White-collar crime affects us all

Internet gives thieves new, lucrative avenue to our pocketbooks

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$1 per week for 24 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $4.00 plus GST every four weeks. After 24 weeks, price increases to the regular rate of $19.95 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.99/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19.95 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 13/03/2010 (5834 days ago), so information in it may no longer be current.

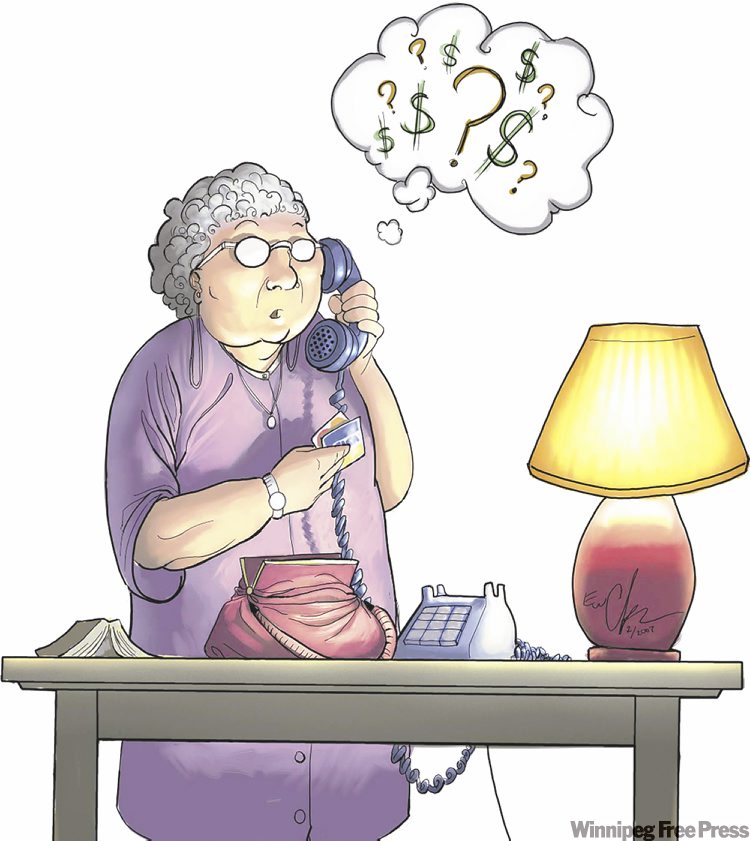

WHEN it comes to crime, media like it blue-collar style. Nothing draws readers’ and viewers’ fearful interest like murders, sexual assaults, drug orgies and other illicit depravity.

In contrast, white-collar crime — fraud, embezzlement, insider trading, identity theft — is blue collar’s less interesting brother until someone comes along and runs the mother of all swindles, like Bernard Madoff with his multibillion-dollar Ponzi scheme or Earl Jones, the Quebec adviser who bilked retirees out of millions of dollars they entrusted to him for their retirement.

While these kinds of crimes don’t make us afraid to walk the streets alone at night, they have a profound affect on our lives nonetheless, fraud prevention experts say.

As many as one million Canadians have fallen victim to investment fraud, according to the Ontario Securities Commission (OSC).

And a recent survey by Visa of Canadians over 50 found that more than one in 10 had been victims of “payment card fraud, identity theft or a violation of financial privacy since they turned 50 years of age.”

Credit card fraud alone accounts for $400 million annually in losses for creditors, consumers and retailers in Canada, says Mike D’Sa, senior manager of data security and investigations for Visa Canada.

Perhaps due to the lack of headline-grabbing crimes associated with the majority of white-collar crime, those involved in preventing fraud and investigating scams are compelled to designate an entire month, March, to fraud awareness.

With that in mind, here are a few scam-fighting tips for consumers and investors to protect themselves from becoming separated from their hard-earned money by online pickpockets and swindlers.

The No. 1 thing to know about fraud, be it credit card or investment, is that it can happen to anyone, even the experts.

“One of my co-workers actually received a call from Blockbuster in Calgary about late fees, and first of all, he didn’t live in Calgary and second, he didn’t have a card at Blockbuster, so we knew someone had stolen his ID,” says D’Sa, who was in Winnipeg recently to speak to a handful of seniors at a community centre.

If it even happens to the pros, then no one should think they’re “foolish” for being defrauded, and they shouldn’t hesitate to alert their financial institution and police as soon as possible.

“Most often, once criminals have access to the card, criminals will run it dry and then move on,” D’Sa says, adding those who don’t report the crime are allowing criminals to continue essentially unimpeded.

Still, consumers can follow a few basic rules to protect their ID, online bank account and credit cards to stop it from happening at all.

Much of it comes down to being a good gatekeeper of your personal information.

“Never give out personal information from unsolicited phone calls or emails,” he says.

“If someone calls you about your card, tell them you’ll call the number on the back of your card to discuss the matter.”

Criminals often only require a little personal information about you to get more. D’Sa says some will go as far as digging through shredded documents to piece together enough personal info to make a phone call, claiming to be a financial institution looking to verify some information.

Before consumers realize they have disclosed private account information, it is often too late, he says.

But at least in this regard consumers are aware something is amiss. With computer-based fraud, the victim may be unaware of a security breach until an account has been bled dry.

