2024 looking better for buyers, sellers

Strong finish for 2023 city housing market an encouraging sign for this year

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 15/01/2024 (677 days ago), so information in it may no longer be current.

Winnipeg’s housing market closed 2023 on the upslope — an encouraging sign, professionals believe, for what’s to come in 2024.

December’s 2,959 listings and 635 sales were up eight and 12 per cent, respectively, from 2022. Overall dollar volume and average sales price in the final month also finished higher than the previous year with the average residential detached dwelling going for $405,702, a seven per cent increase.

It was the third time in the back half of 2023 that every major statistical category saw a year-over-year increase.

Michael Froese of Royal LePage is optimistic about the present and feels that, perhaps, the market is the most stable it’s been since 2019. (Mikaela MacKenzie / Winnipeg Free Press files)

“In my opinion, it was a pretty respectable year from what I see of the stats, so far,” said Rena Prefontaine, president of the Winnipeg Regional Real Estate Board. “I think when you compare to the five-year average, we’re a little bit below the five-year average but very comparable to 2019. And if you compare it even out to 10 years, it’s still a very respectable year we had in 2023.”

Winnipeg’s 12,978 sales were the lowest in the last five years. However, listings — there were just 22,505, the second-fewest in the last five years — sold at a 57.67 per cent rate. For comparison, 2019, which is used as a benchmark due to it being the last year before the pandemic, saw 25,851 listings and 13,601 sales (52.61 per cent sale rate).

A residential detached home sold for an average of $399,430 in 2023, a steep drop from the $412,745 average of a home in 2022, but a 7.46 per cent increase over the five-year average. Condominiums went for $259,420 on average, down from $264,567 in 2022.

The beginning of the year brought uncertainty to consumers coming off a 2022 that saw borrowing rates jump nearly four percentage points, from 0.5 to 4.25 per cent. It didn’t help that rates hiked again to 4.5 per cent shortly after the calendar flipped. Listings, price tags and sales activity all slid, as a result, creating a quieter-than-normal spring in the Manitoba capital.

These days were stark in contrast to the busy pandemic years that saw record-breaking numbers in sales and dollar volume.

“Buyers had to adjust, they had to adjust their spending and adjust budgets at home… sellers were also adjusting to the reality of the market, that it wasn’t a lottery anymore where they could put up a sign and have 30 offers and (sell) for $50,000 over (ask),” said Michael Froese, managing broker with Royal LePage Prime Real Estate.

“What (2023) was, was crawling back out of the depths of the darkest part of our market’s history probably. But then the market did behave quite well, in my opinion.”

Froese said he left 2023 unconcerned with the year as a whole. In fact, the latter parts of the year left him rather optimistic about where the market is positioned in 2024 and that, perhaps, it’s the most stable its been since 2019.

Demand is expected to increase again once the snow melts, as it usually does. It could even be a busier spring than normal, but that could depend on whether interest rates move again later this month.

The Bank of Canada’s next decision is Jan. 24. It has held its 5 per cent lending rate for the last three rounds of decisions, and many of the country’s leading predictors are convinced rates have peaked and that a cut could be in store.

“What’s going to be the big difference is there is going to be consumer confidence with all of these (factors) like inflation stabilizing, rates stabilizing, if not dropping, and price stabilizing… You’re going to see people who had been waiting or who didn’t have to move maybe now when rates do drop, you’re gonna see them potentially come back into the market,” Froese said.

Also worth noting is the number of housing starts that could impact the market in the coming years. An estimate of expected housing starts in Winnipeg this year could not be uncovered by press time.

A surge is in store, given the city’s $122 million grant from the federal government’s Housing Accelerator Fund in December. The cash is expected to help erect 3,166 housing units over the next three years, including about 900 categorized as “affordable.”

The grant came after the city passed new bylaws that allow construction of up to four housing units on a single lot, buildings of up to four storeys anywhere within 800 metres of transit corridors and mid-rise housing targeted for mall-area sites and commercial corridors. As a result, the need for public hearings and city committee approvals to complete such projects was eliminated.

Inventory continues to rebound from the pandemic. In 2019, there were about five and a half months of inventory available. There are about four and a half months of inventory currently.

“We’re getting closer to replenishing that,” said Prefontaine. “Of course, in the beginning of the pandemic, there was very little inventory so that’s what made the prices jump so high, so we’re definitely getting back to replenishing that inventory, which is great for buyers and sellers.”

