Money on the mind As financially strained Manitobans prepare to cast their votes, many are considering which party can effectively take the lead in addressing inflation, price hikes, rising inequality and a daunting housing market

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$1 per week for 24 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $4.00 plus GST every four weeks. After 24 weeks, price increases to the regular rate of $19.95 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.99/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19.95 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 22/09/2023 (896 days ago), so information in it may no longer be current.

It’s felt at gas stations and grocery stores. And while searching for a new house or car.

Cost-of-living increases are impacting a broad swath of Manitobans, including Jessica Sanchez, who looks for every little way to stretch her limited spending money.

Sanchez keeps a close eye on online coupons, and when shopping, she might not check off her entire grocery list, in case something is on sale the following week.

MIKAELA MACKENZIE / WINNIPEG FREE PRESS FILES

“It’s just ridiculous,” she said of higher prices.

Sanchez, 33, is among the thousands of Manitobans changing their shopping habits and lifestyle choices — in small ways or large — amid a global cost-of-living surge.

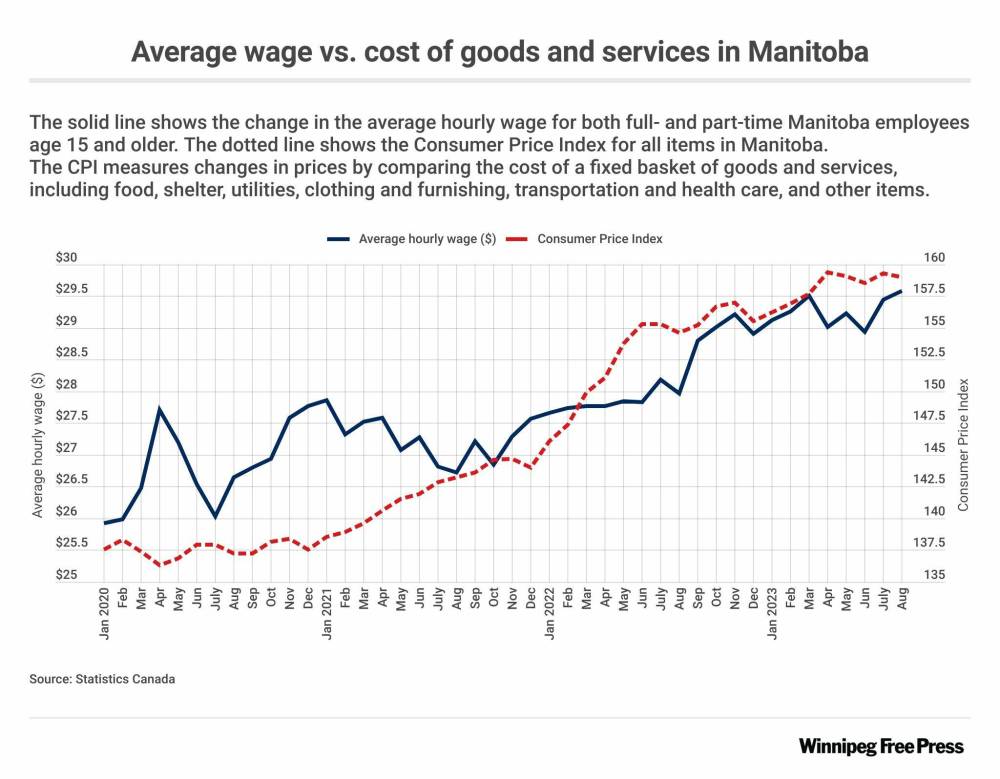

Over the past two years, the general price of goods in Manitoba has increased 15.6 per cent. Meanwhile, median wages in the province have increased around 10 per cent.

Total debt has climbed and larger chunks of repayments are being missed more frequently. Mortgage and vehicle debt has risen and take longer to pay off.

Politicians on the election path tout a range of affordability promises to lure voters — from tax cuts to rent legislation changes.

Economists and housing experts believe major action is needed, regardless of who forms the next Manitoba government — otherwise personal debt will grow, missed payments will become more common, and consumers will continue to feel the financial squeeze tighten even more.

