‘It’s not a good picture’

Manitoba performing poorly in economic indicators

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 14/02/2023 (1030 days ago), so information in it may no longer be current.

When it comes to our closest provincial neighbours, Manitoba fares worst when it comes to how many citizens leave the province, how much we earn weekly, and how much in income tax we pay.

In fact, looking at 33 different economic indicators, we finished last in 11 of them when compared to Ontario, Saskatchewan, Alberta and British Columbia.

The only four the province finishes in first place on are our small business tax rate — we are the only province in the country that doesn’t have one — our low unemployment rate, our fewer regulatory restrictions, and our lowest amount of greenhouse gas emissions.

MIKAELA MACKENZIE / WINNIPEG FREE PRESS

A plethora of ‘for lease’ signs dot many commercial properties in the city, serving as a siren call about the state of the province’s economy.

Entitled the 2022 Prosperity Report, it is put out by the Manitoba Employers Council, whose membership includes more than three dozen employer associations and individual employers representing more than 24,000 individual employers and more than 300,000 jobs.

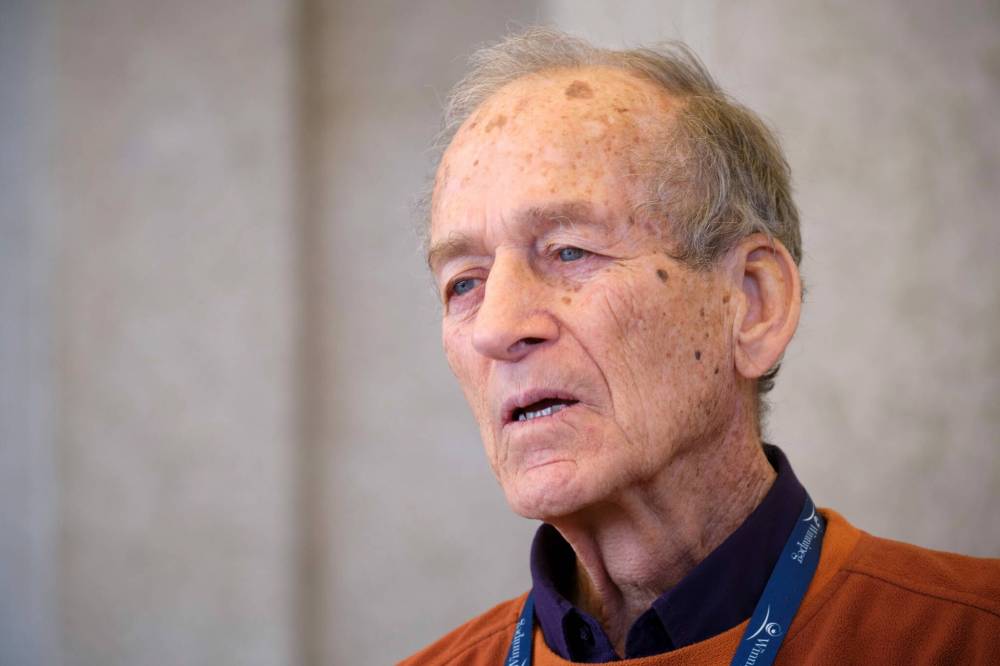

The cover page of the report begins with a question — Are We There Yet? — to which William Gardner, chairman of the MEC, says “we’re not.

“But there are two ways of looking at it,” Gardner added. “One is looking at it that it’s not a good picture.

“But if you look at it if we’re making progress, it is better.”

Gardner said the other 18 indicators are split with the province in second place in five of them, third in seven, and fourth in six.

“The overall picture is we need to work hard in a number of areas,” he said.

“There is no easy solution.”

The MEC does have seven recommendations the province must continue to work at including reducing personal income taxes through rate reductions and increasing tax brackets, reduce and then eliminate the payroll tax, reverse inter-provincial migration losses and reduce the province’s debt load and eliminate the deficit.

Gardner said many different sectors in Manitoba are crying for workers to fill vacancies and gaps. He said that’s why inter-provincial migration out of the province is a hard number to see.

From 2011-2021 Manitoba lost 73,656 people to other provinces, compared to Ontario’s 39,465 and Saskatchewan’s 57,460. Alberta and British Columbia benefited greatly with 88,126 and 159,235 respectively in net in-migration.

“That is a real blow,” Gardner said. “If we could keep our young professionals and our young educated people, that would be a big boost.

“But it’s not a simple solution. It takes a lot of hard work.”

Gardner said the province could help keep workers if it changed the income tax brackets in Manitoba.

He pointed out Manitoba’s highest income tax bracket is the lowest of the five provinces, starting at $74.417, more than $70,000 lower than the next province, Saskatchewan’s $144,639. Alberta’s is the highest at $314,929.

