Young adults more pessimistic over city’s economy, personal finances: poll

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$0 for the first 4 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*No charge for 4 weeks then price increases to the regular rate of $19.95 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.99/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19.95 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 06/07/2023 (918 days ago), so information in it may no longer be current.

Optimism over Winnipeg’s economy seems to be rising, but one group increasingly strikes a negative tone — young adults.

Probe Research and Yes! Winnipeg shared their annual poll on Winnipeg residents’ economic perspectives with the Free Press. For perhaps the first time in the poll’s two-decade history, young adults expressed more pessimism than older groups about the city’s economy and their personal finances.

“Being here just gets worse,” said Linda Jones, 25. “The inflation, everything’s going up. There’s no raises, when it comes to working.”

In an annual poll on Winnipeg residents’ economic perspectives, young adults expressed more pessimism than older groups about the city’s economy and their personal finances. (Graeme Roy / The Canadian Press files)

She makes $16 an hour, she said. Her paycheques go to rent and hydro bills — there’s nothing for her to save.

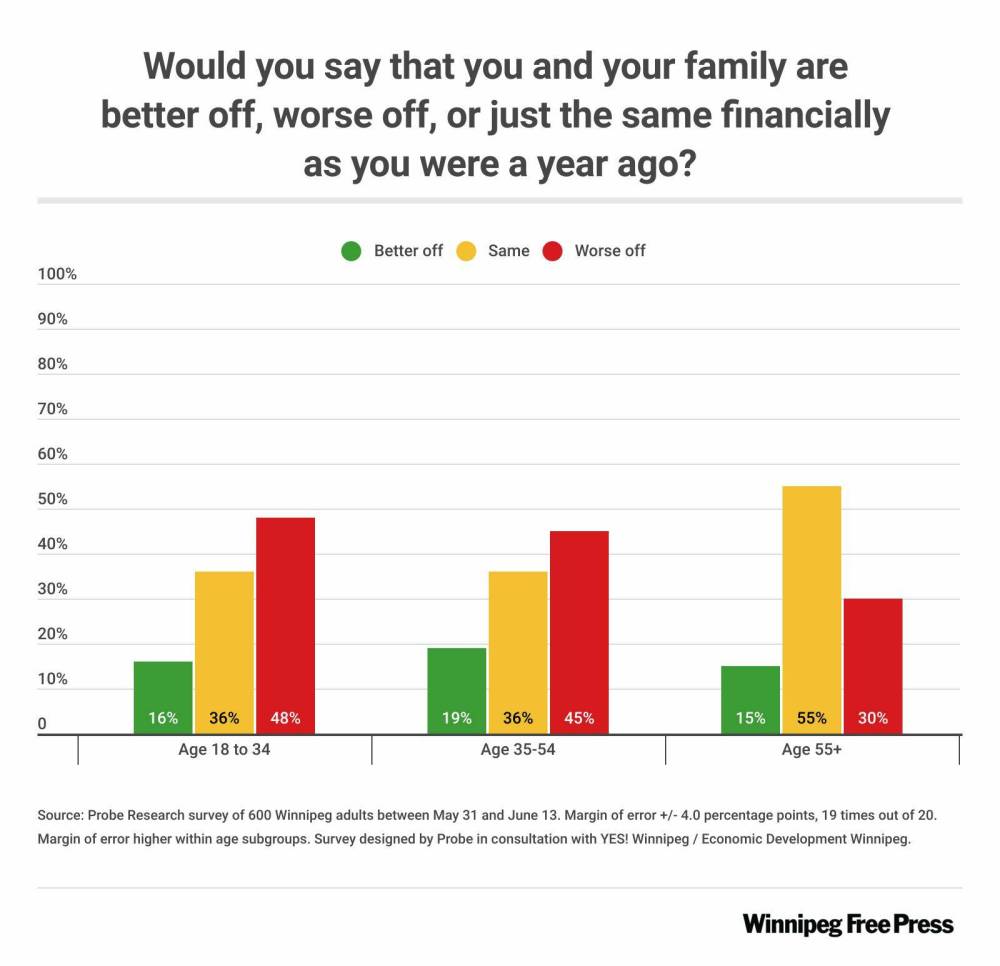

Forty-eight per cent of Probe poll respondents under the age of 35 felt worse off financially this year than last, surpassing the 30 per cent over age 55 who feel the same.

Jones said she’s worse off financially this year because of inflated living costs. She expects next year to be worse if things continue as is.

“We’ll see what happens,” Jones shrugged. “Nothing I can do about it.”