“I don’t have any ways of living to save money,” John Adigwe said. “Everything I work for is being taken.”

Adigwe immigrated last year to Canada from Nigeria, where he worked in telecommunication sales, with hopes of a new job and a good paycheque.

“I was told there’s a space for me to come and work in Canada,” Adigwe said, adding he entered via the skilled labour route.

JOHN WOODS / WINNIPEG FREE PRESS John Adigwe immigrated from Nigeria last year in hopes of getting a good job but has yet to find one. Now, he is barely getting by and says two-thirds of his earnings go to rent.

He’s now making near minimum wage while supporting a family with two children. Two-thirds of his salary goes to his $1,400-a-month apartment rent, while grocery purchases are restricted to necessity-only.

He has applied for higher paying jobs but hasn’t landed one yet.

“I don’t know what the government is going to do to help us newcomers, because it’s really getting hard for us,” Adigwe said.

Winnipegger Enoch Omololu, founder of the financial advice blog Savvy New Canadians, echoes Adigwe, saying 2023 has been the hardest in recent years for newcomers.

DAVID LIPNOWSKI / WINNIPEG FREE PRESS files Human rights activist Ali Saeed

“Almost across the board, everyone is having complaints, regardless of their status,” said Omololu, who started the blog in 2016 to help newcomers navigate Canada’s financial landscape. “This is the worst I have seen it.”

Some new immigrants can’t afford rent — the average Winnipeg two-bedroom suite costs $1,644 a month — and are asking people in their ethnic communities for a room, said Ali Saeed, a human-rights advocate.

“For the newcomers — if you eat lunch, you can’t eat the dinner,” Saeed said. “You can’t live by the minimum wage.”

Minimum wage, now $14.15, is set to increase to $15.30 on Oct. 1. It jumped nearly 13 per cent over the past year, up from $11.95 in the summer of 2022.

Overall goods prices have increased more than 15 per cent in Manitoba, according to Statistics Canada’s consumer price index (CPI) reports. The CPI indexes food, gasoline and shelter, among other things.

Inflation accelerated roughly a year into the COVID-19 pandemic and peaked in Canada last year. It’s gradually decreased as interest rates have risen, but largely, prices have not returned to pre-pandemic levels.

Grocery store prices have jumped so significantly the federal government met with grocery chain CEOs to discuss price-stabilization measures. Earlier this year, a House of Commons committee grilled corporations about the rise in food costs.

The cost of living was increasing pre-pandemic, but “the last three years are the worst ones,” Saeed said.