As well, Manitoba’s lowest personal income tax rate tops out at the lowest of the provinces at $34,431,with British Columbia’s next at $43,070 and Alberta’s at $131,220, while our lowest income tax rate is 10.8 per cent, compared to Saskatchewan’s 10.5 per cent, Ontario’s 5.05 per cent, BC’s 5.06 per cent and Alberta’s 10 per cent.

MIKAELA MACKENZIE / WINNIPEG FREE PRESS FILES

President and CEO of the Manitoba Chamber of Commerce Chuck Davidson cutline please.

Even Manitoba’s basic personal exemption is the lowest of the five provinces — and the third lowest in the entire country — at only $10,145 compared to $16,615 in Saskatchewan and $11,141 in Ontario.

It all means Manitobans pay more provincial income taxes than residents of the other four nearby provinces. A person making $50,000 per year pays $1,029 less in Saskatchewan, $1,512 less in Alberta, $1,702 less in Ontario, and $2,272 less in British Columbia.

“One of the best ways to increase productivity is to decrease how much of peoples’ incomes you take,” Gardner said.

“If you can get tax rates down you make the province more desirable to work. Sixty per cent of nothing if someone leaves is nothing. A lesser amount is something. Our tax burden is just so high.”

Other areas of the report show:

Manitoba comes last with Gross Domestic Product per capita, at 48,073 in 2021, compared to BC’s $54,227 and Saskatchewan’s $69,822.

Manitoba’s payroll tax is the highest at 2.15 per cent compared with BC and Ontario’s 1.95 per cent, and Saskatchewan and Alberta with none.

Per capita, Manitoba has the second highest number of head offices, with 12,783 residents per head office, just behind Alberta with 12,142. There are 108 companies who have their head offices in Manitoba compared to 1,083 in Ontario and 364 in Alberta.

Manitoba’s unemployment rate of 6.4 per cent is the lowest of the five provinces, but while Manitoba has the second lowest Indigenous unemployment rate, it is still at 11.6 per cent.

Aaron Dolyniuk, executive director of the Manitoba Trucking Association, said the province’s trucking firms are at a disadvantage compared to other nearby provinces because of payroll taxes.

“One of the items identified in the report is that Manitoba has an opportunity to be more competitive on payroll tax and other taxes,” Dolyniuk said.

“This illustrates that every day, Manitoba trucking companies are competing at a disadvantage compared to companies in other provinces. Competitiveness is what our industry is all about, But Manitobans pay more payroll tax than other provinces.

“It puts us in a competitive disadvantage.”

Inner city activist Sel Burrows said with 20 per cent of students chronically absent from school there is a large pool of potential employees there untapped.

“Most inner city teens don’t get a job for the summer,” Burrows said. “If we want to improve the prosperity of Manitoba, number one is getting young kids in poverty groups summer jobs.

MIKE DEAL / WINNIPEG FREE PRESS FILES

Anti-crime advocate Sel Burrows says young people in the downtown need summer jobs to help break the cycle of poverty.

“They need to learn how to get into the work force and we have to teach them. And we have to get private business on side.”

Shaun Jeffrey, executive director of the Manitoba Restaurant and Foodservices Association, said staffing for restaurants is his sector’s biggest challenge and the thousands of Manitobans who have left the province doesn’t help.

“It means 70,000 jobs have left Manitoba,” Jeffrey said. “When you compare that to the lowest unemployment rate, which many would say is a good sign, but a lot of people are leaving and a lot of people aren’t looking for work.

“For us, this is not an encouraging indicator for our future. We are losing so many people every year to other provinces and we can’t fill these positions.”

Jeffrey said the tax rates are another problem because it means people who leave Manitoba know they will end up having more in their pockets at the end of the day and restaurants in both Saskatchewan and Alberta need workers.

“I hope the government can get some reasonable progress in place,” he said.

“As a proud Manitoban born and bred here, I was very upset by this report — we are getting whacked by these other provinces and it’s not fun.

“We have to fix one at a time.”

Chuck Davidson, president and CEO of the Manitoba Chambers of Commerce, said personal income taxes are one of the key hindrances in Manitoba.

“We’re not making any headway to the other provinces in the west — we’re out of step with everybody else,” Davidson said. “It’s one of the reasons we’re glad the province has committed to a tax review. We are so out of whack from the other provinces.

“Is there a connection between an uncompetitive tax regime and people leaving? It could be part of it, but it certainly is not helping.”

kevin.rollason@freepress.mb.ca

Kevin Rollason is a general assignment reporter at the Free Press. He graduated from Western University with a Masters of Journalism in 1985 and worked at the Winnipeg Sun until 1988, when he joined the Free Press. He has served as the Free Press’s city hall and law courts reporter and has won several awards, including a National Newspaper Award. Read more about Kevin.

Every piece of reporting Kevin produces is reviewed by an editing team before it is posted online or published in print — part of the Free Press‘s tradition, since 1872, of producing reliable independent journalism. Read more about Free Press’s history and mandate, and learn how our newsroom operates.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.