‘Coming for you at some point’

Winnipeg among last holdouts of steep home prices but clock ticking, real estate professionals event hears

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$1 per week for 24 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $4.00 plus GST every four weeks. After 24 weeks, price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 22/02/2024 (603 days ago), so information in it may no longer be current.

Winnipeg may be among the next round of Canadian centres to face rising home prices driven by outside demand, industry experts say.

The Manitoba capital’s market has stayed relatively stable compared to metropolises across the country, the non-profit Winnipeg Regional Real Estate Board’s annual market insights online event heard Thursday.

However, Canadian Real Estate Association senior economist Shaun Cathcart recalled a time when Vancouver was the only “unaffordable” market. Since then, steep prices have become common in Toronto, Southern Ontario and interior British Columbia.

Phil Hossack / Free Press Files

Home prices in Winnipeg have stayed relatively stable compared to other cities across the country, but it may be among the next round of Canadian centres to face rising prices driven by outside demand.

House prices in Calgary are currently increasing, Cathcart noted, listing four English-dominant, sub-$400,000 (detached home sales price) cities left in the country: Winnipeg, Regina, Saskatoon and Edmonton.

The latter two are already experiencing rising prices, he said.

“I think that this is coming for you at some point,” Cathcart told the Winnipeg audience. “A lot of these… trends tend to only move in one direction.

“The point is: people are willing to move around the country to be able to own a home.”

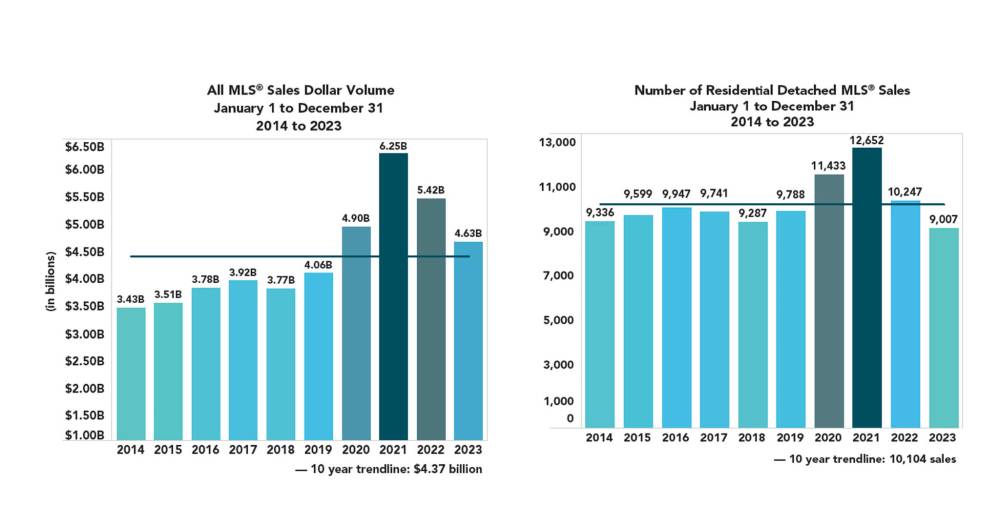

The average price of a residential detached house in Winnipeg dropped three per cent in 2023 from its record high in 2022, to $399,430, recent data show.

It’s the first time in nearly 30 years there’s been a decline. Still, the average price is second-highest on record, noted Jeremy Davis, WRREB market intelligence director.

He called 2023 — a year marked by higher interest rates increasing the price of mortgages — “as steady as it goes.”