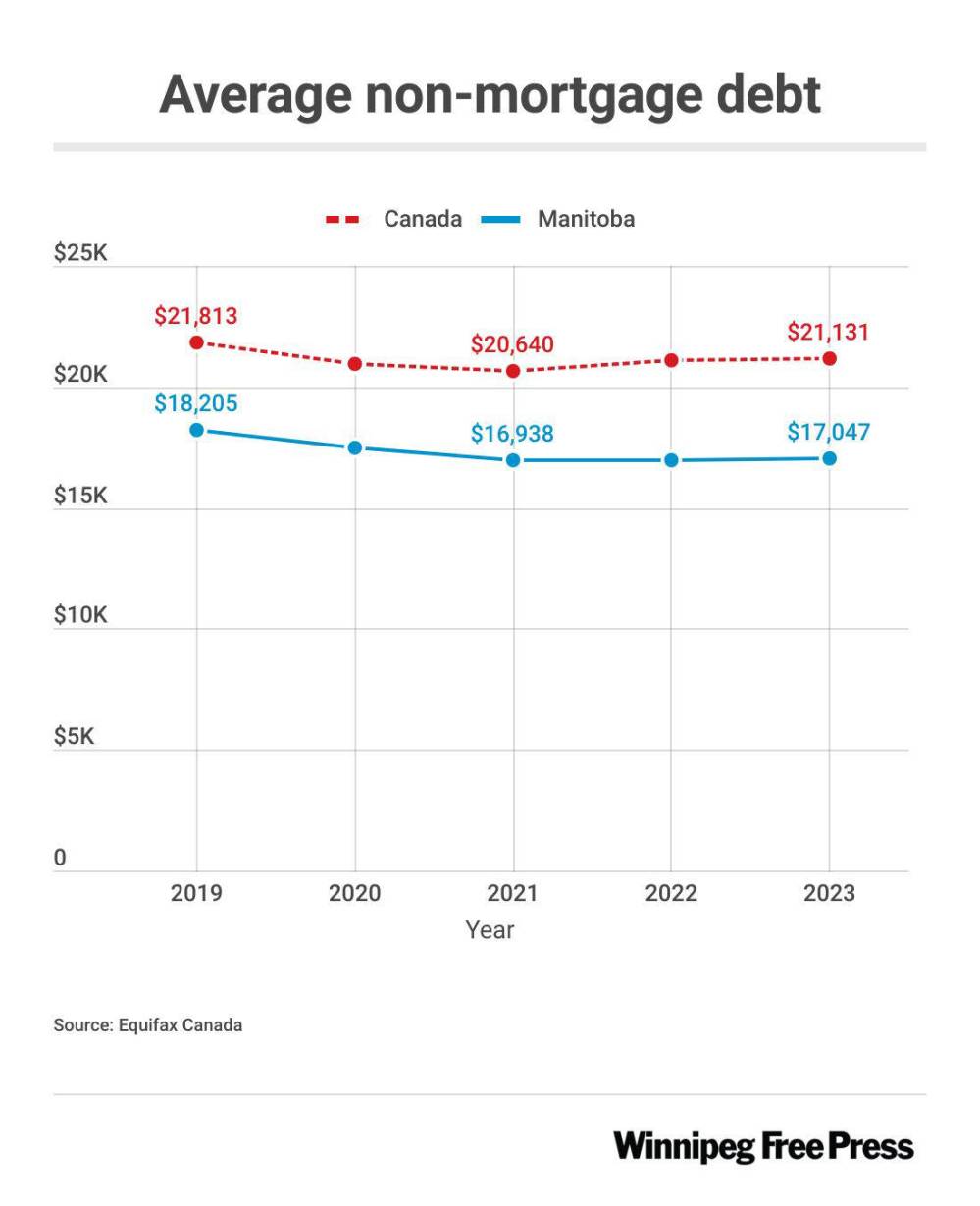

It’s against this distressing economic backdrop that Manitobans’ total debt continues to grow.

By the end of June, Manitobans had racked up $57.6 billion of consumer debt, according to data from Equifax Canada, a credit reporting agency.

Four years earlier, in 2019, the number was $46.6 billion.

“I think debt levels, in general, will increase,” said Rebecca Oakes, Equifax Canada’s vice-president of advanced analytics.

It’s partly because of population growth, she noted — the more people, the more opportunity for debt.