D’Sa says fraud has always been a problem, but the Internet age has given thieves a new, lucrative avenue to our pocketbooks.

Anti-virus, firewall, anti-spyware and intruder protection software are must-haves in the online world. Most major computer security providers bundle the protection together, but many people do not install the software correctly, particularly firewalls. If you’re uncertain, he says, call the software provider.

But it’s not just ID, credit card and online banking theft that require consumers to be ever-vigilant when online. The Internet has given perpetrators of investment fraud unprecedented access to millions of investors.

In 2009, more than one-quarter of Canadians believed they had been approached by a fraudulent investment opportunity, and most of them came via email, states an Ipsos survey conducted for the Canadian Securities Administrators.

“The amazing thing is it is the same old scams over and over again,” says Manitoba Securities Commission investigator Len Terlinski.

The commission recently issued a warning about an obvious rip-off called Genius Funds, allegedly based in Cyprus.

“For some strange reason, Cyprus comes up frequently as the location for Internet scams, even though they’re not actually based out of there,” Terlinski says.

“Just because it says it’s based in Cyprus — or any place — doesn’t mean it actually is because for all you know it could actually be based out of Winkler.”

The so-called investment opportunity guarantees two per cent interest a day on an investment, which should be an immediate red flag.

The problem is some investors do not realize that anything paying triple-digit, guaranteed annual returns is an obvious con job, says Tom Hamza, president of the Investors’ Education Fund, the education branch of the OSC.

“If there’s an investment machine out there providing returns that fantastic, why wouldn’t pension funds and other institutional investors be investing in it, instead of just the average, small investor? Well, it’s because it doesn’t really exist.”

Terlinski says fraudsters are sophisticated, developing slick websites for investment companies on the other side of the world. In fact, he says many will actually copy and paste text from legitimate sites, using it as their original material.

The key for consumers, Hamza says, is to be informed and understand, there’s no such thing as easy money in investment.

“Opportunity doesn’t just knock at your door, email you or call you on the phone,” he says.

“You build it through patience and small steps.”

giganticsmile@gmail.com

Investment scam’s latest flavour

Manitoba Securities Commission investigator Len Terlinski says investors should understand currency trading is not for the average individual. Many large companies engage in currency futures contracts — buying contracts that allow them to purchase currency at a set rate in the future — to hedge their risk when buying and selling goods in foreign markets. But speculative currency trading — trying to profit off price changes between two currencies — is extremely risky and best left to hedge fund managers, he says. “I’m going to stick my neck out a little bit and say that most of the ones advertised on the Internet to small investors are outright scams.” Even if small investors do use a legitimate forex trading site, the chances are slim they will come out on top. “You have to understand that the counterparty could be a major player like Deutsche Bank, and they’re going to eat your lunch,” he says. “It’s like the Detroit Red Wings playing an amateur hockey team.”

Protect the PIN

Visa fraud investigator Mike D’Sa can’t emphasize enough to consumers that they need to protect their personal identification number (PIN). No one — and that means friends and family — should know your PIN but you, he says. “Pick something that you can remember, but that’s not obvious to a stranger — like your birthday — and don’t write it down anywhere.”

Think you’ve been victimized? Contact Phonebusters

Run by the Canadian Anti-Fraud Call Centre, Phonebusters collects and provides information about the latest online, phone-based and mail-based frauds carried out in North America. Visit www.phonebusters.com or call 1-888-495-8501 for more information.

Run by the RCMP, the Ontario Provincial Police and the Competition Bureau of Canada, Phonebusters does not investigate cases of fraud. You must report fraud to your local police and, if it involves your bank account or credit card, also call your financial institution. Generally, the credit card company will remove the charges, D’Sa says.

Fraud’s many faces

The Investor Education Fund’s website (www.getsmarteraboutmoney.ca) lists the basic incarnations of swindling. Here are some of the more common scams:

Ponzi or pyramid schemes: Investors are promised they can earn big money through sales or investments, and at first they actually do receive payments. Money flows to employees and investors as long as new clients invest, bringing in new money, but there is no investment that really earns money. Payments are from new investors’ capital. Once that stops, the scheme collapses because it can no longer make payments. The scheme is named after Charles Ponzi who came up with a scheme involving postage stamps after the First World War.

Pump and dump scams: Investors receive an email or phone call promoting incredible deals on a low-priced stock. But the person contacting you owns lots of the stock. As more investors buy shares, its value skyrockets. At that point, the large shareholder sells shares and the stock value plummets.

Retirement account scams: Aimed at people with LIRAs (locked-in retirement accounts), which restrict when they can access the money, fraudsters will promise they’ve found a way to get around the rules so the money can be accessed, usually tax-free. These types of deals are deliberately incomprehensible, involving RRSP loans. The bottom line is if they claim it’s a tax loophole — even if their lawyers say so — the only loophole you’ll find is the financial noose you’ve tied around your neck.

Affinity fraud: If it’s recommended by an acquaintance, how can it be bad? Con artists have long been joining churches and social groups to find victims because people let their guard down when they think someone shares their beliefs. If you are approached with an investment by someone you trust, take the time to check it out. Get a second opinion, and not one from a lawyer or adviser that your acquaintance wants to provide. Better yet, go by the old adage that friends and money shouldn’t mix.