Location, location, location

2010 Year in Review: CentrePort, stadium and housing were big stories

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$1 per week for 24 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $4.00 plus GST every four weeks. After 24 weeks, price increases to the regular rate of $19.95 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.99/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19.95 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 28/12/2010 (5541 days ago), so information in it may no longer be current.

When it seemed as if the whole world was in a recession in 2009, the Manitoba economy looked like an all-star. But it was back to reality in 2010 with little excitement — the Avenue Building is finally getting renovated! — and some slow, cautious growth. There was a long farewell to Canwest Global as it died a fitful death but there was also a renewed commitment from the Winnipeg business community to take charge of its own destiny and try to make something happen.

Blinded by the light

Five days after David Asper unveiled his plans to use a massive high-end retail development at the site of the current stadium to fund a brand-new Bomber stadium at the U of M campus, the Asper-family controlled Canwest Global Communication Corp. filed for bankruptcy protection. Throughout 2010 as the Asper-owned Bomber stadium plan flapped in the wind, one question remained — what the heck was everybody thinking? Not only did the base of his family fortune utterly disintegrate, Asper was trying to sign up high-end retailers in the aftermath of the biggest financial collapse since the Great Depression followed by a recession that still has North American consumers afraid to spend. While the Bombers and government sponsors stuck with Asper to the bitter end, the punters knew all along it was not going to happen as advertised.

The empty lot should have been the clue

A development plan and some tenants — including an Asian grocery store — have finally been finalized for the five-acre site that used to be the home of the old Winnipeg Arena. There’s no arguing Polo Park is a retail destination, so you’d think if there were retailers out there looking to get in the market they’d have jumped at the chance to build in the Polo Park area. But it took five years for Cadillac Fairview — the largest retailer developer in the country — and Shindico — the city’s largest retailer developer — to find tenants for the muddy parking lot where the arena used to be. So, again, what was it that made anyone think David Asper was going to turn the old stadium site into Rodeo Drive of the north?

Speaking of swamp land…

The year of the Great Manitoba Homecoming was the official birth of CentrePort Canada, potentially the biggest greenfield economic development project for Winnipeg for the next few decades. The thing is, it’s not so much a development as a concept. A highway though the 20,000-acre site is now under construction and a few tenants signed up for a couple of industrial parks in the region this year, but we’d all better get used to the fact that, regardless of the hype, this is Winnipeg; slow and steady is the best kind of growth we can hope for at CentrePort.

Come one, come all to Winnipeg

That’s essentially the message the Yes! Winnipeg initiative is trying to get out there. It has some lofty goals — $1.4 billion in new economic activity and 4,200 new jobs created over the next five years — but when all is said and done it should not be a surprise if much of those metrics are achieved through businesses that are already here. But even if it attracts only one new business to the city, at least they can say they tried — “they” being a private-sector group that has a vested interest in the growth of the city’s economy. The public sector might learn a thing or two from this proactive effort.

Is it a new gold rush or just a return to the scene of the crime?

As much as we like to boast about the diversified economy in Manitoba, when commodity prices are strong the economy looks a lot better. That has partly played out in the mining sector in Manitoba this year where HudBay Minerals started construction on a large new mine in Snow Lake and another one is being revived for reopening next year. Gold prices of more than $1,300 per ounce will do that for your mining sector. But Manitoba also got caught on the short end of the stick of globalization, with a significant drop in exploration spending. Also, the Brazilian owners of Vale Inco decided the smelter at its Thompson nickel complex was the one in its portfolio it could accord to close.

Winnipeg is the new Kelowna

Some worried about a housing price bubble in larger Canadian cities, but that was not the case in Winnipeg in 2010, where home prices were up close to 10 per cent, twice the national average. Slowly but surely market forces are overcoming the institutionalized penny-pinching of the Winnipeg marketplace and real estate is now a good investment… even in Winnipeg. Now if we can only convince a couple more developers to build some new apartment buildings to ease the pressure on the ridiculously low — under one per cent — apartment vacancy rate.

Winnipeg Internationale

While Yes! Winnipeg is going out of its way to beat the bushes to find businesses that might want to move to Winnipeg, Centrallia did the same thing to bring national and international business to the city for a two-day event in October. The stylized international speed-dating conference ended up being a treasure-trove for local small businesses looking for international connections. And even though visa hassles and the recession kept some of the far-flung entrepreneurs from attending it turned into an excellent entrée to the city for foreign nationals who previously did not have Winnipeg on their radar screens.

What goes around comes around

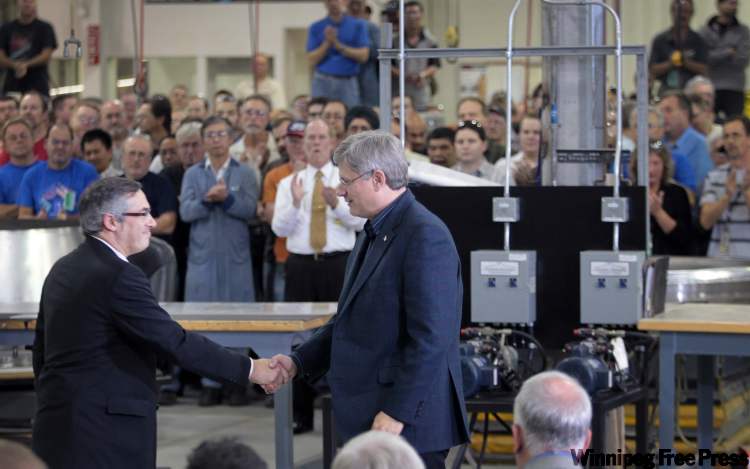

It was almost 25 years ago when the Mulroney government used political favouritism to relocate a lucrative fighter jet maintenance contract from Winnipeg to Montreal. Now that same Winnipeg company, Bristol Aerospace, is part of the manufacturing vanguard in the development of the latest state-of-the-art multinational fighter. Bristol is in line for $1-billion worth of contracts for the F-35 or Joint Strike Fighter, but that is being made more uncertain than it needs to be by partisan political sniping about a project that has been part of the federal agenda of both Liberals and Conservative governments.

The story that keeps on giving

Five years after the Crocus Investment Fund was shut down — effectively shutting the province out of the venture capital market — the only one still getting paid is the receiver. When the court appointed the receiver it was estimated it would take five years to wind it up. It’s now been five years. The fund still holds shares in 14 companies and the receiver is billing the fund about $100,000 per month which may answer the question, “What’s taking so long?”

The money-go-round

Not counting the slow death of Canwest Global, it was a quiet year on the corporate front. Motor Coach Industries, one of the stalwarts of the city’s industrial economy, was bought by New York private equity fund KPS Capital Partners. Another Winnipeg head office was gobbled up by a larger company when Rona Inc. of Quebec bought TruServ Canada , the company that was created from the ashes of the Macleod Stedman chain in the 1990s. Exchange Income Corp. bought Bearskin Airlines in northwest Ontario and Ag Growth International acquired another U.S. agricultural equipment maker.

martin.cash@freepress.mb.ca