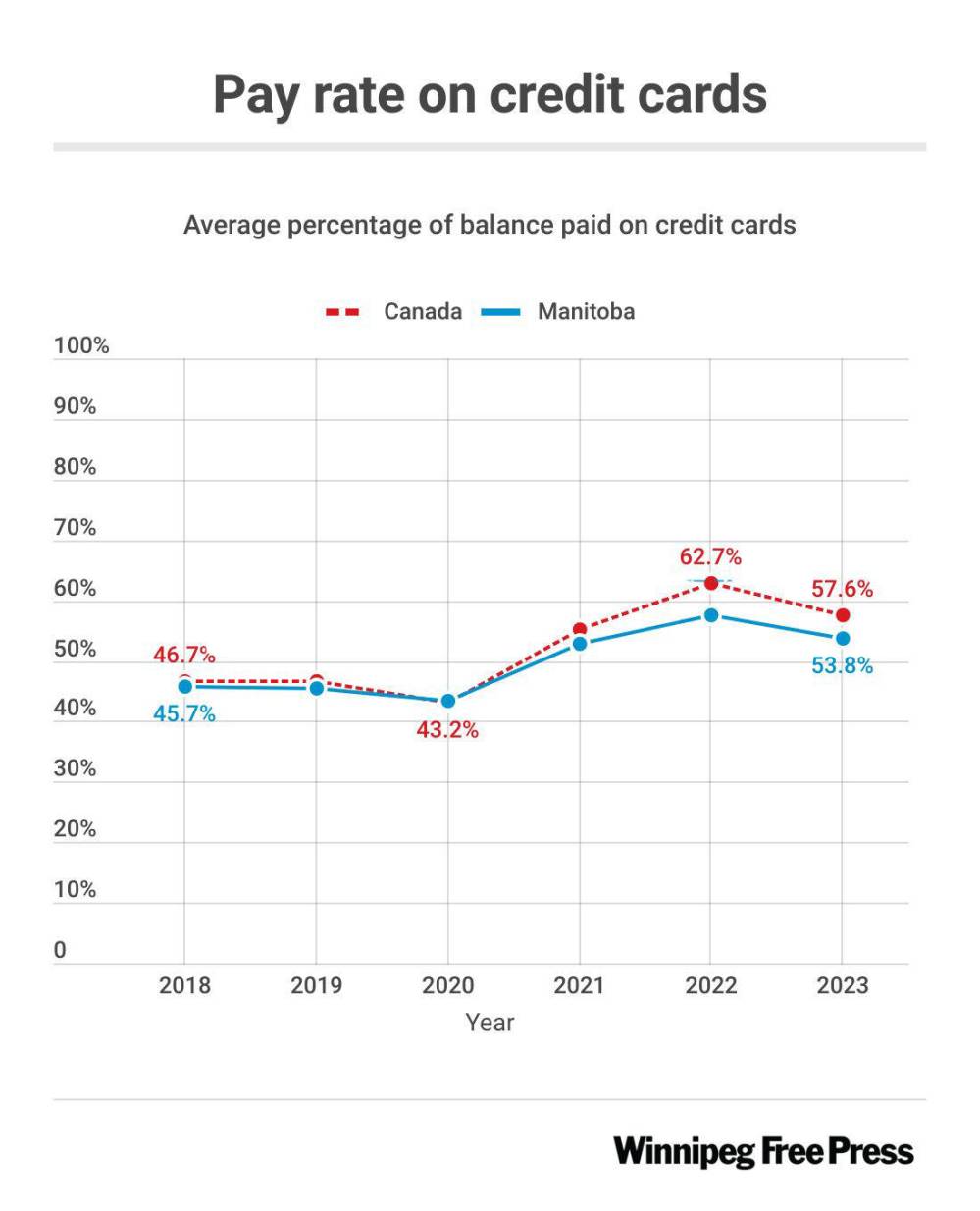

Recently, though, Equifax has clocked a rise in credit card balances.

“Trying to keep up with your day-to-day expenses, we are seeing … more people starting to use credit more,” Oakes said.

Younger Manitobans, such as millennials, and lower income groups are among those most likely to have a higher credit card balance.

