BoC delivers half percentage point rate cut, says it now must keep inflation at 2%

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 23/10/2024 (393 days ago), so information in it may no longer be current.

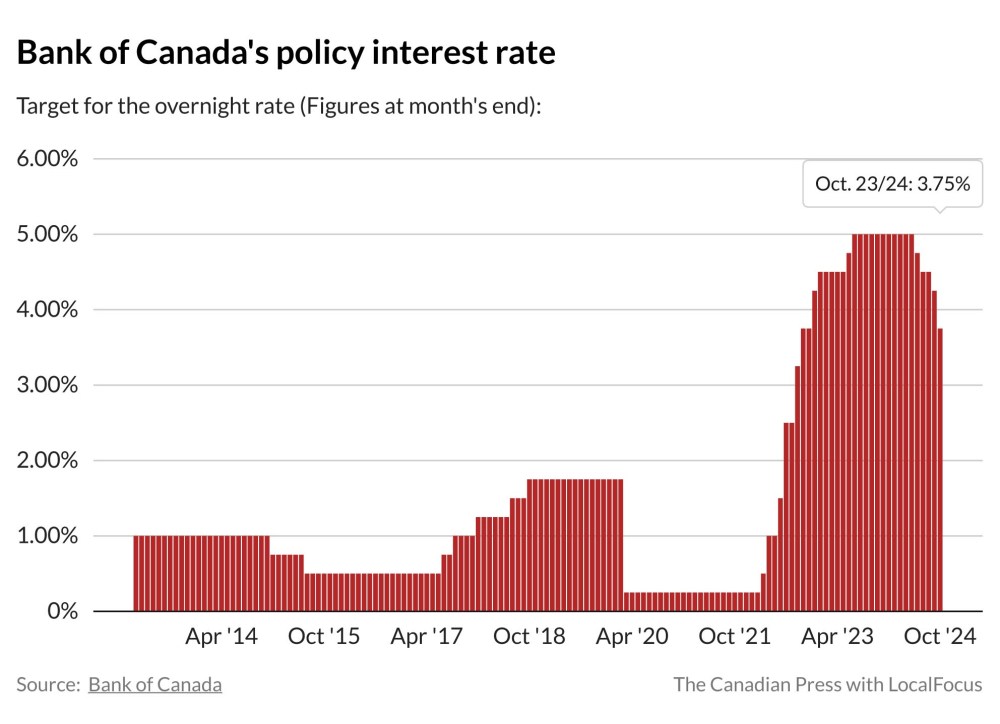

OTTAWA – The Bank of Canada claimed victory against high inflation on Wednesday as it delivered a supersized interest rate cut and signalled its policy rate will likely continue falling in the coming months.

The half-percentage point interest rate cut marks the fourth consecutive reduction since June and brings the central bank’s policy interest rate down to 3.75 per cent.

With annual price growth now around two per cent, governor Tiff Macklem said the Bank of Canada’s job has shifted from lowering inflation to maintaining it around the inflation target.

“We took a bigger step today because inflation is now back to the two per cent target and we want to keep it close to the target,” Macklem said in his opening statement.

“High inflation and interest rates have been a heavy burden for Canadians. With inflation now back to target and interest rates continuing to come down, families, businesses and communities should feel some relief,” he went on to say.

Canada’s inflation rate fell to 1.6 per cent in September, solidifying forecasters’ expectations for a larger rate cut. Bigger cuts mean the rate can be lowered faster.

“The recent data has allowed the Bank of Canada to more decisively plant the victory flag in its battle to get inflation to its two per cent target on a sustainable basis,” wrote CIBC chief economist Avery Shenfeld in a client note.

The governor said the central bank expects it will lower the interest rate further — so long as the economy evolves in line with its forecast — but he stopped short of saying whether the he expects another half-point cut is likely in December.

“I’m not going to handicap the next move,” Macklem said. “I think we’ve been pretty clear on the direction. And I think we’ve been pretty clear that the timing and the pace is going to depend on how the data evolves.”

He later went on to say that it’s difficult to lay out a clearer trajectory on interest rates because the central bank “doesn’t know the future.”

“We’re discovering how the economy is evolving, like everybody else, and based on the best available information we have at the time, we’ll take our decisions,” he said.

BMO chief economist Douglas Porter said his impression of the latest interest rate announcement is that the central bank will likely revert back to quarter-percentage-point rate cuts moving forward.

“I took away that they don’t seem to be in any great urgency to follow this up with another supersized cut in the future,” Porter said.

“It seems like they view the risk to their outlook as being relatively well balanced. They didn’t really change their economic forecast at all.”

However, CIBC is still betting on another half-percentage-point cut in December.

Shenfeld said with interest rates still at a level that restricts economic growth, “it would take a major turn of events to stand in the way of another (half-point) reduction in December, driven by the same logic as today’s decision.”

The Bank of Canada attributed on Wednesday the slowdown in price growth to shelter price inflation easing, supply outpacing demand in the economy and global oil pricing falling.

It’s now forecasting inflation will remain around the two per cent target throughout its projection horizon, which extends to 2026.

High interest rates have sent a chill through the Canadian economy, slowing growth and loosening the labour market.

The central bank says in its monetary policy report that while layoffs have remained stable, businesses have pulled back on hiring, which has disproportionately affected young people and newcomers.

As interest rates continue to come down, the Bank of Canada is projecting economic growth to pick back up in 2025 and 2026.

The Bank of Canada’s next interest rate announcement is scheduled for Dec. 11.

This report by The Canadian Press was first published Oct. 23, 2024.

History

Updated on Wednesday, October 23, 2024 9:01 AM CDT: Adds graphic