Cautious venture into capital

Angel investors to get a little help from above

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.95 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.99/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19.95 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 15/05/2014 (4257 days ago), so information in it may no longer be current.

After almost a decade on the sidelines, the Manitoba government is cautiously returning to the venture-capital business with a modest new $4.5-million fund aimed at early-stage established businesses that need capital to grow.

The new fund — called the Manitoba Innovation Growth Sidecar Fund (MIGSF) — will invest in companies by matching private-sector investments under exactly the same terms and conditions the private-sector investors have negotiated with the company.

Jobs and the Economy Minister Theresa Oswald said the decision to embark on this pilot project was simple.

“We’re doing it to compete,” she said. “When I started in this portfolio, the first people in the door were from the innovation community, and the single biggest thing we heard over and over was that they need access to capital.”

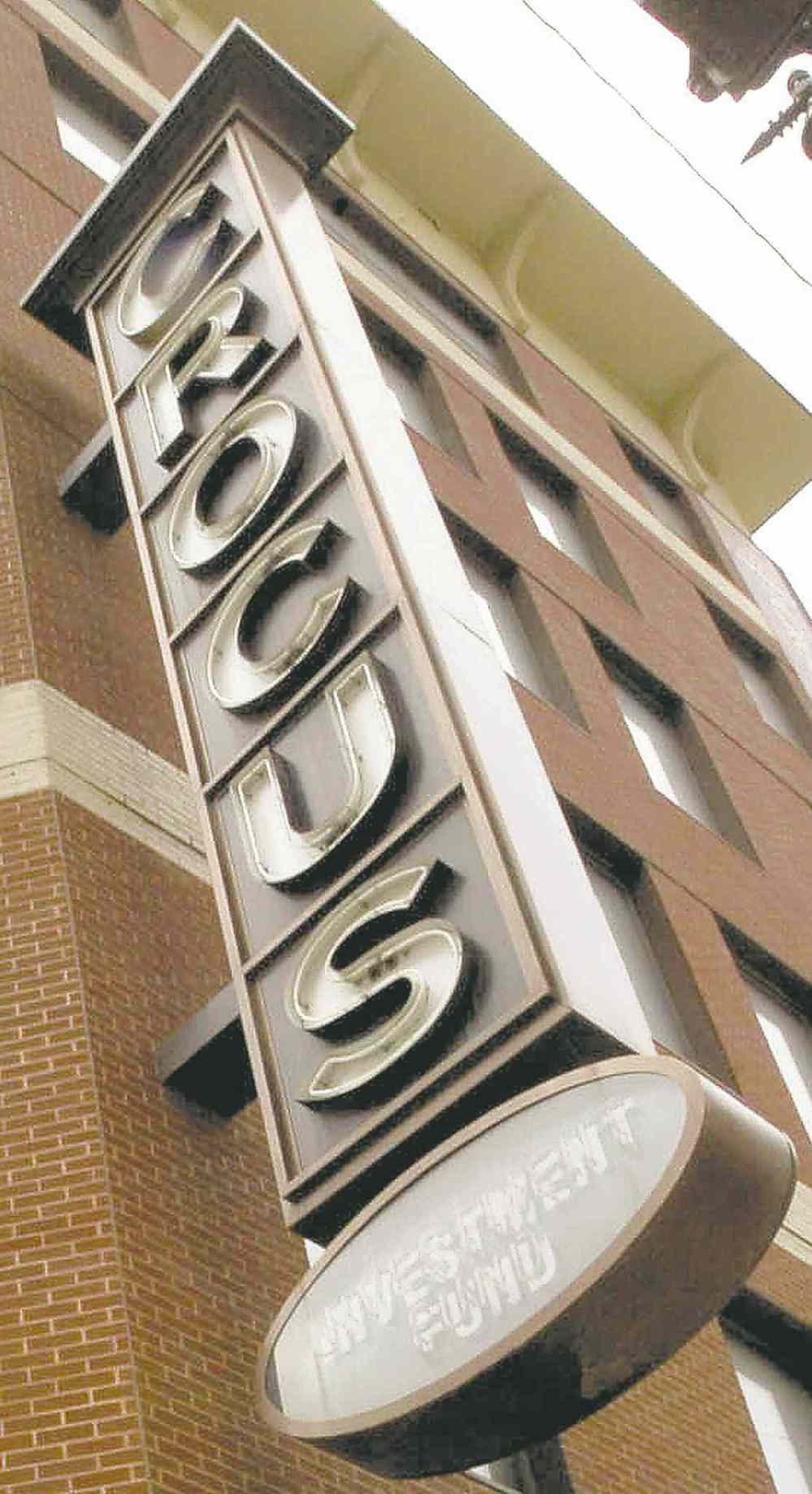

The province was burned badly by its involvement in the Crocus Investment Fund, a labour-sponsored investment fund that went into receivership in 2005 after a series of missteps and embarrassing questions about public-sector involvement in the fund management.

Since the failure of that fund, the province has stayed out of the field, and it’s also thought the dearth of venture capital in this province has been a major stumbling block for the growth of homegrown enterprises in Manitoba.

“We do not need our best and brightest to be lured away to big financial centres like Toronto,” Oswald said. “We need to provide opportunities right here at home.”

While that is not necessarily a new concern, the concept of the sidecar fund is relatively new. Over the past five years, a handful of U.S. states have set up similar funds, and at least a couple of Canadian provinces have looked at the concept.

The term “sidecar” alludes to the fact the private-sector investors are driving the investment and the “sidecar” piece is along for the ride.

It is designed to target companies that are already up and running and have raised some funds from friends and family, have already started generating revenue and need add-on rounds of financing to break into new markets or scale up to the next level.

Jim Kilgour, the senior executive director of the financial services branch of the Department of Jobs and the Economy and whose office designed the program, said it will assist angel investors who may not be able to come up with all the funds the company needs to achieve its goals.

‘We’re doing it to compete. When I started in this portfolio, the first people in the door were from the innovation community, and the single biggest thing we heard over and over was that they need access to capital’

– Jobs and the Economy Minister Theresa Oswald

“We are the top-up. We are not first in,” Kilgour said. “This is really a lever for the investor. It will allow them to put more money in to require the company to pursue a couple more goals or milestones.”

Sean Burns, president of the Manitoba chapter of the VA Angels, a veteran angel-investor group formed many years ago in Calgary, said a fund like this will make a big difference in Manitoba.

“It will really be a welcome partner to the party,” Burns said. “I have heard from investors who want to get more involved locally. It doesn’t happen overnight, but this will start the momentum.”

Burns organizes pitches to the VA Angels investors 10 times per year. He believes there are many companies out there that might benefit from this kind of fund.

However, it will not be big enough to do many deals.

With a minimum of $200,000 per investment and a maximum of $500,000, it might end up doing as few as three deals per year. There will be no restrictions on the type of company, but Kilgour said the expectation is the most likely hits will be in the information technology, life sciences and clean technology companies.

Oswald said the fund will be a patient investor.

“It will be up to the motorcycle driver,” she said. “We will be in the sidecar. Patience will be required.”

The new fund is part of the province’s recently released Innovation Strategy. Oswald said the intent is to have a “cohesive, coherent strategy to get us all rolling in the right direction.”

In addition to the MIGSF, the province is also announcing it will accelerate implementation of changes to the small-business venture capital tax that were announced in this year’s budget.

It increases the tax credit in that program to 45 per cent from 30 per cent, increases the maximum amount that can be raised and loosens the eligibility for the credits for founders and larger shareholders.

martin.cash@freepress.mb.ca