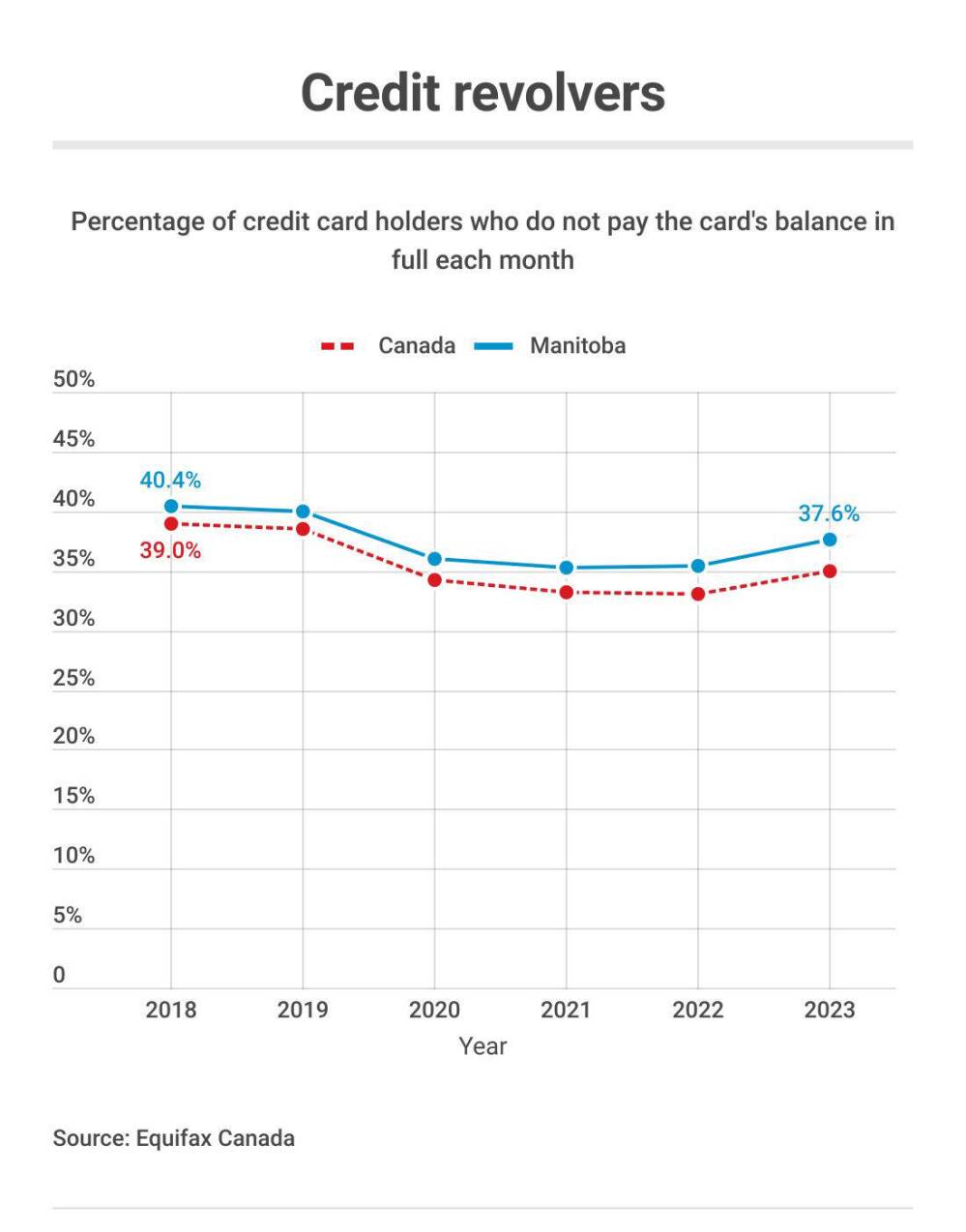

“We’ve seen less people paying their balance in full,” Oakes said. “We’re also seeing, when they are paying, they’re paying less.”

It’s a trend playing out across Canada.

On average, Manitobans paid 53.8 per cent of their credit card balances in the spring, dropping from 57.5 per cent during the same season last year.

