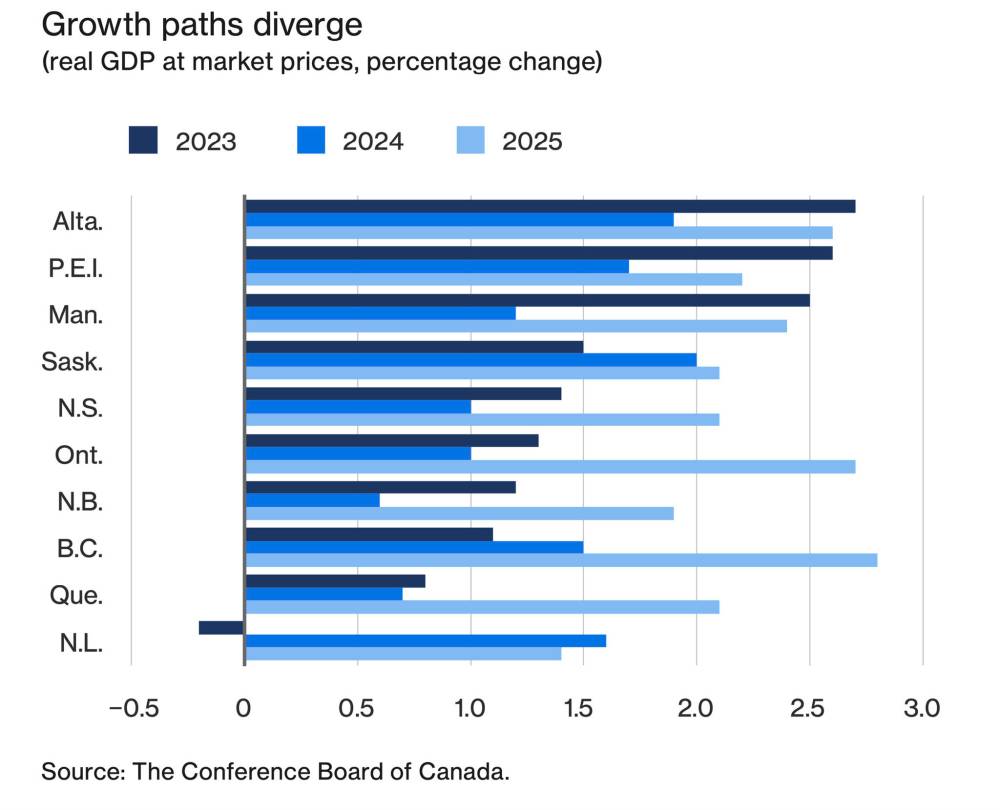

For a number of reasons, it is expecting Manitoba’s economy to grow by about twice that rate to 2.5 per cent this year after coming off a gaudy 4.2 per cent increase in 2022. (It is forecasting that only Alberta and P.E.I. will have a greater economic growth rate this year.)

FREE PRESS FILES

The most recent “quality rating” in the province’s weekly crop report, has most cereal grains from most regions rated “good”.

While the agricultural industry may not dominate the provincial economy, Richard Forbes, senior economist with the Conference Board, said that the province’s strong economic performance in 2022 was reflective of the tough hit the provincial economy took from the drought in 2021 and the bounce back in 2022.

Forbes said that while there are some concerns about drought conditions on the Prairies this year — those concerns are more concentrated in southern Saskatchewan and Alberta — indications are that a good crop is expected in Manitoba.

“The data indicates it will be a good year for the ag sector,” he said. “Prices are still really, really high and there is good production expected from that industry.”

The most recent “quality rating” in the province’s weekly crop report, has most cereal grains from most regions rated “good”.

Neil Townsend, chief market analyst with the agriculture marketing and technology firm, Grainfox, said that while there have been some violent storms and some weather variability, Manitoba “has the potential to be the garden spot” this year.

“It will be a good crop for most of Manitoba,’ he said. “If it gets to the five-year average, I think that would be pretty good.”

After this year’s 2.5 per cent growth rate in Manitoba, the Conference Board is forecasting 1.3 per cent in 2024 and 2.5 per cent in 2025, which would still be near the top among the provinces.

This year the Conference Boards noted the robust order book at NFI Group as an encouraging sign for the manufacturing sector. NFI just completed a financial reorganization that will help super-charge its production activity after almost two years of pandemic and supply chain woes that cut production from 6,200 buses in 2019 down to 3,000 in 2022. It expects to get back to 2019 level in 2025.

Forbes said that and a strong climate of business investment in the province will bolster the manufacturing sector.

He said the province is also going to be benefiting from increased activity in the mining sector.

The economic impact of the upsurge in the sector so far has been in dramatically increased exploration spending.

But the real impact will come when some of those exploration projects turn into producing mines.

That’s what Potash and Agri Development Corporation of Manitoba Ltd.’s (PADCOM) has just become. Production at the potash mine in Harrowby, Man., near Russell, began in June and commercial sale production is expected by October.

Daymon Guillas, PADCOM’s president, said by next summer it will be getting close to target production rates of 250,000 tonnes per year. (Just as a reference point the large potash mines just across the line in Saskatchewan do about five million tonnes per year.)

Meanwhile a number of very promising mineral exploration sites across the province are undertaking further development.

Perhaps the closest to production is Alamos Gold’s Lynn Lake gold project. Earlier this month it released an updated feasibility study reflecting a larger operation. When the trigger is pulled, it will mean about $500 million will be injected into an otherwise economically barren part of the province.

It’s also likely the first of at least a couple of other new producing mines in the province.

“I’ve been around for a long time,” Guillas said. “The spirit of cooperation in the mines brand has not been this good in the 16 years I’ve been around. We’re pleased with the can-do approach the team has brought to the department.”

The Conference Board is bullish on the province with a low unemployment rate — the lowest in the country in StatCan’s June Labour Market report — as well as potential large-scale commercial real estate developments like the CentrePort Rail Park and the redevelopment of Portage Place.

A potential drag continues to be the availability of the workers to fill out manufacturing plant workforces.

martin.cash@freepress.mb.ca