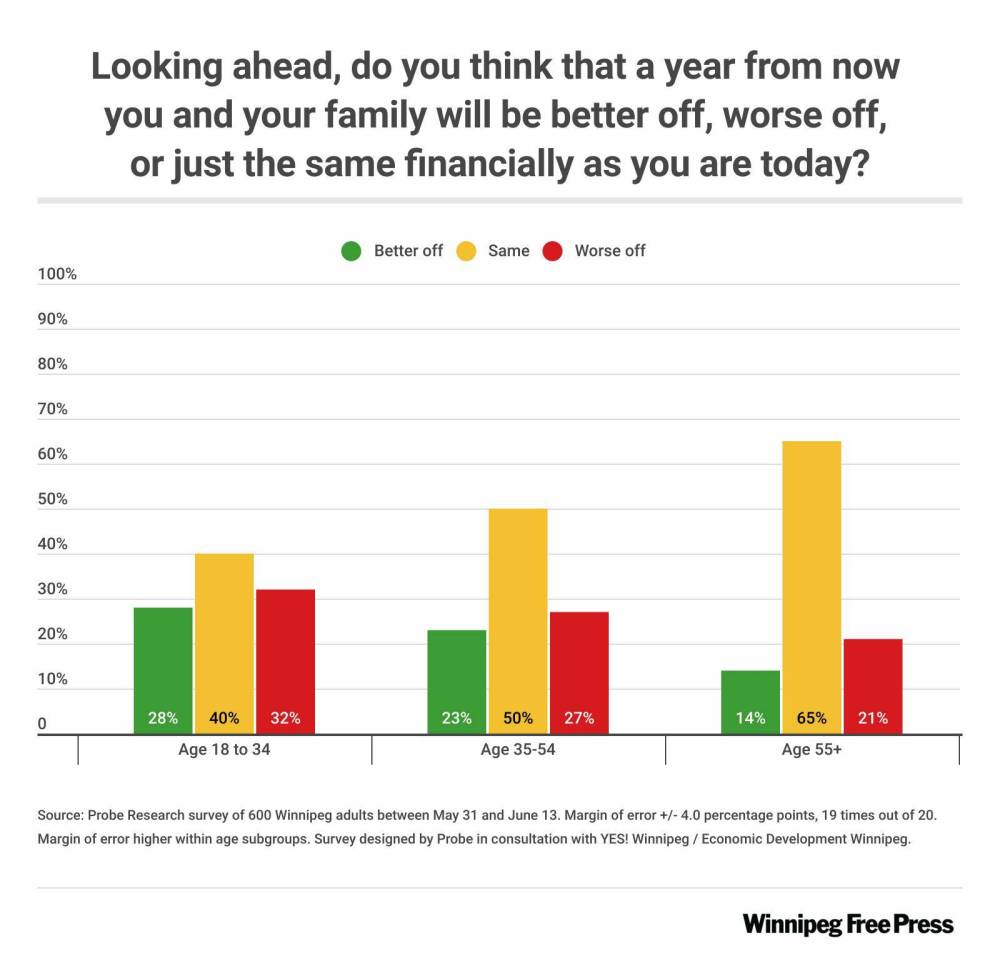

Younger Winnipeggers — roughly one-third of respondents under 35 years old — were most likely to believe their financial situations will decline over the next year.

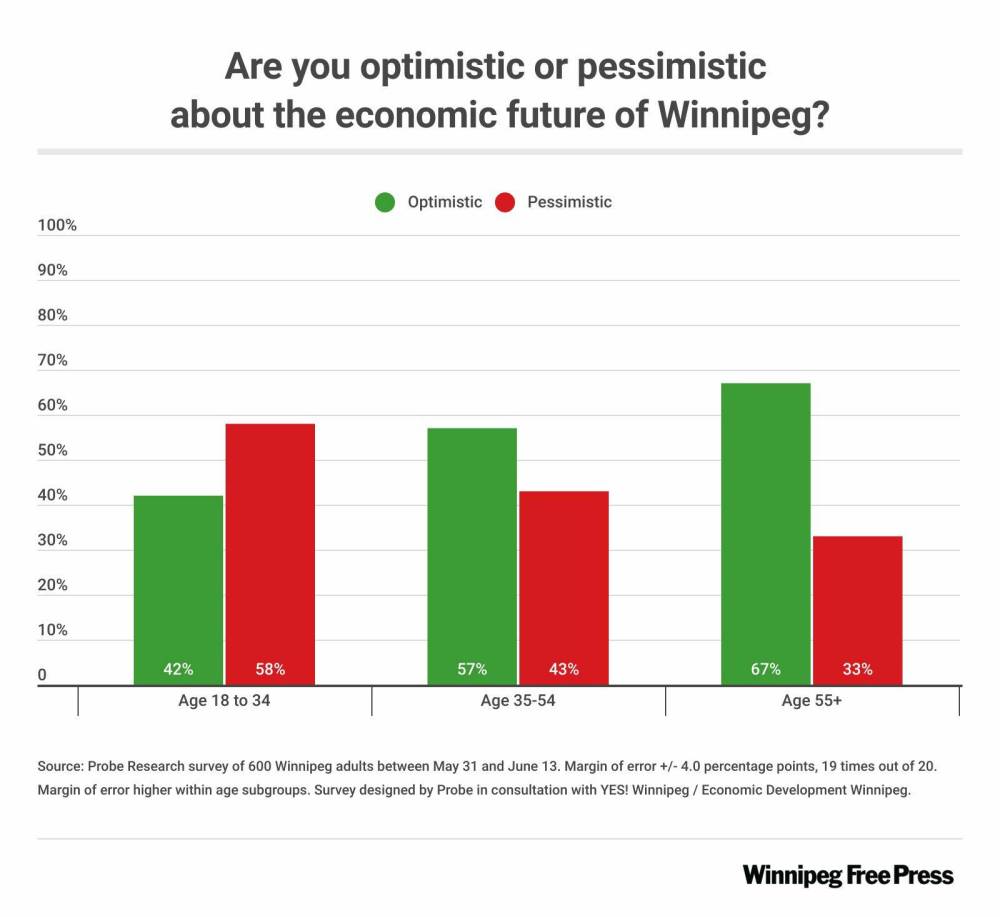

The age group also felt more pessimistic about Winnipeg’s economy than older adults — 58 per cent and 33 per cent reported pessimism, respectively.