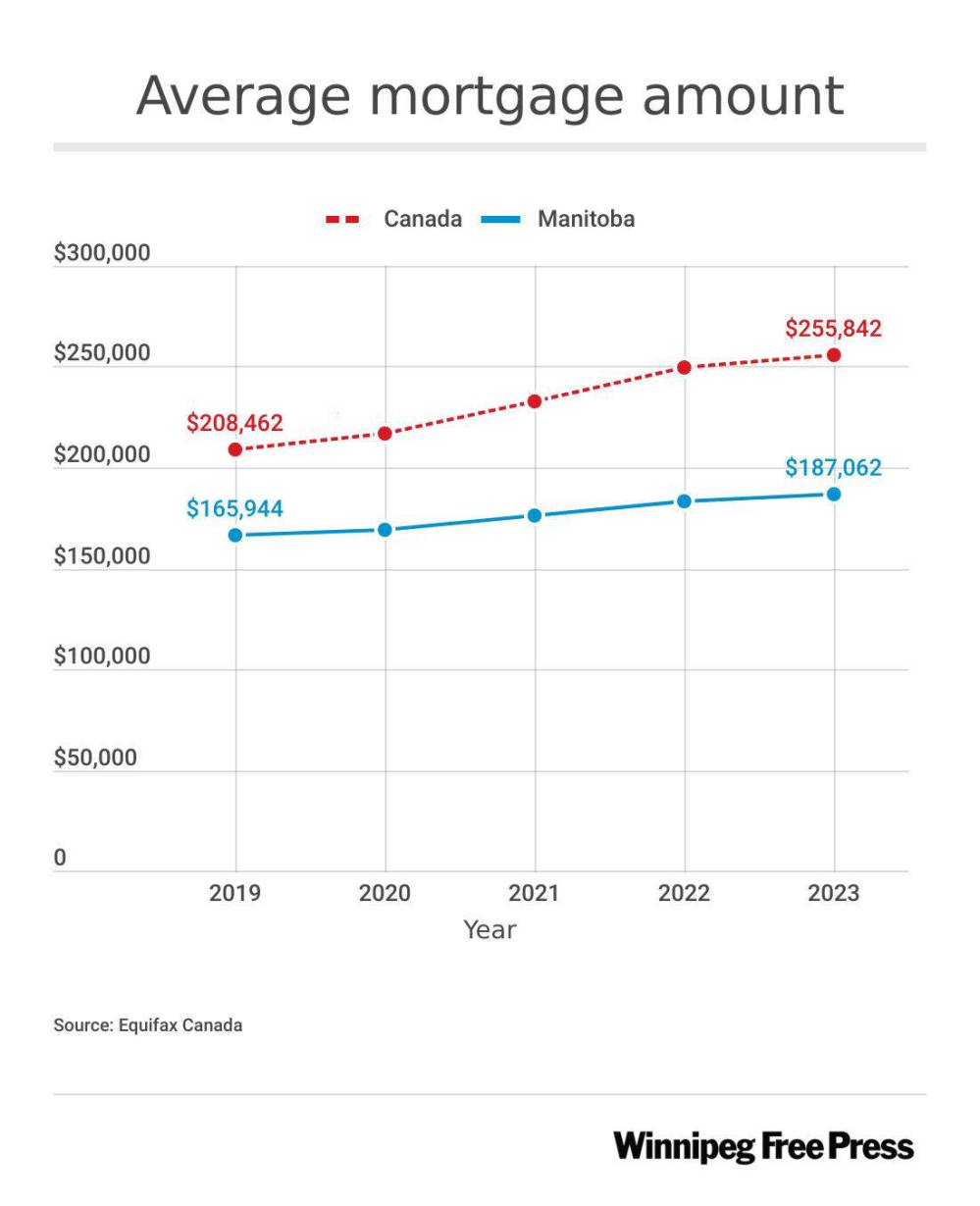

Non-mortgage debt is a small fraction of overall debt, Oakes noted. Mortgages make up the lion’s share — roughly three-quarters of consumer debt.

The average mortgage amount on a Manitoba home was $187,062 last spring, Equifax found, up from $165,944 four years earlier.

Interest rates, controlled by the Bank of Canada, will have a “significant impact” on upcoming missed payments, Oakes said.

The central bank ratcheted up its key policy rate from 0.5 per cent in April 2022 to five per cent in July 2023 in an effort to rein in inflation. The rate, which affects mortgages and other loans, has held steady since.

Laurie Boudreau began a career as a Manitoba mortgage broker 25 years ago.

Interest rates were higher in the 1990s, but home prices were lower, making housing more affordable, Boudreau said.

“When I started my career, I saw a lot of lower income, entry level jobs like cashiers… they owned houses,” she said. “Over the years, I have seen that fewer and fewer people are able to buy a house because house prices have went up so much.”

Manitoba’s real minimum wage in 1993 was $7.37, today it’s currently $14.15. Meanwhile, the average house price is five times higher, climbing from $81,171 in August 1993 to $405,477 today for a typical detached home.

