The money psychotherapist

Best-selling author, trail-blazing therapist suggests self-compassion for those not up to big holiday spend

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 16/11/2024 (384 days ago), so information in it may no longer be current.

If the holiday season causes pocketbook pangs and shivers of anxiety, a best-selling author and leading money therapist has a suggestion.

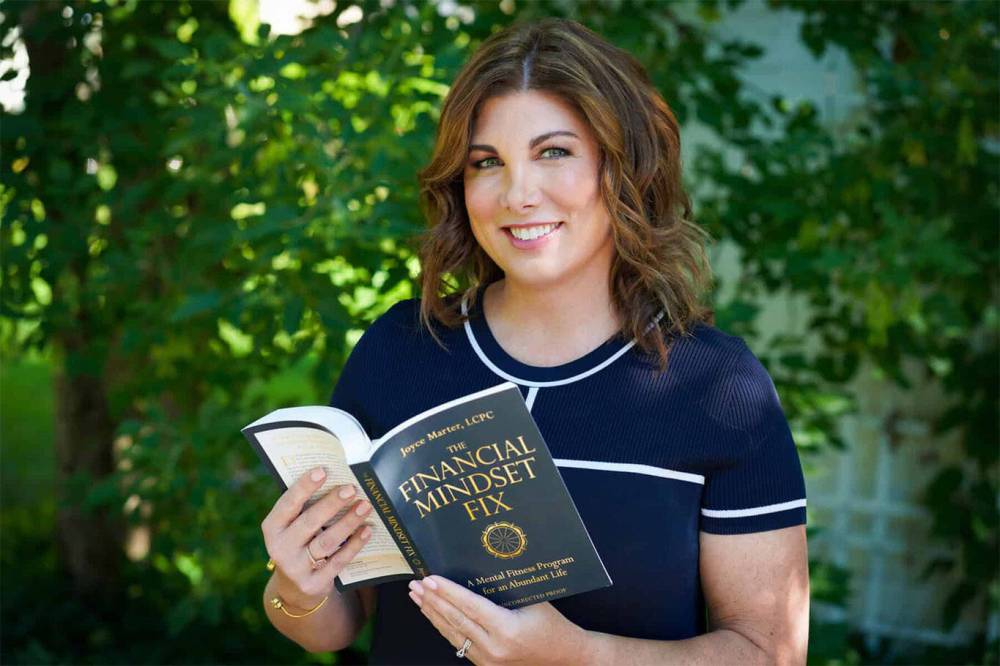

U.S.-based psychotherapist Joyce Marter is a highly sought-after corporate trainer and keynote speaker on “mental wealth” — which focuses on the intersection of mental health and finance.

The author of the award-winning book, The Financial Mindset Fix: a Mental Fitness Program for an Abundant Life, suggests if you’re feeling anxious, depressed and maybe even a little angry about your financial situation at this time of year, you should not simply aim to practise more rigorous household budgeting (though that’s never a bad thing).

She suggests engaging in a little self-compassion.

“That’s an important step,” Marter says in a recent interview with the Free Press.

To do that, however, individuals need to tame the nattering in their mind that creates storms of negativity.

Many Canadians may be hearing a lot of negative self-talk right now. A recent survey by CPA Canada (Chartered Professional Accountants) found 94 per cent of respondents are feeling financial stress heading into the holiday season.

That’s not surprising to Marter.

“There is always a pattern of anxiety increasing during the holiday season,” she says. “Money stress can trigger or exacerbate anxiety, depression, substance use disorders, relationship conflict and domestic violence.”

Add in low self-esteem, eating disorders and even financially induced post-traumatic stress disorder (PTSD) — and consumers have much to fret about.

For anyone struggling to get to a place of self-compassion — as in, not being so hard on yourself — it does not happen overnight.

“One of the best strategies (to do that) is to apply mindfulness to finance,” Marter says. “Many of us ruminate about the pas or we worry about the uncertainty of the future and peace can really be found in the present.”

Practice indeed does make perfect or at least increases your ability to reach a mindfulness state. Marter suggests meditative exercises, deep breathing, yoga or “even being in nature and unplugging from technology to get out of the mind chatter” can promote mindfulness.

Shutting out doom scrolling, for example, reconnects people to their own selves and “detach from the ego.”

Marter adds the ego is where our money stories reside, including how we perceive our self-worth. “And when we attach our worth to our bank account or material possessions, and those are down, that negatively affects our feelings of self-worth.”

Mindfulness facilitates stepping out of negative thinking, affording time to respond constructively to financial problems rather than reacting emotionally.

Overall, it reduces stress — critical to making changes like implementing a budget.

“Curiously, a lot of us overspend when we’re financially stressed, especially during the holidays,” Marter says, noting this irrational financial behaviour offers a false sense of control.

“Maybe purchasing nice gifts makes us feel better and alleviates anxiety at first, but it’s actually financial self-harm.”

Folks who come from backgrounds of financial trauma are often more prone to money stress and impulsive behaviour, Marter adds.

Individuals may have grown up in poverty or experienced systematic economic discrimination based on race, sexual orientation or gender. They might face unemployment, a business failure or even divorce. All these can lead to higher incidence of feeling disempowered and hopeless.

“It (financial strife) can even trigger thoughts of suicide,” she adds, citing one study suggesting 16 per cent of suicides in the United States are financially driven.

To reduce stress, it’s important to break unhelpful thought patterns, which isn’t easy given strong negative emotions can spur “compulsive behaviours whether that’s hoarding, gambling or spending.”

Marter adds psychotherapy is a late comer to behavioural finance — which explores the psychology behind money decisions. Yet, therapy’s tools can help individuals facing money stress, including cognitive behavioural therapy, “one of the most empirically supported forms of therapy,” she says.

“It asserts that our thoughts precede our emotions and behaviours, so that if we have negative thinking around money, it will fuel depression and anxiety.”

Those negative brain pathways — such as ‘I am broke’ and ‘I am going to end up homeless’ — can become entrenched over time.

“But if we can change those to thoughts like, ‘I am working on my money management and improving my financial well-being’ … we can slowly decrease our anxiety and depression,” she says. “A big part is also shifting from blame to responsibility.”

This involves not just stopping blaming ourselves. Many blame parents, partners, the government and employers, but “by focusing on those externals, we’re spinning our wheels.”

Instead, if they “take the reins” and “practice acceptance for the hand we’re dealt,” people are more likely to seek help — including improving financial literacy — to fix their financial situation.

Marter practises what she preaches in this respect, having lived through extreme financial stress when a few years ago, her business was edging toward insolvency.

“I was fortunate, able to use the tools from my clinical training to change my money story,” she says. “And so seven years later, I was able to sell my business for an eight-figure exit.”

Part and parcel to her success was giving herself that regular mindfulness break. Others can do the same, Marter suggests.

“Wrap yourself in some self-compassion and forgiveness and avoid the self-flagellation of being hard on yourself.”

Joel Schlesinger is a Winnipeg-based freelance journalist

joelschles@gmail.com