Court approves Hudson’s Bay plan to auction its royal charter; $18M bid expected

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

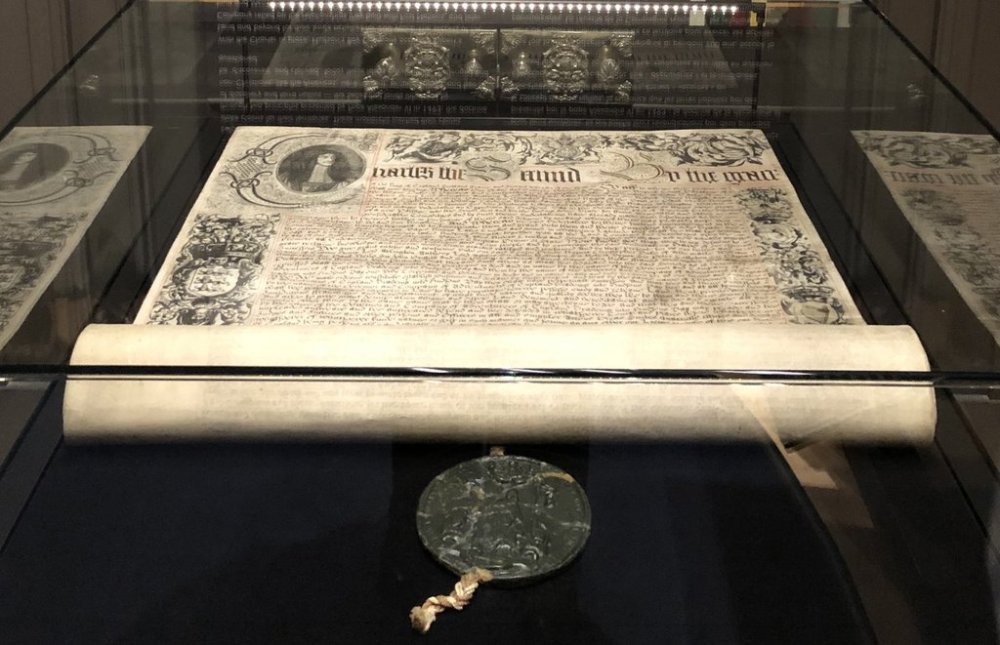

TORONTO — The royal charter that created Hudson’s Bay in 1670 is on its way to the auction block.

Ontario Superior Court judge Peter Osborne on Friday approved a process that will see the document owned by the defunct retailer sold early next month in a competitive process that will kick off with an $18 million bid from holding companies belonging to two of Canada’s richest family.

The charter, signed by King Charles II more than 350 years ago, not only created HBC but gave the company control over one-third of modern Canada’s land mass, trade and Indigenous relations for decades to come.

The document is being sold to help Hudson’s Bay chip away at the $1.1 billion in debt it had when it filed for creditor protection and closed its stores earlier this year.

HBC lawyer Ashley Taylor told the court Friday “there is no better viable alternative” than the auction, which “will maximize proceeds for the applicant’s creditors.”

Under the motion approved by Osborne on Friday, anyone wanting to buy the charter will have to signal interest by Nov. 28 and agree to donate the document to a public Canadian institution, which will share it with the public and Indigenous organizations.

A live auction open to qualified bidders will be held at the Toronto office of Stikeman Elliott, HBC’s lawyers, on Dec. 3. The process will be overseen by Reflect Advisors, HBC’s financial advisor, and any buyer that is chosen will still be subject to court approval.

Holding companies belonging to the Thomson and Weston families have agreed to start the bidding at $18 million. The Westons are best known for their ties to Loblaw Cos. Ltd., while the Thomsons are media barons with links to tech firm Thomson Reuters Corp.

If the families are successful in buying the document, they will donate it to the Archives of Manitoba, the Manitoba Museum, the Canadian Museum of History, and the Royal Ontario Museum.

While the charter would be equally owned by the four public custodians, Manitoba will be designated its home and selected as the site for its first public exhibition after donation.

The two families plan to give a further $5 million to the organizations to fund the conservation, education and tours for the charter. The Desmarais family and Power Corp. of Canada, along with The Hennick Family Foundation, have also committed additional support.

The Thomson and Weston bid expires on Dec. 31, requiring HBC to move quickly to auction off the charter, Taylor said, when Osborne asked him why the auction timeline was “quite tight.”

The two-week window is “shorter than what we had an initially anticipated but we have not been idle,” Taylor said.

He explained HBC, Reflect and others have been drumming up interest among potential bidders they know of for months and media coverage of “the various twists and turns” associated with the auction also means anyone interested in making an offer is likely aware of the impending sale.

The twists and turns he alluded to played out over months of legal proceedings.

Originally, HBC planned to auction off the document until Weston holding company Wittington Investments Limited offered $12.5 million in July to buy the charter outright and donate it to the Canadian Museum of History, a Crown corporation in Gatineau, Que. The company also offered $1 million for conservation and sharing of the charter.

The offer convinced HBC to call off the auction and prepare to sell the charter to the Westons until David Thomson and his DKRT Family Corp. emerged in August.

Thomson wanted the company to stick with an auction and agreed to start the bidding at $15 million. If his company was successful in purchasing the charter, he wanted to give it to the Archives of Manitoba, which already holds the biggest collection of HBC artifacts and is located where the company was based when it shifted its headquarters from England. He planned to allocate $2 million for charter touring and preservation.

After DKRT announced its intentions, Taylor said Friday that Wittington wouldn’t promise to be part of the auction. HBC asked several times and never got a guarantee, he said.

Nonetheless, the Thomson and DKRT offer pushed HBC back toward its auction plan. Then, at a September hearing meant to get approval for the sale, Hudson’s Bay instead revealed it had received another unsolicited offer for the charter. It refused to identify the bidder and then asked for an adjournment.

The joint offer from the Thomsons and Westons was revealed as the mystery bid in court documents filed last week.