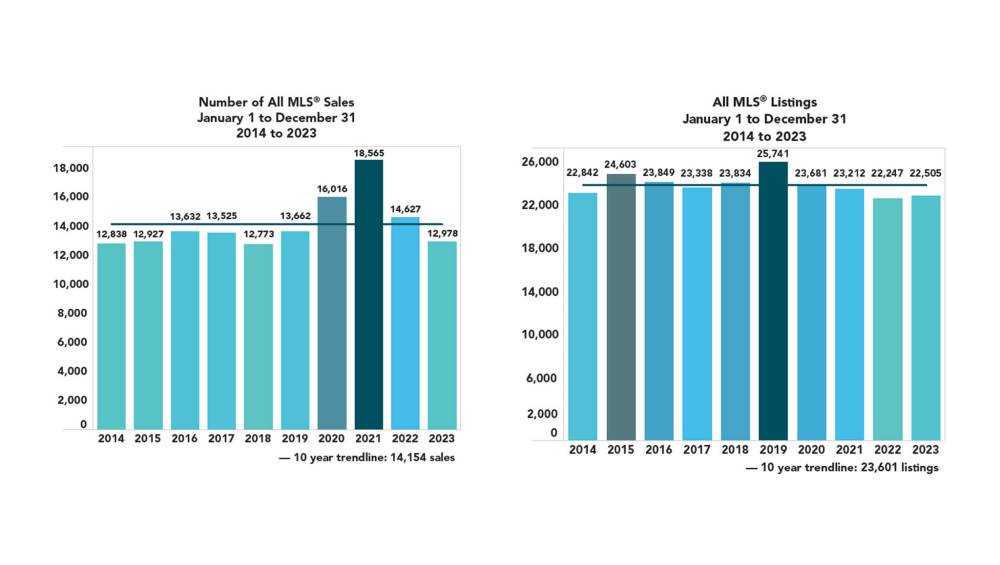

The WRREB clocked 12,978 home sales in 2023, an 11 per cent decline from the prior year. Over the past decade, six years have had more home sales in Winnipeg than 2023.

The overall dollar volume — $4.6 billion — as dropped year-over-year by 14 per cent. Still, 2023 ranked fourth for highest dollar volume sales in the WRREB history.

Davis gave a “conservative” forecast of a 1.2 per cent increase in residential detached and condo home prices this year. The WRREB projects sales increasing two per cent in 2024.

“(It) would translate into a similarly steady year,” Davis said.

Economists have predicted the Bank of Canada will lower its key interest rate sometime this year. In January, the country’s rate of inflation hit 2.9 per cent, nearing the BoC’s stated two per cent target.

The central bank will likely keeps interest rates as is, for now, to tamp down the oft-busy spring market, Cathcart said during the WRREB event.

He shared graphs predicting a 10.4 per cent increase in home sales and a 2.3 per cent jump in prices across Canada.

However, he also expects the 2024 projections to be wrong.

“The amount of demand that’s out there waiting to come back into the (housing market) is way more than people think,” Cathcart said, pointing to an aging population and Canada’s record-high immigration.

The country had a target to accept 465,000 immigrants in 2023; by September, 371,299 had arrived.

They need homes, Cathcart noted.

“We’ve also got two years of pent-up demand from 2022 and 2023, people that weren’t able to buy homes when rates went through the roof,” he stated. “All of that’s waiting on the sidelines.”

Meanwhile, Canada faces a well-publicized housing shortage. The country needs to build 580,000 units per year to reach its goal of 3.5 million additional houses by 2030, Cathcart said.

The numbers don’t include all recent population growth and crews aren’t close to building the homes needed per year, he added.

The Canada Mortgage and Housing Corp.’s latest report projects Manitoba to have a 170,000-unit gap by 2030, in a baseline scenario.

Meantime, the latter half of 2024 will see a “very strong” real estate market, said Benjamin Tal, CIBC deputy chief economist.

He anticipates a BoC interest rate cut of 1.5 percentage points (to 3.5 per cent) during the second half of 2024. Ultimately, the key interest rate could drop and then stay at 2.75 per cent in 2025, Tal said.

If rates decrease, the “tailwinds” experienced in 2021 and 2022 could establish themselves again, said Dan Chubey, Colliers Canada managing director, Winnipeg.

Industrial, retail and apartment space have high demand and low vacancy, Chubey said during the WRREB event.

Winnipeg’s apartment vacancy rate hovers around two per cent, despite a steady increase in new builds (an average 2,000 units annually for the last five years).

“This increase is not at a pace that can keep up the advancing levels of immigration,” Chubey said, adding rising interest rates, construction costs and the province’s strict rent controls have been investment deterrents.

He highlighted Ottawa’s removal of GST on new rental apartment builds and the feds’ housing accelerator funding as helping boost construction.

Chubey figures vacancy for retail space will remain low this year, with possibly higher rents in busy areas. Supply for industrial space may increase due to expansion at CentrePort, bringing the market more into balance, he added.

Meantime, downtown offices — especially older, outdated builds — continue to struggle with vacancy, he noted. The rate hit 18.3 per cent by the end of 2023, according to CBRE data. Suburban office space has fared much better, with a vacancy rate of 10.9 per cent, the CBRE found.

gabrielle.piche@winnipegfreepress.com

Gabrielle Piché reports on business for the Free Press. She interned at the Free Press and worked for its sister outlet, Canstar Community News, before entering the business beat in 2021. Read more about Gabrielle.

Every piece of reporting Gabrielle produces is reviewed by an editing team before it is posted online or published in print — part of the Free Press‘s tradition, since 1872, of producing reliable independent journalism. Read more about Free Press’s history and mandate, and learn how our newsroom operates.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.