“It just seemed that (in the past) no matter what was going on, if you looked to the young people, you would see more optimism,” said Scott MacKay, president of Probe Research. “I can’t think of a single time when this younger age cohort was not more optimistic than their older counterparts.”

The team at Probe had a theory about recurring youth optimism: the life stage can elicit career advancement and opportunities to pay down debt, bringing about hopefulness.

(Wendy Sawatzky / Winnipeg Free Press)

The recent findings show “that’s not so much the case,” MacKay said.

“I don’t want to make too big a deal about it, because it’s not really a trend until we start to see this over time,” he added. “You really want to see that repeat itself a couple times before you can make… scientific inferences from this.”

Joyous Vasquez, 20, works at least two retail jobs. Every week seems to bring another grocery price increase, he noted.

“From being a college student, I’ve found it really hard to save money,” Vasquez said. “Everything’s so expensive.”

He’s been living at home, which helps, he said. Next year, as he steps into a career and takes on further responsibilities, he expects his debt load to increase.

Still, he’s “not really too concerned.”

“If I’m going to be broke, I have a feeling most people will be broke too, and that wouldn’t be good for Canada,” Vasquez said. “(If) everyone can’t afford things, what’s the point of having these things?”

(Wendy Sawatzky / Winnipeg Free Press)

A Statistics Canada report, released Tuesday, highlights a growing income inequality across the country. Debt-to-income ratios for younger and core working-age groups have hit their highest rate since tracking began in 2010.

Overall, however, Winnipeg residents reported more optimism about the city’s economy and their own financial futures, when comparing this June to June of 2022.

Fifty-five per cent of Probe Research’s 600 respondents expressed optimism about Winnipeg’s economic trajectory. When looking at adults age 55 or older, optimism jumps to 67 per cent.

“(Winnipeg’s economy) is not that bad,” said Jamie Rivera, 65.

He’s a hotel maintenance worker. He watched his co-workers laid off en masse during the pandemic — most are back, new hires are on board and the facility has had several fully-booked nights, Rivera said.

But “everything is expensive,” he added.

He retired, but he continues working to make money. He doesn’t take his annual summer trip to the United States and he’s regularly hunting for sales.

Forty-three per cent of Probe respondents believe their financial state is worse than last year. It’s a dip from 48 per cent in June of 2022 but a significant increase from 26 per cent in September of 2019.

(Wendy Sawatzky / Winnipeg Free Press)

Meantime, 40 per cent of respondents believe their finances are the same as last year, a bump from 34 per cent in June of 2022.

“During COVID… people had a lot of uncertainty,” said Dayna Spiring, Economic Development Winnipeg’s CEO. “We’re seeing that kind of behind us.”

The negativity emanating from Winnipeg’s younger demographic is something to keep an eye on, Spiring said.

However, the poll’s overall results are “pretty positive,” she continued.

“We have… to remind ourselves of all the great things that are happening,” Spiring said.

She highlighted Manitoba’s unemployment rate — 4.8 per cent in May — and increased connectivity. Porter Airlines will begin shuttling customers between Winnipeg and Toronto in September; WestJet’s direct flights to Atlanta will also start in September, and direct flights to Los Angeles began last October.

The cost of living, though higher than pre-pandemic, is lesser than in major Canadian cities like Toronto and Vancouver, Spiring noted.

(Wendy Sawatzky / Winnipeg Free Press)

Probe’s poll results showed an 85 per cent job satisfaction rate in Winnipeg, consistent with results over the past four years.

“Winnipeg has a lot going for it,” Spiring said. “The grass always looks greener somewhere else, until you start to dig in and do the homework.”

Probe Research conducted its survey between May 31 and June 13, reaching out to Winnipeg adults via phone. Respondents then filled in an online survey. The poll has a 95 per cent certainty the results would be +/- four per cent what they would be if Winnipeg’s entire population had responded.

gabrielle.piche@winnipegfreepress.com

Gabrielle Piché reports on business for the Free Press. She interned at the Free Press and worked for its sister outlet, Canstar Community News, before entering the business beat in 2021. Read more about Gabrielle.

Every piece of reporting Gabrielle produces is reviewed by an editing team before it is posted online or published in print — part of the Free Press‘s tradition, since 1872, of producing reliable independent journalism. Read more about Free Press’s history and mandate, and learn how our newsroom operates.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.