Global Interdependence

Please review each article prior to use: grade-level applicability and curricular alignment might not be obvious from the headline alone.

Art for Minneapolis: West Broadway not-for-profit partners with sister agency

3 minute read Preview Sunday, Feb. 8, 2026Cascadia movement has roots in the past, but does B.C. separatism have a future?

10 minute read Preview Updated: Yesterday at 7:44 AM CSTBracing for a future global water shortage

4 minute read Preview Thursday, Feb. 5, 2026Is the concept of Canada as a ‘middle power’ meaningless?

5 minute read Preview Thursday, Feb. 5, 2026Teen newcomers hope powerful poem opens minds

3 minute read Preview Wednesday, Feb. 4, 2026Extreme cold perfect for Operation Nanook

4 minute read Preview Monday, Jan. 26, 2026Family from the Democratic Republic of Congo navigates chilly firsts alongside IRCOM supports

8 minute read Preview Friday, Jan. 2, 2026A forgotten chapter: The stories of Allied POWs in Nagasaki during the atomic bombing

6 minute read Preview Friday, Jan. 2, 2026‘Canada is not for sale’ hat makers want to share domestic manufacturing tips

4 minute read Preview Wednesday, Dec. 31, 2025Canada wraps up G7 tech ministers’ meeting after signing EU, U.K. deals

4 minute read Preview Wednesday, Dec. 10, 2025Churchill’s future has looked bright in the past, then politics dimmed the lights

5 minute read Preview Monday, Nov. 24, 2025U.S. directs its embassies in Western nations to scrutinize ‘mass migration’

4 minute read Preview Tuesday, Nov. 25, 2025Immigration minister extends pause on new private refugee sponsorships to 2027

3 minute read Preview Sunday, Nov. 23, 2025Former judge in Ukraine sacrifices career to be reunited with family in Winnipeg

5 minute read Preview Thursday, Nov. 20, 2025UN approves the Trump administration’s plan for the future of Gaza

5 minute read Preview Tuesday, Nov. 18, 2025Almost Armageddon: a personal history

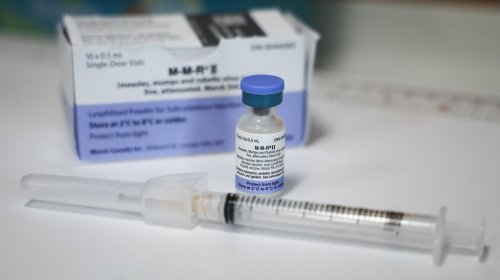

5 minute read Preview Monday, Nov. 17, 2025How Canada can regain its measles elimination status

6 minute read Preview Wednesday, Nov. 12, 2025A century later, Ukrainian church still helping new Ukrainians

4 minute read Preview Thursday, Oct. 30, 2025The road not taken: lowest number of Manitobans in three decades cross border at Pembina in July, August

5 minute read Preview Wednesday, Oct. 29, 2025TikTok as a tool — but for whom?

4 minute read Preview Wednesday, Oct. 1, 2025The simplest way to raise living standards? Build a better business climate.

Manitoba is a small, open economy. That should be freeing. It should mean we focus on what we do best, and trust the market to send signals about where investment belongs. But more often, government takes the wheel.

The record on that isn’t good. Governments like to believe they can allocate capital more efficiently than markets. History says otherwise. The “winners” chosen often reflect politics more than economics.

Tariffs are the clearest example. Drop a tariff, and one industry will feel the pain of new competition. But the benefits are spread out: lower prices for consumers, lower costs for businesses, higher productivity overall. Raise a tariff, and the reverse happens.

Big Tobacco and Big Oil are eerily similar. One knowingly produces a product that slowly but surely kills its consumers. The other knowingly produces a product that surely but not slowly kills the planet.