Final chapter?

Loss of provincial tax credits could close the book on some local publishers

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$1 per week for 24 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $4.00 plus GST every four weeks. After 24 weeks, price increases to the regular rate of $19.95 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.99/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19.95 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 04/11/2017 (3047 days ago), so information in it may no longer be current.

Some Manitoba book publishers may be forced out of business and others may have to lay off workers or slash wages if the provincial government eliminates long-standing printing and book publishing tax credits, industry officials warn.

KPMG, a consultant hired by the Pallister government to help it find ways to control costs, has recommended it phase-out or eliminate the print and book publishing tax credits, which cost about $1.8 million per year.

But the president of the Association of Manitoba Book Publishers (AMBP) said Canadian and Manitoban book publishers are already reeling from a number of other major setbacks, including the loss of millions of dollars in copyright revenues and distribution challenges created by Amazon’s entry into the Canadian market.

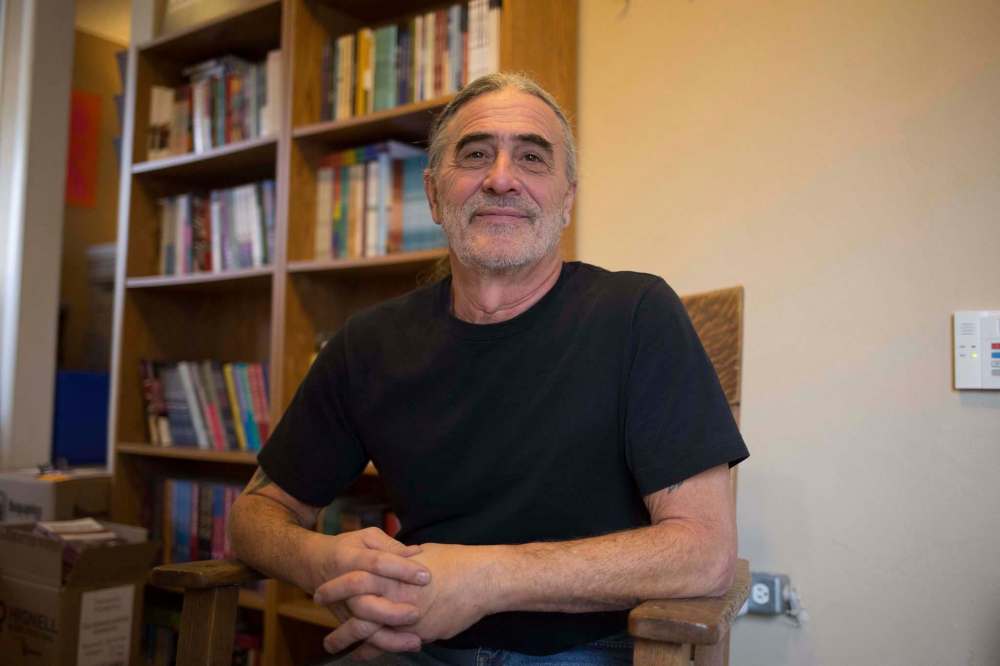

So for some local firms, the added loss of the tax credit could be disastrous, Wayne Antony added.

“I guess it’s like the proverbial final straw. For many independent publishers, we’re not big businesses. So for many of us, that would mean the difference between continuing or going out of business, or laying people off.”

Antony said the AMBP currently has about 15 members, with two smaller firms waiting to join.

He said his company — Fernwood Publishing — is one of the province’s larger book publishers, with three full-time workers and about a dozen freelance employees. While it could survive the loss of the tax credit, it would mean big changes.

“There’s no question it would be very difficult for us to keep everyone at full time and at the salaries they’re at now. Or we’d have to stop using as many freelancers, or maybe cut back on the number of books we do. We’d have to find ways to cut some of our costs.”

The co-owner of another local award-winning book publishing firm — Great Plains Publications — said the loss of the tax credit would also have a big impact on his business.

“It pretty much has made the difference some years between it being a profitable year and not,” Gregg Shilliday said.

“Some years we would have been profitable regardless, but the margins are so tight in book publishing that it often does make the difference (between an operating profit or a loss).”

Shilliday said the tax credit has also enabled Great Plains to pay its employees a more livable wage, and to extend the hours of some of its part-time workers. Without it, that may no longer be possible.

The potential loss of the tax credit has also threatened his plans to retire and sell the company to his employees.

“They’re now a little apprehensive ,because for the last few years we’ve had this tax credit which made things more predictable in terms of the yearly income,” he said.

“It probably means if my staff is willing to take a chance and proceed, we’ll probably have to have a more open-ended agreement where the sale price would be predicated on whether or not the tax credit continues.”

Antony said he understands the government wanting to rein in spending and balance its budget. But in this case, the savings would be a mere $1.8 million per year.

He also argued the KPMG report fails to take into account the benefits of having a healthy and vibrant book publishing industry.

He noted the majority of the books published by Manitoba publishers are written by local or first-time authors, and about 20 per cent also are either by Indigenous authors, or are about local Indigenous communities.

“We help (Manitoba) stories to be told in ways that otherwise wouldn’t be told. The KPMG report, I don’t think, puts any of this in context.”

He also noted the industry employs about 120 people, and most of the money local publishers spend is spent in Manitoba.

The president and CEO of the province’s largest book printing company — Altona-based Friesens Corporation — said eliminating the printing tax would also have a big impact on local book printers.

“The cultural industries printing tax credit ‘levels the playing field’ for Manitoba printers competing in the three largest Canadian publishing markets in Ontario, Quebec, and British Columbia,” Chad Friesen said.

Without them, Manitoba printers would be at a 10 to 15 per cent price disadvantage when competing for book-printing jobs in those markets, he said, so they’d have to make up the shortfall by cutting costs elsewhere within their operations.

In Friesens’ case, options would include setting up a printing facility in Ontario in order to qualify under their tax credit scheme, scaling back its business and eliminating jobs, or reducing its capital investment in future growth, Friesen added.

“None of these options benefit the province of Manitoba or the local economy in the Pembina Valley,” he added. “We understand the fiscal pressures the government is under, but it is not in the financial interest of the province to make Manitoba companies less competitive in other markets.”

Sports, Culture, and Heritage Minister Cathy Cox’s office was non-committal about whether the tax credits might be eliminated.

“The department will consider the information and advice provided by KPMG, along with other sources of information, as it reviews its programs and services,” she said in an email.

murray.mcneill@freepress.mb.ca