Froese maintained 2024 will be a better year for buyers and sellers, as consumers have settled into the new reality of prices and made the necessary adjustments for home ownership.

“The market fundamentals,” he said. “Demand is still very strong, people want to buy homes, people want to live in Winnipeg — it’s still one of the most affordable major city centres in Canada — so those are beacons and those are still true.”

jfreysam@freepress.mb.ca

Josh Frey-Sam reports on sports and business at the Free Press. Josh got his start at the paper in 2022, just weeks after graduating from the Creative Communications program at Red River College. He reports primarily on amateur teams and athletes in sports. Read more about Josh.

Every piece of reporting Josh produces is reviewed by an editing team before it is posted online or published in print — part of the Free Press‘s tradition, since 1872, of producing reliable independent journalism. Read more about Free Press’s history and mandate, and learn how our newsroom operates.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.

History

Updated on Monday, January 15, 2024 7:51 AM CST: Corrects lending rate to 5 per cent

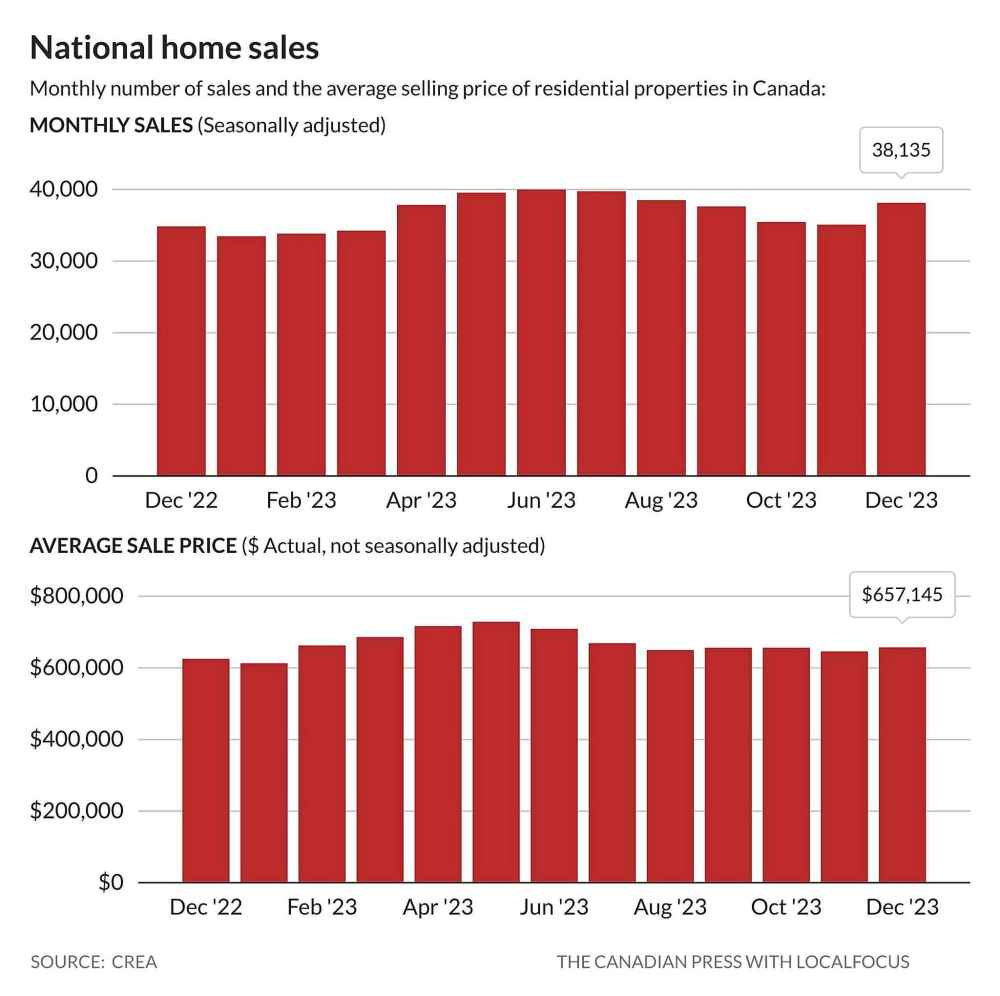

Updated on Monday, January 15, 2024 9:08 AM CST: Adds graphic