JESSICA LEE / WINNIPEG FREE PRESS files Broker Laurie Boudreau says lower income earners have been priced out of the homebuying market.

When Boudreau conducts a homebuyer stress test to determine what clients can afford, she’s seeing higher debt loads, firsthand.

“Nowadays, I find that it’s not uncommon to see a vehicle payment that’s like $600 bi-weekly,” she said. “Those large vehicle payments have cut into (clients’) buying power.”

Car prices jumped during the COVID-19 pandemic, when supply did not meet demand due to supply-chain snarls.

The average new auto loan in Manitoba, as of June, was $28,597, according to Equifax. It’s an uptick from $26,218 in 2019. Meanwhile, Boudreau’s clients also have student loans and debts accrued from vacations and smaller purchases, she said.

“People today, they want a house like their parents had,” she added. “(They’re) overbuying.”

Apartment rents are also increasing. It’s a “perfect storm” of population growth, higher inflation and low production of new housing, said Giacomo Ladas, Rentals.ca’s communications director.

In August, the average price was $1,232 for a one-bedroom suite, up 5.8 per cent from the prior year, Rentals.ca data show.

Still, Winnipeg is among the most affordable major Canadian cities for rent, ranking far below cities such as Calgary and Halifax, despite a drop in vacancy rates.

Housing shortages are a national problem, Ladas noted. On Sept. 14, Prime Minister Justin Trudeau announced Ottawa would remove the GST from new rental apartment construction.

“The solution truly is to build purpose-built rentals at a mass scale,” Ladas said.

Provincial governments should do what they can to reduce red tape for home builders and work with municipalities, he said.

Manitoba’s political parties have pledged change on the housing front while on the election campaign trail.

The NDP promised a $700 tax credit to renters, at a cost of $26.7 million annually, and to amend laws regarding above-guideline rent increases. Earlier this week, they proposed cutting the provincial sales tax on rental builds.

The Liberals similarly promised a crackdown on above-guideline increases and “reno-victions.”

Both the NDP and the Progressive Conservatives committed to creating social and affordable housing. The Tories also announced they’d eliminate the land transfer tax for first-time homebuyers. The average detached home comes with a $5,700 land transfer tax.

“(It’s) a pretty big hit,” said Boudreau.

The tax was introduced in 1987 when home prices were much lower — it was meant to hit luxury homes, Boudreau explained.

“Everyone’s (now) paying a large amount of land transfer tax, not just the wealthy,” she said.

Eliminating the tax isn’t simple, Boudreau added — often, someone who isn’t a first-time buyer, such as a parent, co-signs on the contract.

She recommends changing the tax thresholds to match current home prices and avoiding taxing people buying less expensive homes. The next provincial government could offer grants and incentives to first-time homebuyers, Boudreau added.

All three major parties have targeted affordability during the first two and a half weeks of the election campaign.

The Tories have campaigned heavily on tax cuts — promising to eliminate the education property tax, cutting the provincial sales tax from restaurant meals and removing the federal carbon tax.

They’ve also pledged to end the sales tax on flowers and trees, to cut personal income taxes, and to allow Manitoba seniors to defer some or all of their annual property taxes.

The New Democrats promised a temporary cut to the provincial gas tax and a one-year freeze of electricity rates. NDP Leader Wab Kinew said his party will eliminate homelessness in eight years.

The Liberals have vowed to house homeless people within a day of them applying for assistance by 2025, and to create shelters.

They’ve also said they’ll raise provincial income taxes on Manitobans who earn more than $120,000 per year and set a guaranteed minimum income for people over 60, alongside people with severe physical and mental disabilities.

The party’s platform includes expanding $10-a-day child care and covering psychotherapy.

JOHN WOODS / WINNIPEG FREE PRESS files Jesse Hajer is assistant professor of economics and labour studies at the University of Manitoba. He is also the author of the Canadian Centre for Policy Alternatives report Surviving on Minimum Wage.

Jesse Hajer, a University of Manitoba economics professor, considers tax cuts “highly inequitable.”

