Stock market today: Wall Street slips in final days of a banner year for US stocks

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 30/12/2024 (341 days ago), so information in it may no longer be current.

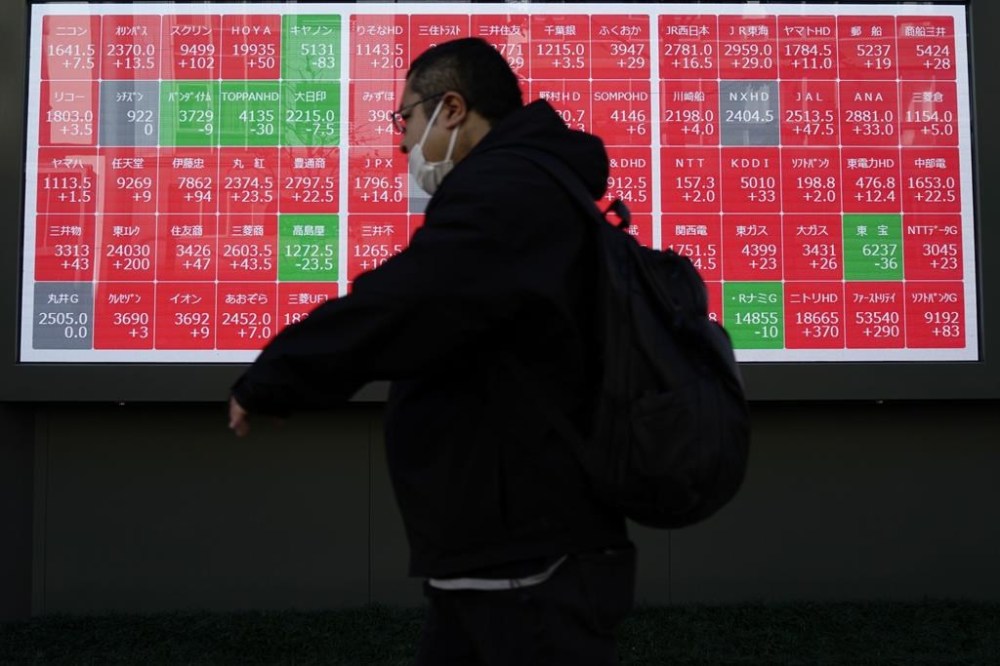

NEW YORK – U.S. stocks closed broadly lower Monday as a banner year on Wall Street looked set to finish on a sour note.

The S&P 500 fell 1.1%, its third straight decline. Roughly 90% of stocks within the index lost ground. On the second-to-last day of 2024, the benchmark index was still on track for its second straight yearly gain of more than 20%.

The Dow Jones Industrial Average fell 1%, and the Nasdaq composite ended 1.2% lower.

Big Tech companies were the heaviest weights on the market, worsening the slump. Apple and Microsoft fell 1.3%. Their pricey valuations tend to have an outsized impact on the broader market.

Elsewhere among tech stocks, Meta Platforms dropped 1.4%, Netflix slipped 0.8% and Amazon fell 1.1%.

The S&P 500’s technology and communication services sectors have been the market’s high flyers, notching gains of 37.1% and 39.9%, respectively, so far this year.

Boeing fell 2.3% after one of its jets skidded off a runway in South Korea, killing 179 of the 181 people aboard. South Korea is inspecting all 737-800 aircraft operated by airlines in the country.

The disaster was yet another blow for Boeing following a machinists strike, further safety problems with its troubled top-selling aircraft and a plunging stock price. Its shares have declined more than 30% this year.

Airlines that fly Boeing jets wavered in the wake of the crash. United Airlines fell 1.4% and Delta Air Lines dropped 0.9%.

All told, the S&P 500 fell 63.90 points to 5,906.94. The Dow dropped 418.48 points to 42,573.73, and the Nasdaq fell 235.25 points to 19,486.78.

Bond yields fell. The yield on the 10-year Treasury fell to 4.53% from 4.63% late Friday. The yield on the two-year Treasury fell to 4.25% from 4.33% late Friday.

The price of U.S. crude oil rose 0.6%. Energy stocks held up better than the rest of the market, falling just 0.1%.

Natural gas prices jumped 12%. That helped support gains for natural gas producers. EQT Corp. rose 5.1% for the biggest gain among S&P 500 stocks.

Indexes in Europe and Asia mostly fell.

Markets are nearing the close of a stellar year driven by a growing economy, solid consumer spending and a strong jobs market. Wall Street expects companies within the S&P 500 to report broad earnings growth of more than 9% for the year, according to FactSet. The final figures will be tallied following fourth-quarter reports that start in a few weeks.

Wall Street was encouraged by cooling inflation throughout the year that had brought the rate of inflation close to the Federal Reserve’s 2% target. That raised hopes that the central bank would deliver a steady stream of interest rate cuts, which would ease borrowing costs and fuel more economic growth.

The Fed cut interest rates three times in 2024, but has signaled a more cautious approach heading into 2025 amid stubborn inflation and worries about it reheating. The latest report on consumer prices showed that inflation edged slightly higher, to 2.7%, in November.

Worries about the potential for inflation reigniting have been further fueled by tariff threats from incoming President Donald Trump. Companies typically pass along the higher costs from tariffs on goods and raw materials to consumers.

While U.S. stock indexes have historically gotten a boost at year’s end —- often referred to as a ‘Santa Claus’ rally — the recent market declines put a damper on that.

“The ‘Santa Claus rally’ that most were calling for and asking for we perhaps got earlier in November,” said Keith Buchanan, senior portfolio manager at Globalt Investments. “This week is going to be another week of drift, whether it’s drifting up or down.”

Investors have very little corporate and economic news to review this week, which is shortened by the New Year holiday. Markets will be closed on Wednesday.

On Thursday, investors will get an updated snapshot of U.S. construction spending for the month of November. On Friday, Wall Street will receive an update on manufacturing for December.