“When you try to address affordability through tax cuts, you end up giving huge amounts of money to people who are wealthy,” Hajer said. “It’s not the population as a whole that’s facing an affordability crisis.”

The gap between Canada’s rich and poor has recently widened at the fastest pace on record, according to a Statistics Canada report released in July.

Nationally, the highest 20 per cent of income-earners grew their average disposable income in the beginning of 2023 at a faster-than-average pace; almost all other groups’ net savings dropped compared to the year prior.

“I do push back on this idea that we’re in this completely unaffordable cost-of-living crisis,” Hajer noted, adding many private sector workers have received raises to match inflation. “(Some) wages are keeping up.”

The median hourly wage in Manitoba last month was $25, Statistics Canada data show, up roughly 10 per cent, or $2.25, from August 2021.

“There are groups in society who aren’t keeping up,” Hajer said, highlighting seniors and public sector workers. “Prices are definitely going up — that’s what people are seeing, and they’re not used to that.”

The last period of rapidly increasing inflation was the 1970s, Hajer added.

He offered several suggestions for addressing affordability at a provincial level, including incentivizing people to quit fossil-fuelled car use.

Gas prices in Manitoba hit $1.63 per litre on Sept. 18, mirroring last year’s average. In 2019, the highest gas price was around $1.27 per litre, according to fuel tracker GasBuddy.

Government could revisit public options for phone and internet services, providing an alternative to a high-priced and uncompetitive market, and they could push home retrofitting at a policy level in “an aggressive way,” to reduce energy costs, Hajer said.

He argued the province is too reliant on federal money transfers and that cutting taxes won’t help.

MIKAELA MACKENZIE / WINNIPEG FREE PRESS Almost across

the board,

everyone is

having complaints, regardless of

their status.

This is the worst

I have seen it’ — Enoch Omololu, creator of the personal finance blog Savvy New Canadians

Others, like Savvy New Canadians’ Omololu, favoured proposed tax cuts.

“It’s small amounts, but every small bit helps when you’re trying to make ends meet,” Omololu said, adding “something … needs to be done” about affordable housing.

Dennis Smela, 64, would like an end to the carbon tax. He’s now working upwards of 50 hours a week, 10 more than previously, to keep pace with expenses, he said.

The property maintenance worker lost his job during the pandemic and ended up in a lower-paying one.

“I have to work longer hours (and) worry about my retirement,” he said. “I could have been retired next year.”

RUTH BONNEVILLE / WINNIPEG FREE PRESS Sheri Benson is thankful to have access to a food bank to help offset cost-of-living increases.

Sheri Benson, 60, is reliant on disability income. By the time rent, insurance and phone bills are paid, there’s little money left. She thinks she’d starve if she didn’t attend food banks.

“I love my oranges, but to get a bag of oranges? Oh my God,” Benson said.

Benson’s and Smela’s stories are all too familiar to Al Wiebe, managing director for Of No Fixed Address.

“We’ve had a lot of people, since the pandemic, drop from middle class to poverty, and poverty into homelessness,” he said. “We … need to address the working poor.”

This includes helping with child poverty — for example, maintaining provincial government-funded school lunch and breakfast programs, Wiebe said.

Harvest Manitoba served 22,000 households in March, a record high. August was at a similar level, with 21,500 households, Stephanie Mikos, the organization’s communications lead, wrote in an email. Those numbers are double 2019 levels.

Wiebe worries the number of working poor will only increase.

“So far, nobody’s really come up with a solution that’s going to help (right) now,” he said. “The provincial government really needs to take the lead.”

gabrielle.piche@winnipegfreepress.com

Gabrielle Piché reports on business for the Free Press. She interned at the Free Press and worked for its sister outlet, Canstar Community News, before entering the business beat in 2021. Read more about Gabrielle.

Every piece of reporting Gabrielle produces is reviewed by an editing team before it is posted online or published in print — part of the Free Press‘s tradition, since 1872, of producing reliable independent journalism. Read more about Free Press’s history and mandate, and learn how our newsroom operates.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.

History

Updated on Thursday, September 28, 2023 5:56 PM CDT: Corrects spelling of Omololu